Gold Correction UnderWay, Buy Back in at $1600

Commodities / Gold and Silver 2011 Aug 25, 2011 - 06:29 AM GMTBy: George_Maniere

Yesterday we witnessed the mother of all head fakes. The ishares ETF GLD was unbelievably overbought. We began Tuesday with the spot price of gold at $1900.00 and more telling the RSI was at 80. This is “nosebleed territory” This correction which I wrote about on Tuesday was long overdue. Since the 1st of July gold has run up in a parabolic move. There was a two day pullback in Mid August when the CME raised margin requirements 22%. That slowed down gold for two whole days. Well today, for the second day in a row, gold dropped another $104.00 to close at $1757.30. There was no news that drove the price down. I believe it was a healthy and expected correction that as I have said was long overdue. The RSI as I mentioned was at 80 and dropped to 54.34. I expect we may get another drop tomorrow but that should do it. I have written that I was looking for a correction to $1600.00 - $1650.00 and another 100 point drop tomorrow will put us right in the sweet spot for another continued run up.

Yesterday we witnessed the mother of all head fakes. The ishares ETF GLD was unbelievably overbought. We began Tuesday with the spot price of gold at $1900.00 and more telling the RSI was at 80. This is “nosebleed territory” This correction which I wrote about on Tuesday was long overdue. Since the 1st of July gold has run up in a parabolic move. There was a two day pullback in Mid August when the CME raised margin requirements 22%. That slowed down gold for two whole days. Well today, for the second day in a row, gold dropped another $104.00 to close at $1757.30. There was no news that drove the price down. I believe it was a healthy and expected correction that as I have said was long overdue. The RSI as I mentioned was at 80 and dropped to 54.34. I expect we may get another drop tomorrow but that should do it. I have written that I was looking for a correction to $1600.00 - $1650.00 and another 100 point drop tomorrow will put us right in the sweet spot for another continued run up.

On Wednesday, I received many emails asking me if it was time to dump the gold holding and I told them that while I felt it would be prudent to take some profits I felt that this was an long overdue correction. I emphasized that corrections are not to be feared but rather embraced. I sold 1/3 of my entire gold position on Tuesday and I sold another third of my position yesterday. I will look to add to my position when the correction is over.

According to strategic investor, commodities expert and professional talking head, Dennis Gartman, the sell-off is not a buying opportunity at all. Indeed he felt the buying opportunity is behind us. I do not agree.

Mr. Gartman said that he pays a great deal of attention to something technicians call an outside reversal. An outside reversal occurs when the market makes an all-time new high and closes on the lows of the day. This is then followed by a closing below the previous day’s lows. If you don’t pay attention to that and don’t liquidate you’re going to find yourself in a lot of trouble.

To his credit, Gartman is putting his money where his mouth is. Gartman sold a lot of his gold in the last 54 hours and wished he had sold everything. He’s not alone. Trader Steve Cortes thinks the patterns in the gold chart now are eerily similar to those in 1980 when gold completely topped out for years to come.

In addition to the technicals both traders feel the fundamentals will also generate selling pressure, now. Of particular concern is that the general public probably got into the gold trade during the later innings. “The public owns gold at high prices – and now any rally will be met with sellers,” Gartman says. He also thinks big hedge funds will be damaged by the sharp decline. Hedge funds who say they are long in a position if they hold it longer that 15 minutes stand to lose huge amounts of money in gold and that too could generate liquidation pressure.

Gartman then said the magic words I had been hoping to hear. He said that he thought this trade could go down another $150 in a short span of time. He said we will go to $1650 in the next month and a half. That is exactly what I have been saying and hoping for. If you think I enjoyed watching gold run up $50.00 a day you’re wrong. It’s not healthy for any commodity to run up in a parabolic fashion. Don’t get me wrong I was happy to take the profits but I wanted gold to correct back down because it is not healthy for a stock to act like gild has the last two months and not only have I been saying it to my readers that have written to me but now I have the esteemed Denis Gartman saying the same thing.

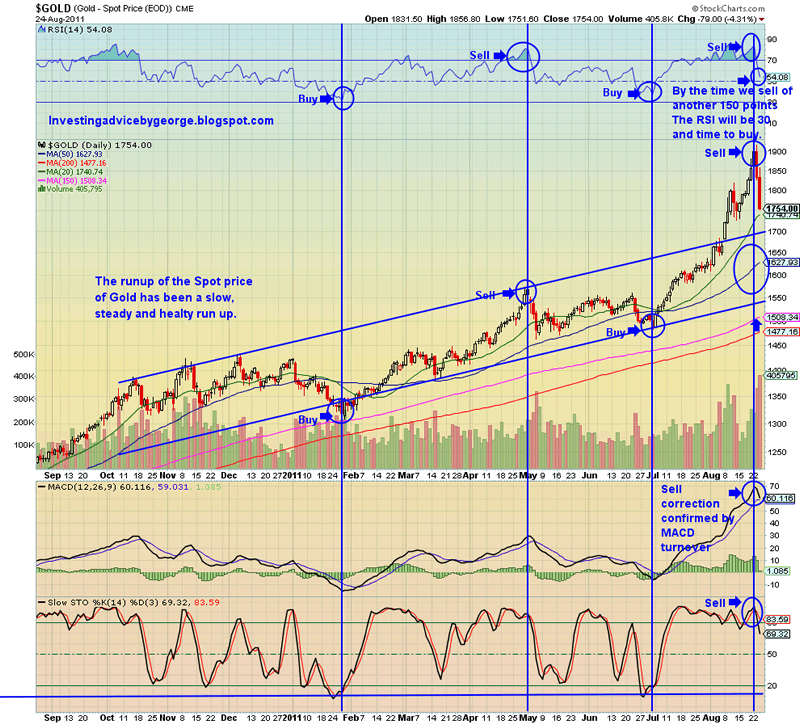

I will disagree with him when he calls gold a bubble. A bubble is a holding whose price is not supported by its underlying asset. In this case what is supporting the price is the fact that gold has been the safest port in the storm to hedge the global contagion of debt and the continued debasement of currencies. Please see the chart below

Please take note that the chart gave very clear buy and sell signals for the last year. If there was a problem (and I call it a high quality problem) it was that since July it ran up to far and too fast. Well now the correction I have been predicting and the chart was begging for has finally taken hold. Denis Gartman said we will correct at $1650.00 I said somewhere between $1600.00 and $16500.00. Either way the road is finally clear before us. If you have not done so yet start taking profits and when gold goes to $1650 slowly start buying in because I might be right and we could see a new low of $1600.00. Either way this plays out gold will be $2,200.00 by the end of the year but gold will be $75.00 - $100.00 by the end of the year.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.