Gold Price Pullback, Time to Sell? Or Buy?

Commodities / Gold and Silver 2011 Aug 25, 2011 - 06:42 AM GMTBy: Jeff_Berwick

I had one of those days. You know how sometimes you’re just humming along in your car in the zone… green lights at every intersection… slow-pokes in front of you moving to the slow lane before you lose patience and honk… just generally it’s as if the sea has parted for your journey.

I had one of those days. You know how sometimes you’re just humming along in your car in the zone… green lights at every intersection… slow-pokes in front of you moving to the slow lane before you lose patience and honk… just generally it’s as if the sea has parted for your journey.

Today was the opposite. It was like an obstacle course. I was expending twice the energy to get the usual amount of work done.

On top of it all it didn’t help any to learn in the middle of it that gold was down a full c-note, even though we had expected it. Last week we suggested some profit taking BUT ONLY to rebalance portfolios in favor of the relatively undervalued miners!

With this gold pullback, however, it was as though they had these anti-gold pundits on ice for years waiting for this day! They rolled out the usual suspects on bubble television to all identify this as "the top"! Everyone agrees! Uh-oh. As predicted last weekend, the week would be full of gold-bearish rhetoric on the approach to Manipulator-In-Chief, Bernanke’s speech.

Some think the Fed will stand pat like a seasoned blackjack player; others think it will unveil new schemes to stoke the boom…QE3, QE2.5, QE2.1, the twist, repo madness, whatever.

While the pull back in gold prices was expected, and is probably healthy (and almost too rational), the press took the opportunity for many jabs, and pointed to several factors:

- The market cap of a gold ETF surpassed the market cap of the S&P SPDR (SPY)

- Shanghai and the COMEX raised margins (the latter after the day’s session)

- Gold is insurance said one smart guy, it should not be a core strategy

- Gold is the “stopped clock” strategy in a Barron’s critique aimed at Ron Paul

- Everything is okay now, we don’t need safehavens like gold and tbonds now

The question, like most asked on mainstream TV, was a trick question. Is the gold bubble popping? A-ha! They've already got you. Gold isn't in a bubble.

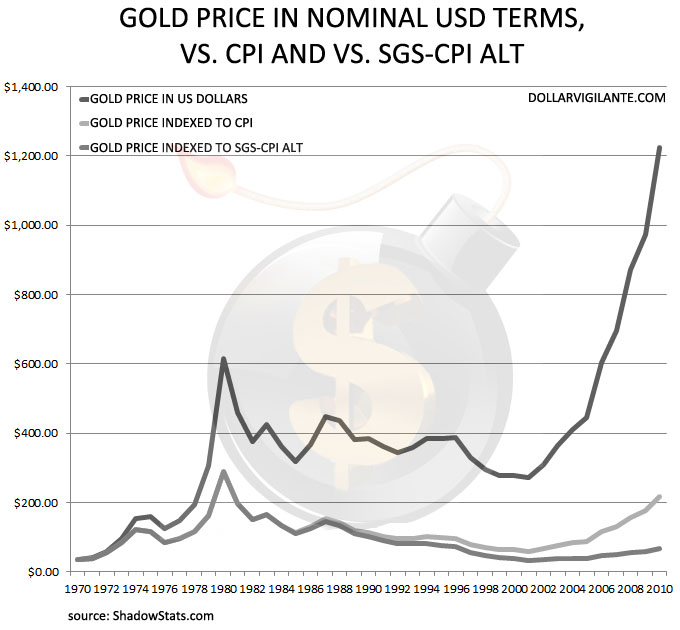

The chart below is up-to-date as of 2010... If you look at gold when adjusted for the government CPI (their so-called inflation statistic), gold is still down from 1979. But if you calculate the CPI before the government learned to hedonically adjust out all of the inflation from the CPI - as Shadowstats.com calculates - gold has been in a terrible bear market for 30 years and continues to be in one.

This is why Jeff Berwick has repeatedly told subscribers to be wary of watching gold in dollar terms. As the dollar collapses it will SEEM like gold is skyrocketing. But in real terms, the ride hasn'even begun.

Besides, If gold is in a bubble I have never seen a more under-owned bubble in anything! Indeed, that is a key takeaway, along with the perceptible hate of gold.

It reminded me of some quotes I read recently in a book written by economist and gold analyst Gary North in 2009 called the Gold Wars. He writes,

“Politicians hate a rising price of gold. So do central bankers. A rising price of gold testifies against the politicians, who spend more money than they collect in taxes or borrow at interest, and it also testifies against central bankers, whose promises to stop rising prices is a lie that has not come true since about 1939. So, these people do whatever they can to ridicule gold and gold buyers. They do whatever they can to drive down the price of gold – everything except the one thing that would drive it down: cease inflating.” Gold Wars Chapter 1, Gold at $10,000?

