Stock Market Waiting Patiently!

Stock-Markets / Stock Markets 2011 Sep 19, 2011 - 02:49 AM GMTBy: Dr_John_Trapp

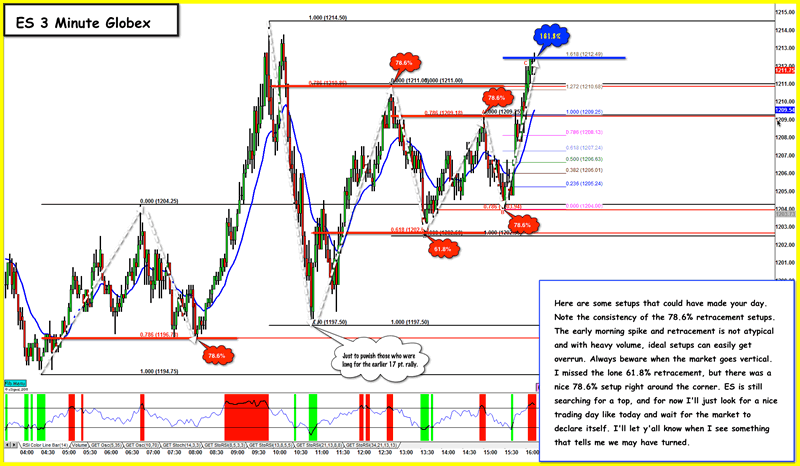

I'm looking forward to getting past this correction. Let's begin this weekend analysis with a review of Friday's action. You will remember that I said my favorite Fibonacci setups are the 78.6% retracement and the 161.8% external retracement. I commented that they were almost always good for at least a scalp. Friday was a day when they were good for more than a scalp.

I'm looking forward to getting past this correction. Let's begin this weekend analysis with a review of Friday's action. You will remember that I said my favorite Fibonacci setups are the 78.6% retracement and the 161.8% external retracement. I commented that they were almost always good for at least a scalp. Friday was a day when they were good for more than a scalp.

The early morning spike and sharp retracement is a good example of the kind of market you don't want to step in front of however. Note that the other trade setups were preceded by orderly moves with good structures (3 trend moves with 2 counter-trend moves). That's what I want to see when I place a limit order at my target level. When I trade this setup, I'll take 1/2 off the table after I have about 3 points and place a break-even on the rest. I'll take the rest off if ES reaches the 78.6% retracement going the other way. Don't expect to see this action on a strong trend day, but how often are we in a strong trend day verses a consolidation day.

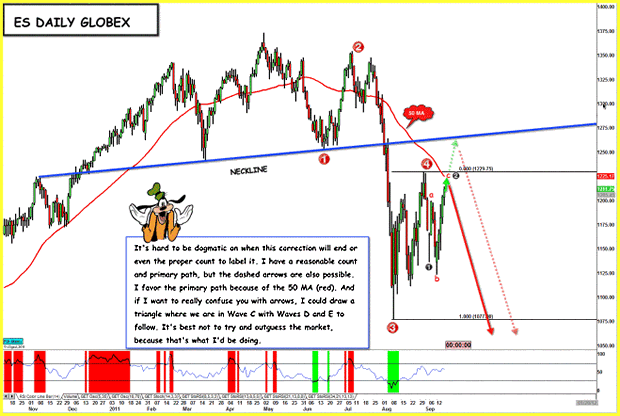

Next we'll look at the Daily chart for my best guess as to what we might see on Monday. The 50 MA is my key to the upside prediction for this correction. This chart is of the continuous data versus the current contract only. Unfortunately, the numbers don't coincide perfectly, so be sure to look at the December contract for the 50 MA level (1220.31). I don't expect a run for the neckline yet, but that's always a possibility (dashed arrows). I also mention the possibility of a triangle forming, but that would be my third best scenario.

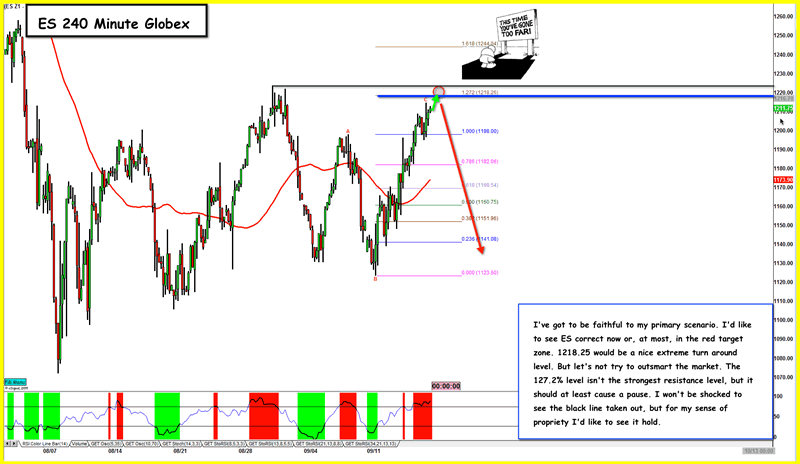

I use the 240 minute chart to show a possible target area (red circle). The blue line is the 127.2% external retracement of the preceding correction. It's not the strongest of the external retracements, but it does coincide nicely with the approximate level of the 50 MA on the Daily chart. A little overthrow to the black line would give us a double top, and it's so close I can't rule it out. If we start getting much above that area, ES will have gone past my top scenarios and I'll have to reconsider my opinion. ES is going to have to call this one. Our job is to be listening and watching.

If you like what you see here, wait to see how MortiES's analysis can assist you in your everyday investing or trading strategy! Go ahead, check out my track record and Sign Up.

I am offering a 30 day free trial period to be followed by a new monthly price of $60.

Dr. John Trapp a.k.a. Mortie for Value of Perfect Information who offer stock market commentary, fundamental & technical analyses on the financial markets. Try MortiES' 30 day free trial.

© 2011 Copyright Dr. John Trapp - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.