Europe, Bearish Technicals Drag Down Longer-Term Outlook for Stocks

Stock-Markets / Stock Markets 2011 Aug 29, 2011 - 08:43 AM GMTBy: Chris_Ciovacco

With Ben Bernanke’s Jackson Hole speech in the rear-view mirror, the markets will most likely turn their attention back toward Europe. In the short-run, it is doubtful market-calming news will emerge concerning debt and slowing growth in Europe. Add in a bear-market-like technical back drop (see video below) and we have a recipe for continued stress-inducing volatility in the stock, bond, commodity, and currency markets.

With Ben Bernanke’s Jackson Hole speech in the rear-view mirror, the markets will most likely turn their attention back toward Europe. In the short-run, it is doubtful market-calming news will emerge concerning debt and slowing growth in Europe. Add in a bear-market-like technical back drop (see video below) and we have a recipe for continued stress-inducing volatility in the stock, bond, commodity, and currency markets.

While a strong countertrend rally in risk assets could easily emerge following the recent waterfall declines, comments from policymakers will remind seasoned traders sharp rallies are often retraced in relatively short order when conditions are this unsettled. Christine Lagarde, the new managing director of the International Monetary Fund, said in her prepared remarks over the weekend in Jackson Hole:

- European banks should be required to raise more capital to prevent further contagion of the debt crisis.

- The United States needs to address the slide in housing prices.

- Short-term stimulus is needed in both the U.S. and Europe.

Lagarde said the global economy has entered a “dangerous new phase” in which “we risk seeing the fragile recovery derailed.” In the United States, many questioned the need for Bank of America to raise additional capital, and yet the mortgage-saddled bank gladly took in new funds from Mr. Buffet. In Europe, talk centered around the shorts and traders targeting banks without merit, and yet the director of the IMF sees reasons to be concerned. The problems in Europe are far from over.

In the September 5 issue, Fortune reported on the growing concerns about the mountains of debt in the euro economy:

Even if Europe’s banks don’t face a liquidity crunch, a drop in the value of sovereign bonds would severely deplete their capital, forcing them to halt new lending. The credit crunch would probably throw Europe into a severe recession. That in turn could kill the U.S. recovery, since the European Union accounts for 21% of U.S. exports. Even a truly apocalyptic outcome — where one or more weak nations abandon the euro, causing gigantic defaults and a Europe-wide banking crash — can no longer be dismissed.

Without question, the markets face serious fundamental hurdles. As we outline in the video below, the current technical backdrop for stocks compares favorably enough with the dot-com and mortgage/housing bull market peaks to keep an open mind about lower lows in the months ahead. Even if we have entered a new bear market, countertrend rallies are to be expected. The video covers some bull/bear clues to watch for in the coming weeks.

This week brings some important economic reports which have the potential to move the markets. The best hope for bullish outcomes is better than expected economic progress since many believe countries can grow their way out of this mess. Thursday’s ISM manufacturing report is forecast to come in at 48.5, indicating a contraction in manufacturing activity. On Friday morning, the monthly labor report is due to be released. The early Bloomberg consensus calls for a meager 67,000 jobs; the low end of the forecast range calls for a loss of 5,000 and the high end points to 150,000 new jobs having been created.

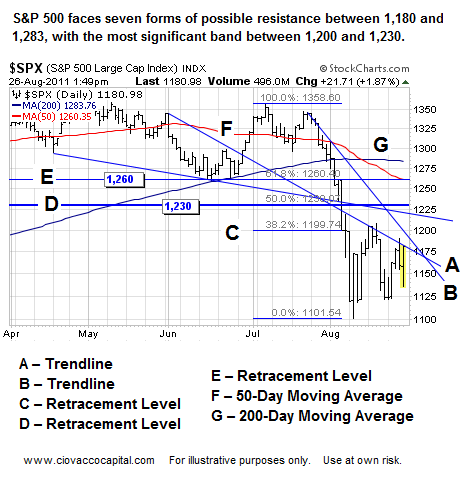

Our approach in the short-term is to respect the bearish tone while keeping an open mind about better than expected outcomes. At some point, a sharp and somewhat promising rally will materialize. As the rally begins to take shape, we will review the relative merits of the long (SPY) and short (SH) sides of the market. If a stock rally looks unconvincing, we will also consider adding to our positions in fixed income instruments, such as TLT and BND, under more favorable risk-reward conditions. We will continue to watch the list of top-ranked ETFs for both bullish and bearish indications. Should stocks rally, we will be looking for signs of shorts entering the market between 1,180 and 1,230 (see chart below).

-

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.