Indeed, he says,

“Hostility to the traditional gold coin standard has been the mark of Establishment economists and editorialists since the US government confiscated Americans’ gold in 1933. The establishment hates gold. Its spokesmen ridicule gold.” Gold Wars, Chapter 15, The Establishment vs Gold

And why do they hate gold?

“Because…gold is a powerful tool of control by the public. A gold coin standard places in the hands of consumers a means of controlling the national money supply. A gold coin standard transfers monetary policy-making from central bankers and government officials to the common man, who can walk into a bank and demand payment for paper or digital currency in gold coins. This is the ultimate form of democracy, and the Establishment hates it. The Establishment can and does control political affairs. They make democracy work for them. They are masters of political manipulation. But they cannot control long-run monetary policy in a society that has a gold coin standard. They hate gold because they hate the sovereignty of consumers.” Ibid

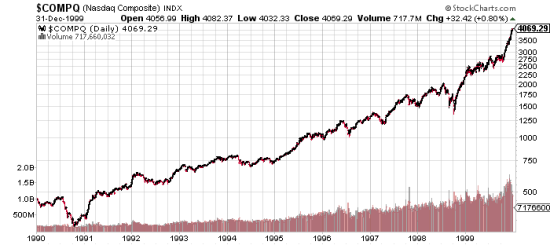

Indeed, the bearish noise reminds me of the rumbling we heard back in 1999 when the NASDAQ broke out past the 2000 level early in the year. The bears grumbled about the nosebleed valuations.

After all, in 1990-91 the NASDAQ was at about 350. It had gone up year after year after year, much like gold had this past decade. In 1998 it hit 2000 for the first time, then got smacked in a heavy liquidation that prompted a rate cut from the Fed, fueled in part by the Y2K scare, and off she went to 5000 within 14 months, wiping out every last bear.

There’s no reason gold couldn’t do the same thing. If the gold market really is ready to go parabolic then this correction is going to be over by next week. But that is likely a little bit premature. What’s more likely is a repeat of the 2006 blow off where, following the long anticipated breakout over $500, the market ran up about 50% in six months then fell 22% rather sharply…it took a whole year to make a new high.

If we superimposed that situation on the recent break past $1450 you could expect to see the market rally to around $2100 over the next three months then fall back to around $1650 by January-February. That’s a possible outcome.

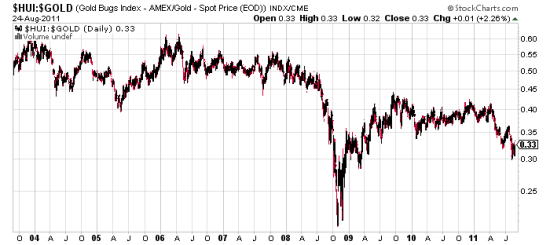

As far as gold stocks go, while they will likely fall when gold prices fall, we don’t expect them to fall that much. Moreover, we expect a big gold stock rally when and if gold prices stabilize anywhere above $1500, or if they get to $2100. If the short-term top is in at $1900, I see the market holding that level as well. Either way, this next dip may be our last chance to buy gold shares cheap. After that, they may still continue to rally with gold but the risk-return won’t be the same, so buy the dip.

My target on the HUI over the next 12 months is 759. I raised it from 700.

That’s an average gain of about 33% with gold prices going nowhere. In fact, that target can be achieved, in my opinion, with gold prices at $1650. That would equate to an HUI/Gold ratio of just 0.46 –about the low end of the 2004-08 range.

In that environment we could expect even stronger returns in the TDV portfolio…without new highs in gold prices.

Nobody owns this bubble. Have any taxi drivers promote you on gold stocks lately? If you know one he is probably a TDV subscriber!

And the fundamental drivers aren’t going away any time soon. As my illustrious partner-in-crime, Jeff Berwick said in a personal email to me after the market today: “Until we see ANY evidence that the governments of the world are going to stop indebting themselves and printing more money and destroying their currencies, i dont ever think about selling.”

And neither should you.

Ed. Note: This is the type of insights and analysis that Ed Bugos provides to TDV subscribers on a weekly basis.

Subscribe to TDV today (90 day moneyback guarantee) to access our Special Report on How to Own Gold as well as get complete access to our newsletter and portfolio selections.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2011 Copyright Jeff Berwick - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.