SPXU Still in Play

Stock-Markets / Stock Markets 2011 Sep 15, 2011 - 06:31 AM GMTBy: George_Maniere

Pro Shares Ultra Pro S&P 500 (UPRO) is a triple leveraged fund that seeks a 300% return on the performance of the S&P for a single day. Conversely, The Pro Shares Ultra Pro Short S&P 500 (SPXU) seeks a triple leverage or 300% return on the inverse performance of the S&P 500. If you believe as I do that we are setting up for a leg down on the S&P then SPXU is the best way to profit from this trade.

Pro Shares Ultra Pro S&P 500 (UPRO) is a triple leveraged fund that seeks a 300% return on the performance of the S&P for a single day. Conversely, The Pro Shares Ultra Pro Short S&P 500 (SPXU) seeks a triple leverage or 300% return on the inverse performance of the S&P 500. If you believe as I do that we are setting up for a leg down on the S&P then SPXU is the best way to profit from this trade.

Singapore's former Prime Minister Lee Kuan Yew put a damper on any European hopes for an Asia-led rescue, even as China offered vague words of comfort and the euro zone's bailout fund expressed confidence in Asia's strong support.

Just hours after German Chancellor Angela Merkel and French President Nicolas Sarkozy declared that Greece's future remains in the euro zone and agreed to widen the scope of the European Financial Safety Facility, there was scant evidence that Beijing or other deep-pocketed Asian governments want to deepen their commitment.

With speculation of a Greek default causing yet another flurry of high-level meetings and turmoil on global markets, attention turned to potential help from Asia.

While there were hopes that China would be actively buying bonds from the Euro nations, Singapore, in an article in this morning’s Wall Street Journal, said that with an economy just one-60th the size of Europe's, they we're in no position to rescue the Europeans by buying their bonds. Nor did they think that buying their bonds would necessarily rescue them.

The euro zone has a fundamental problem in making all member countries march to the same drummer, but you cannot expect the Greeks to march like the Germans.

The fact is that China can't purge the world of the economic crisis. Indeed, some countries have overestimated China's role in the global economy. The fear of contagion is a domino effect in which European banks with exposure to Greece, Portugal, Ireland, Italy, and Spain have come under the microscope and this has contributed to a lot of weakness of European equities and the euro. As I wrote earlier, Italy is actually a country that is too big to save.

I conclude that market investors who have firmly placed themselves on the side of believing that a Greek default is almost a sure thing are in a state of full blown denial. In my opinion, Greece has already defaulted. It’s just a matter of time.

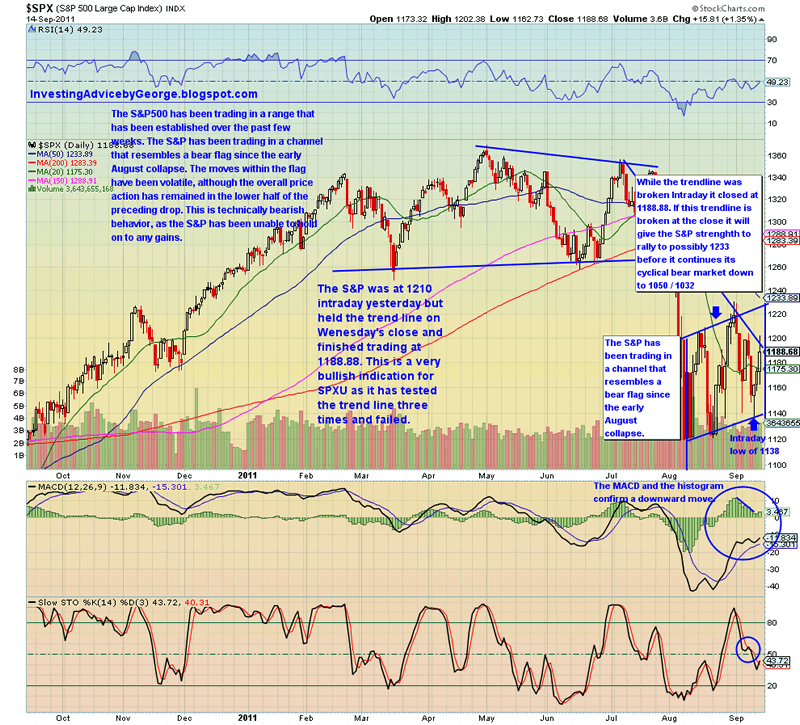

With a break of 1258 I believe that the S&P has completed a major distributive top and with the deteriorating picture in the world equity landscape it represents the start of a new cyclical bear market. I am sticking with my call that we are witnessing the first wave of bear market that will begin no later than early October. The macro picture is that we would see a fourth quarter rebound that would set us up for a deeper bear market that would likely last deep into 2012. Please see chart of S&P below.

For those of you that read me on a regular basis know that I have been calling for a sell off on the S&P. Yesterdays market would lend credence that my SPXU trade is still in play as the S&P closed at 1188.88. That is 1.22 points under my resistance level of 1190.00 so today bears keeping a watchful eye on The S&P and SPXU. As I have written, that while my timing may have been off on this trade, if the S&P continues its rally I will continue to buy SPXU because by early October the S&P will sell off to at least 1050 / 1032 and if it breaks that support will continue lower.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.