U.S. Consumer Spending Pickup in July Lacks Durability

Economics / US Economy Aug 30, 2011 - 01:36 AM GMTBy: Asha_Bangalore

Real consumer spending increased 0.5% in July after holding steady in May and June. Consumer outlays of durables (+2.0%) raised the overall reading; it was largely an increase in purchases of cars (12.2 million vs. 11.6 million in June). The 0.5% gain in service expenditures reflects a big increase in health care expenditures. Purchases of non-durables declined 0.3% in July vs. a 0.4% increase in the prior month.

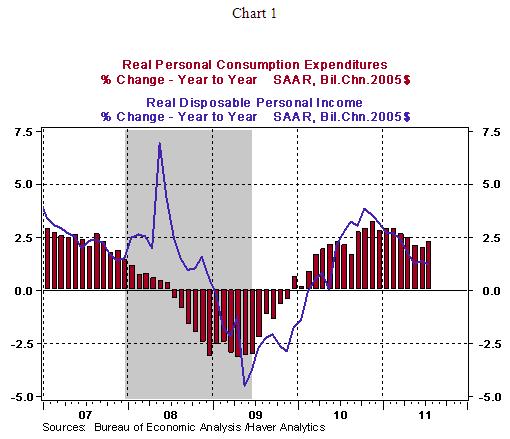

Personal income advanced 0.3% and saving as a percent of disposable income was 5.0% in July. Strong employment and income growth are necessary to support consumer spending. Real disposable income advanced 1.2% (see Chart 1) from a year ago but slipped 0.1% on a monthly basis. As Chart 1 indicates, the decelerating trend of disposable income is not favorable for consumer spending.

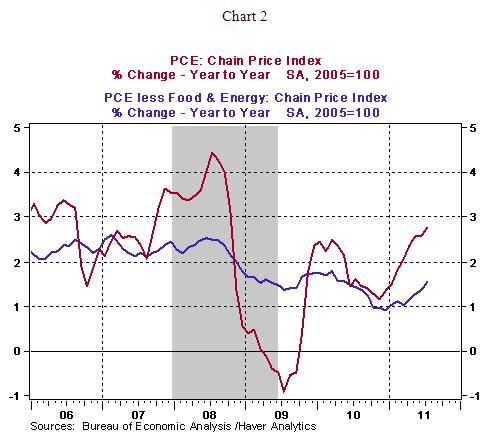

The personal consumption expenditure price index moved up 0.4% during July, after a 0.1% drop in the prior month, putting the year-to-year increase at 2.8%. The core personal consumption expenditure price index, which excludes food and energy, rose 0.2% in July. The core price gauge has risen 1.6% from a year ago. These year-to-year gains of both the overall and core price measures show that an upward of inflation is in place. Stability of energy prices in recent weeks, projections of slow-to-moderate growth of the economy, and contained inflation expectations are factors supporting the Fed’s focus on economic growth in the inflation-growth debate.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Compan

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.