Gold Bull Market Over With Double Top?

Commodities / Gold and Silver 2011 Sep 07, 2011 - 02:48 PM GMTBy: David_Banister

A few weeks ago I penned a public article and private forecast for my subscribers calling for a major correction in Gold being due. 72 hours after my forecast, Gold had dropped a stunning $208 per ounce in 3 days catching most by surprise. Why did I forecast a top in Gold then? Why did Gold rally back to new highs recently? Is the Gold Bull Market now over? Let’s see if I can answer those questions with some level of logic below.

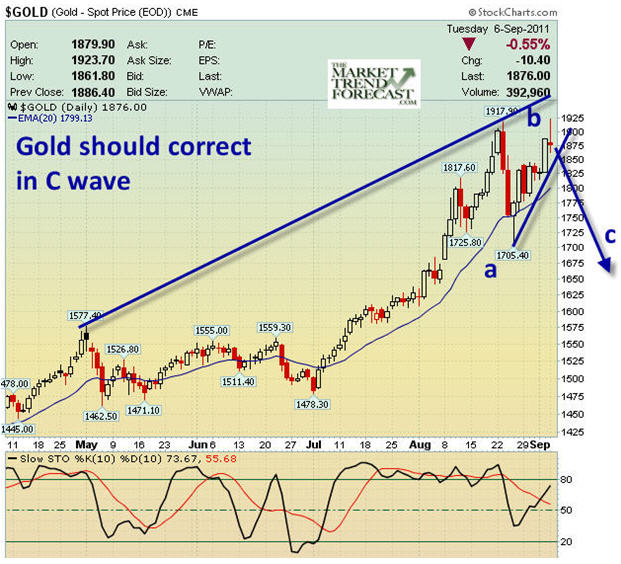

I had forecasted a major correction because Gold has had a run of 34 Fibonacci months from October 2008 to August of 2011 from $681 to $1910 per ounce spot price in US dollars. That type of pattern was formed with a clear 5 wave move, with obvious corrections along the way. The reason I was confident of a major correction was due to the confluences of the 34 months of time, the price relations to prior rallies and corrections, and the Fibonacci sequences coupled with the sentiment and cover stories on Gold in major publications. Gold should have entered into a multi-month correction that will consolidate that 34 month move, and the first shot across the bow was the $208 drop in 3 days.

Interestingly, that $208 drop over 3 days corrected 50% of the 8 week move from $1480 to $1910. As we can see markets move very very fast these days and can whipsaw even the best of traders. I told my subscribers to cover their short bets at $1724 spot, and since then we rallied to $1920 this week before topping again.

The reason Gold rallied back and touched the old highs and then some was due to the German Court pending decision regarding the constitutionality of backing the Eurozone countries with bailout funds. Today we had a positive decision by the court denying claims that the bailouts were unconstitutional. Had the German Court ruled the other way, we would have seen Gold spike to $2000 and the SP 500 and European Bourses tank hard. So if you were getting long Gold on this recent rally, you were taking on a lot of short term headline risk and I told my subscribers it was best to stand aside until we got the ruling.

Now that the ruling came out, Gold has topped at 1920 in what typically traders would call a “Double Top” pattern, but it’s more involved than that. In the work I do, we call it an “Irregular correction “ pattern, where the retracement of the $208 decline runs all the way back up and past where the decline began at $1910. These are very rare patterns and again, I believe exacerbated by the Eurozone issues as they hinged short term on the German decision. What we should see now is what I call a “C WAVE” to the downside, with targets typically at $1620 relative to the rally from $681 to $1910 over 34 months. A drop of $290 is only 15% from the highs and would fill in gaps in the Gold chart.

Will Gold drop that low? The fundamentals for Gold are screamingly bullish, but the entire world knows that and it may be priced in for a while. Gold should consolidate those topping highs for a while to let the fundamentals catch up the price action in Gold which ran ahead of them and then some. The Gold bull market should run for 13 Fibonacci years, and I have been bullish since November 2001. I understand the fundamentals are very strong for Gold, so please don’t miss-read my comments ore forecast. I use crowd behavior and psychology to help pinpoint major tops and bottoms, and right now we should have some more work to the downside to correct sentiment in Gold and then allow for the base building period before the next leg up towards the highs in 2014.

Over at my TMTF service, we called the top in Gold and shorted it and covered at $1724. We also recently forecasted the deep drop in the SP 500 from 1231 highs and warned our subscribers in advance. My methods use contrarian signals and behavioral patterns to warn of pivot highs and lows in advance. Consider checking us out at www.MarketTrendForecast.com and take advantage of a 33% discount or sign up for our occasional free updates.

Dave Banister

CIO-Founder

Active Trading Partners, LLC

www.ActiveTradingPartners.com

TheMarketTrendForecast.com

Dave Banister is the Chief Investment Strategist and commentator for ActiveTradingPartners.com. David has written numerous market forecast articles on various sites (SafeHaven.Com, 321Gold.com, Gold-Eagle.com, TheStreet.Com etc. ) that have proven to be extremely accurate at major junctures.

© 2011 Copyright Dave Banister- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.