Soaring Inflation Means the Bull Market In Gold and Commodities Has Further to Run

Commodities / Gold & Silver Dec 07, 2007 - 01:16 AM GMTBy: Aden_Forecast

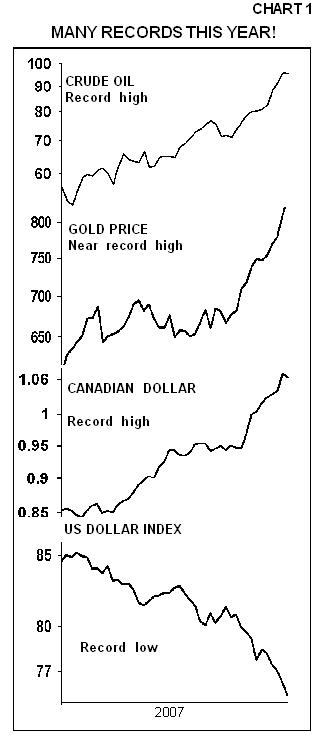

Huge moves have been taking place this year (see Chart 1 ). It's a big deal but, with the exception of oil, not many people are paying attention. In fact, it seems like most people don't really care, and that's good for us.

At the New Orleans Investment conference in October, for example, attendance was lower than last year. Several of the speakers also commented on a general lack of enthusiasm.

Considering that these attendees are mostly gold investors, and gold was more than $200 higher than it was last year, this is quite strange. But this nonchalance tells us that gold's bull market still has a lot further to go. In other words, the normal psychological steps, which happen in any bull market, have barely gotten started.

Considering that these attendees are mostly gold investors, and gold was more than $200 higher than it was last year, this is quite strange. But this nonchalance tells us that gold's bull market still has a lot further to go. In other words, the normal psychological steps, which happen in any bull market, have barely gotten started.

... AND MORE TO COME

Normally, for instance, you'll see the so called smart money go into a developing bull market first. This includes investors who understand the markets and the big picture, some professionals and so on.

As prices rise, more gold bugs will move in, usually followed by some early bird Wall Street types.

This is basically where we are now, in the second phase. But as New Orleans illustrated, this bull market rise is still lacking investor and Wall Street enthusiasm. That's still to come and we think that'll probably happen once gold hits a new record high above $850.

During the third phase of a bull market, the public jumps in. The public is usually late to the party and in their collective excitement, they'll drive prices up to extreme levels. The most recent example of this happened in the late 1990s when tech stocks were all the rage. Everyone was “into high tech” and these stocks were going to keep rising in the “new era,” but of course they didn't.

As for gold, the public is barely aware of gold's ongoing rise and they're not in the market. The reason that's good is because the longer gold goes without attracting much attention, the higher it will ultimately go once the public starts moving in.

This suggests that the gold price could literally skyrocket at some point to levels far higher than most people are expecting. And with world tensions increasing on several fronts, it's providing plenty of fuel for the markets.

GEOPOLITICAL TENSIONS GROWING

In recent months, for example, there have been growing problems in Iran , Iraq , Russia , Turkey and Pakistan , and the markets did not take these developments lightly.

The oil price soared as tensions in the Middle East intensified. This in turn kept upward pressure on both oil and gold. These tensions are far from over and they'll likely continue to keep a solid foundation under both of these markets.

As you know, international tensions are good for gold because it's historically a safe haven and gold rises as tensions increase. In oil's case, when these tensions occur in the Middle East , it raises concerns that the oil supply could be disrupted and that drives the oil price higher.

So when the U.S. imposed the strongest sanctions on Iran since 1979 when the U.S. hostages were taken, it made investors nervous, especially because Iran holds the world's second largest oil reserves.

FROM RUSSIA WITHOUT LOVE

Meanwhile, Putin visited Iran and signed a declaration supporting their nuclear program. He condemned the U.S. 's “madman waving knife” approach to dealing with Iran and he opposes sanctions or military threats because they'll worsen the situation. China agrees.

But Putin is also furious about the missile shield the U.S. is planning to install in Poland . He feels it's a threat to Russia and that it's straining relations, to say the least.

On another front, Newsweek calls Pakistan the most dangerous nation in the world. Al Qaeda, the Taliban and other insurgents essentially call Pakistan home and they move around the country quite freely. The bombing that killed more than 125 well wishers when former Prime Minister Bhutto returned home reinforced this.

Pakistan is a boiling pot. It has nuclear weapons and it's definitely a wild card we're keeping a watch on.

TURKEY AND IRAQ

Not to be underestimated is what's happening in Turkey and Iraq .

The Turkish military has been moving into Northern Iraq . They're fighting against Kurdish rebels and the death toll has been mounting. This part of Iraq was previously an island of stability within the war torn country but now that is changing.

Since Iraq contains the world's third largest oil reserves, fears are growing that this will further destabilize the region and halt oil supplies out of Northern Iraq . This alone sent oil soaring and the higher oil price helped boost the gold price.

MEANWHILE THE DOLLAR FELL

Aside from what's happening on the international scene, the U.S. dollar has been falling more steeply. This too has been very bullish for gold. And with the Fed lowering interest rates, the dollar is less attractive, which is going to push the dollar even lower as rates continue to decline.

The bottom line is that all of these factors, combined with China's growth and demand, surging money and world liquidity, out of control spending, and inflation pressures, means that this bull market in gold and other commodities is not only going to be a big one, but a long lasting one as well. All of the evidence suggests that it's going to be a once in a generation type of move and a very profitable one.

So despite gold's ups and downs, gold is not far from its $850 record high and once it reaches a new high it'll mark a huge milestone. So we strongly recommend riding this bull market through to its conclusion and enjoy the ride for as long as it lasts.

By Mary Anne & Pamela Aden

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter providing specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com

Aden_Forecast Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.