HUI GOLD Stocks vs Bank Of America

Commodities / Gold & Silver Stocks Aug 25, 2011 - 01:59 AM GMTBy: Willem_Weytjens

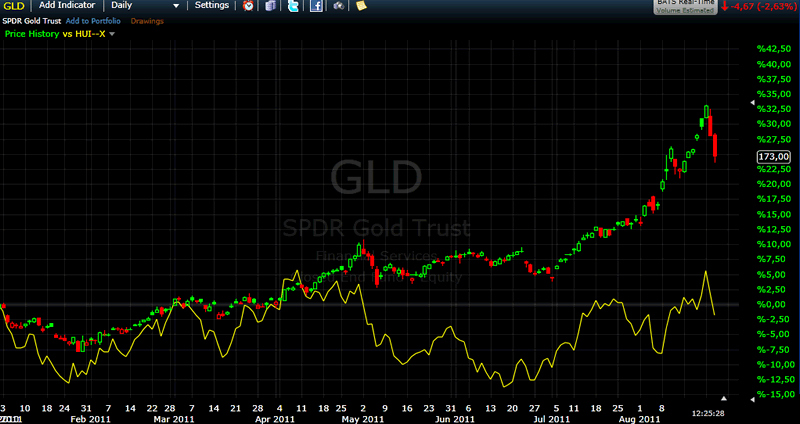

Gold has reached an all-time high well over $1900 yesterday, so the Gold bugs have reason to celebrate. Or, at least the physical gold bulls (like mr. Paulson, who is the biggest shareholder of the GLD ETF). Not the gold stock bulls: while the GLD ETF is up almost 25% since January 1st (even after the sell-off on Tuesday and Wednesday), the HUI index is actually DOWN over the same period.

Gold has reached an all-time high well over $1900 yesterday, so the Gold bugs have reason to celebrate. Or, at least the physical gold bulls (like mr. Paulson, who is the biggest shareholder of the GLD ETF). Not the gold stock bulls: while the GLD ETF is up almost 25% since January 1st (even after the sell-off on Tuesday and Wednesday), the HUI index is actually DOWN over the same period.

Chart created with Freestockcharts.com

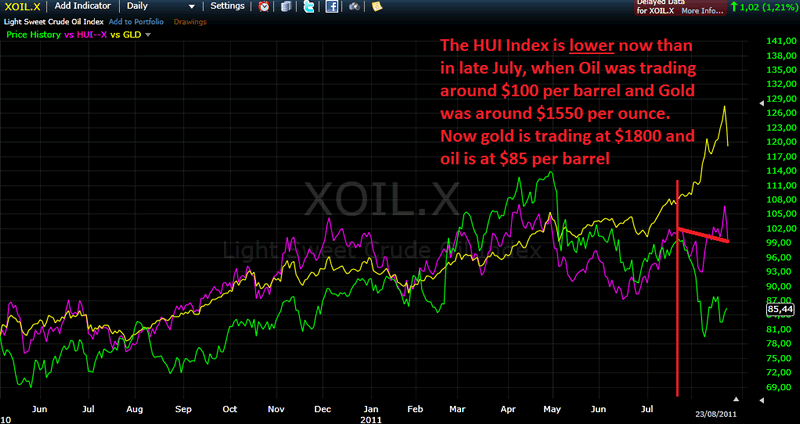

I have read many articles claiming that the underperformance of gold stocks was due to high oil prices, which increases energy costs and thus production costs of the gold mining companies. This would lead to lower profit margins.

While that sounds absolutely plausible, one should wonder what is holding gold mining stocks back, now that gold reaches new all-time highs, while oil prices have plummeted recently:

Chart created with Freestocharts.com

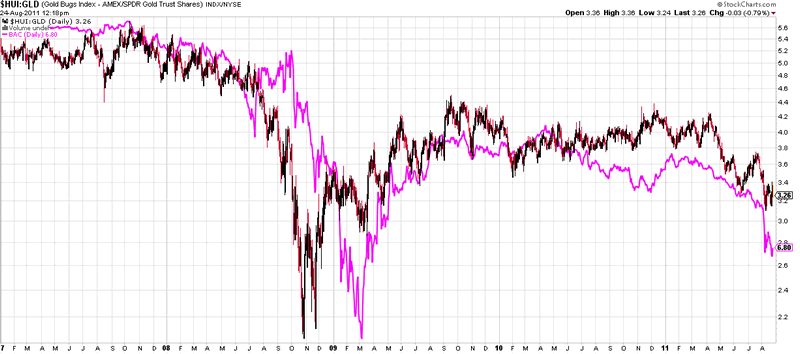

When we then plot the ratio of the HUI-index divided by the Gold price, we get a ratio. When this ratio is rising, it means gold stocks are outperforming Gold and when the ratio is falling, it means gold stocks are underperforming gold.

Outperformance doesn’t necessarily mean rising prices. It can also mean that gold stocks fall less than the gold price for instance.

What I find interesting, is that so many people are so bearish on Bank stocks, and especially Bank Of America (Ticker: BAC)

However, if you look at the ratio of the HUI-index divided by the gold price and compare this ratio to the price of BAC, don’t you think they are a perfect match?

Chart courtesy stockcharts.com

My conclusion is that gold stocks seem to be leveraged to higher gold prices IF the general market sentiment is positive. If that’s not the case, gold stocks seem to act more like equities than gold, and can sell-off no matter how high gold is trading.

***** You can now try out our services during 5 days for only $5. That is only $1 per day! For more information, please visit the following Link: $5 Trial *****

For more analyses and trading updates, please visit www.profitimes.com

Willem Weytjens

www.profitimes.com

© 2011 Copyright Willem Weytjens - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.