Gold Forecast $1950 September, $2,500 Before End of the Year

Commodities / Gold and Silver 2011 Aug 30, 2011 - 11:42 AM GMTBy: GoldCore

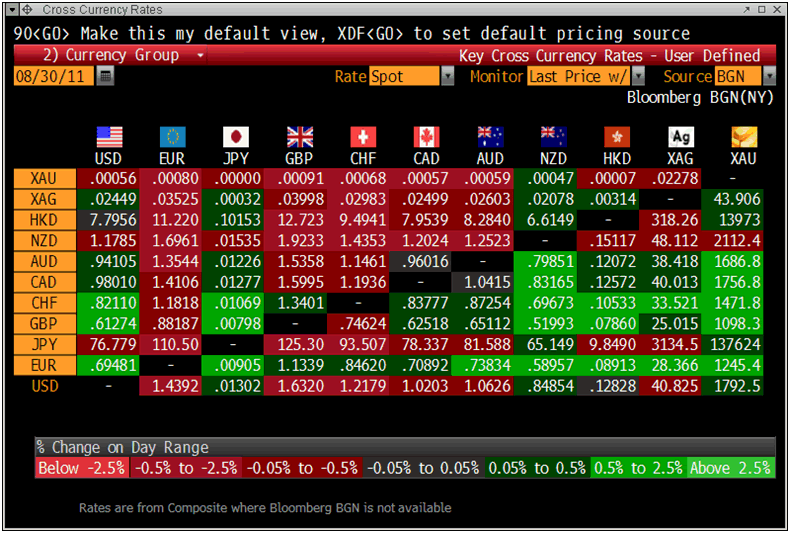

Gold is higher against most currencies and especially the euro. Gold is trading at USD 1,792.50, EUR 1,245.10, GBP 1,098.30, CHF 1,471.50 and JPY 137,624 per ounce.

Gold is higher against most currencies and especially the euro. Gold is trading at USD 1,792.50, EUR 1,245.10, GBP 1,098.30, CHF 1,471.50 and JPY 137,624 per ounce.

Gold’s London AM fix this morning was USD 1,791.00, EUR 1,243.49, GBP 1,097.56 per ounce. Gold fixed marginally higher than last Friday’s AM Fix which was at USD 1,787.00, EUR 1237.10, GBP 1,094.17 per ounce which suggests physical demand is supportive at the $1,800 level.

Cross Currency Table

Asian equities rose again today but China’s stock markets were again lower on concerns about the Chinese and global economy. Initial gains in Europe have turned to weakness but the FTSE is higher as it plays catch up after being closed yesterday.

The mooted German proposal to use periphery nations’ gold reserves as collateral was back on the agenda in Germany yesterday.

The Irish Times reports that in an interview with Der Spiegel in Berlin, influential senior minister Dr. Von der Leyen called for a guarantee system to secure loans issued until the permanent rescue fund ESM, with its inbuilt guarantee mechanisms, comes into effect in 2013. “The task of my generation is to create a united Europe. The problem is that, after the introduction of the euro, we simply stood still,” she said.

“For the labour minister, an ad-hoc collateral system on gold reserves or state assets would discipline national governments and prevent the current bailout regime going the way of the stability pact.”

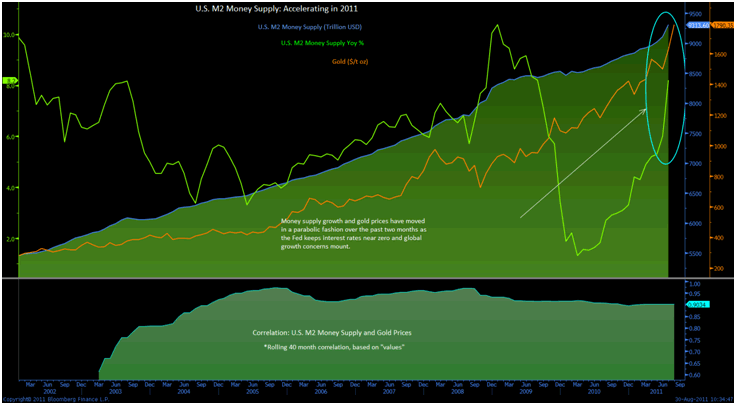

Fastest Money Supply Growth in 52 Years Supports Gold's Surge

The United States M2 money supply accelerated 2.2% in July from the prior month, the fastest pace in 52 years, and grew 8.2% yoy, the highest reading in 23 months. The correlation between total U.S. M2 and gold has held above 0.90 since November 2004, as currency debasement creates safe haven buying for the precious metal.

At the moment Asians seem more worried regarding inflation but this sort of money supply growth is likely to lead to inflation in the U.S and much of the western world.

Premiums for physical bullion in Asia remain high showing continuing strong demand.

Indian premiums were strong again yesterday as were those in Vietnam and Shanghai.

Reuters reports that Hong Kong dealers quoted premiums for gold bars as high as $1.50 an ounce to spot London prices, from $1.20 last week. Bullion markets were closed in Singapore, Indonesia and Malaysia for the Muslim Eid al-Fitr festival.

Physical dealers in Tokyo saw selling from local investors, but they also noted buying interest from China, where demand for jewelry increases during the mid-autumn festival in September.

Journalist John Brimelow, who publishes the JBGJ, reports in Lemetropolecafe.com that according to the Shanghai Gold Exchange website a “substantial proportion” of the trade there is for delivery. “This is not just a paper phenomenon.”

Brimelow said that “bearing in mind the huge gold importing by China in the latter part of last year, in JBGJ’s opinion this is currently the key issue in the gold market.”

The UBS daily note reports that “the mood among gold investors appears to be to buy the dip rather than chase the market, which is understandable given last week's volatility.”

UBS conclude that the “violent sell-off hasn't done any lasting damage to gold, and the reasons investors bought gold in recent months remain valid. Our one-month forecast of $1950 remains in place.”

UBS three month price view is $2,100 per ounce.

Very significant demand being seen for bullion internationally and especially in Asia means that gold’s correction is likely to again be of short duration. Indeed, the scale of demand suggests that gold may not need a long period of consolidation and could again surprise to the upside.

Non gold experts, many in the financial services industry, continue to warn of a bubble. Their analysis is extremely simplistic and almost exclusively based on recent price action.

However, the majority of those in the industry and the majority of gold market analysts remain bullish.

Throughout August, prior to the recent record nominal high and subsequent selloff, many banks raised their forecasts for the year.

SocGen raised its average gold price forecast to $1,950 an ounce for the fourth quarter of 2011 and to an average of $2,275 per ounce in 2012.

Bank of America-Merrill Lynch said in a research note it was revising its 12-month gold target to $2,000 an ounce.

JPMorgan said that gold could reach over $2,500 per ounce prior to year end.

The recent sell off has not seen banks and analysts revise down their price forecasts.

GoldCore has said since 2003 that the real high of $2,500 per ounce (inflation adjusted and based on CPI) would likely have to be reached prior to gold being a bubble.

Those informed about the gold market know that absolutely nothing has changed about the supply and demand dynamics driving the gold market.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

SILVER

Silver is trading at $40.90/oz, €28.38/oz and £25.05/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,829.50/oz, palladium at $762/oz and rhodium at $1,800/oz

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.