Gold Mining Stocks: A Questionable Performance

Commodities / Gold & Silver Stocks Aug 29, 2011 - 07:08 AM GMTBy: Bob_Kirtley

The gold bull remains intact and continues to show strength despite the recent take down. However a question mark still hovers over the gold mining stocks which are trading as though gold is in its seasonally summer doldrums.

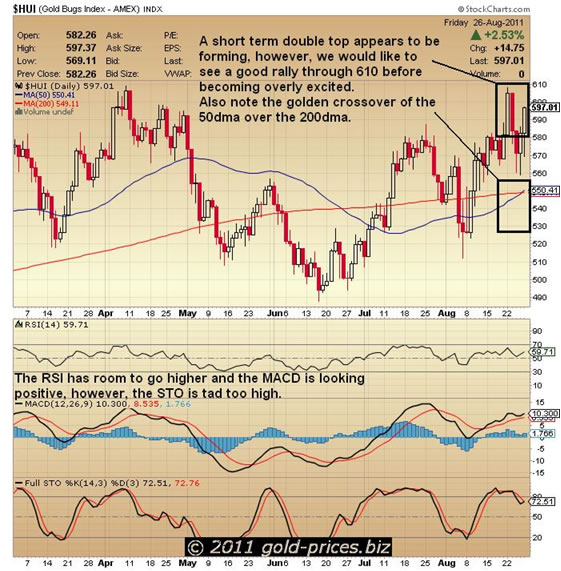

Taking a quick look at the the chart of the HUI* we can see a possible short term double top forming, as the mining stocks make another attempt to rally high enough to break the 610 level. Given that gold was trading at around $1250.00/oz a year ago and it closed at $1830.80/oz on Friday for an increase of around 50%, we should be seeing fire works in the mining sector. What we have is a HUI Index that was trading at 480 a year ago and it closed on Friday at 579.01 for a gain of around 20%, which is pretty poor. A positive indication is the golden crossover of the 50dma over the 200dma, which is usually positive for stocks. The RSI has room to go higher and the MACD is looking positive, however, the STO is tad too high. All considered we think the chart is reasonably positive for the stocks.

We invest in mining stocks for the leverage that they return when compared to gold. This leverage is necessary in order to compensate for the numerous risks that are inherent in the mining sector. Below is a short list, courtesy of Ernst and Young, of the risks that are alive and well in this industry today:

Resource nationalism

Skills shortage

Infrastructure access

Maintaining a social license to operate

Capital project execution

Price and currency volatility

Capital allocation

Cost Management

Interruptions to supply

Fraud and corruption

No doubt from your own experience you could add even more threats to the difficulties of design, construction and operation of a mine.

When considering threats to mining stocks we cannot ignore the possibility of another shock to the financial system. If and when this event occurs and the general market sells off, our mining stocks could be the baby that is thrown out with the bath water, despite the strength of gold.

We can only conclude that a serious breakout by the HUI from its current trading zone has to be established before we increase our exposure with the acquisition of more mining stocks.

In the mean time we will content ourselves with a few well thought out options trades, where we currently have six open trades all showing a good paper profit, in an attempt in maximize our returns in this gold and silver bull market. However, we will remain vigilant and observe the behavior of the stocks in order to be prepared should a breakout come sooner rather than later.

Two events to observe going forward are the two day meeting of the Federal Reserve in three weeks time and also the European Summit where they vote on expanding the rescue fund (EFSF). This proposal is not a done deal in Germany where the objectors are growing in numbers and without the support of Germany all bets are off.

[*The AMEX Gold BUGS(Basket of Unhedged Gold Stocks)Index represents a portfolio of 15 major gold mining companies. The Index is designed to give investors significant exposure to near term movements in gold prices - by including companies that do not hedge their gold production beyond 1 1/2 years.]

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.