Merrill Lynch and Morgan Stanley Expect US Recession During 2008

Interest-Rates / Money Supply Dec 12, 2007 - 10:08 AM GMTBy: Gold_Investments

Gold

Gold

Gold was up $4.00 to $811.60 per ounce in New York yesterday and silver was up 3 cents to $14.67 per ounce. Subsequent to the Federal Reserve's 25 basis point interest rate cut gold fell in the less liquid New York Access market and erased the earlier gains. In volatile trade gold then fell as low as $796 but then rallied strongly and again erased the short term losses and in Asian and early European trading gold has been strong was at $807.50 at the today's London AM Fix. Gold was largely flat in pounds sterling and euros and at the London AM Fix gold was trading at £394.77 GBP (up from yesterday's London AM Fix at £393.79) and €549.21 EUR (up from yesterday's London AM Fix at €549.15). http://www.lbma.org.uk/statisti cs_current.htm

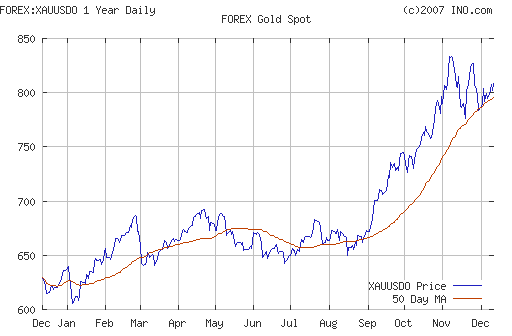

Gold's action yesterday was very counterintuitive and confusing with a sharp rally, a sharp sell off and then another sharp rally to finish largely unchanged from London AM Fix to London AM Fix. Gold may have rallied on the rumour of the Bernanke interest rate cut and then sold on the news as often happens in the markets. The fact that gold remains above $800 shows that the cash market is well bid with international physical demand remaining very robust. Gold looks very well supported at the 50 day moving average as per below. Meanwhile supply continues to fall with South African gold output falling 5.8 percent in volume terms compared with the same month the previous year, official data showed yesterday. In September, year-on-year gold sales fell 27.1 percent to 3.099 billion rand.

Merrill Lynch and Morgan Stanley have issued reports stating that they expect a US recession in first half of 2008 and this will lead to increasing risk aversion. We predicted a US recession months ago and viewed it as an inevitable consequence of the sharp deterioration of the US housing market. The question then as now is not whether the US and UK economies have a recession rather the question is how long and deep will the recessions be and whether the US and UK economies suffer a depression which is a severe or long recession.

There is increasing fears that the world's major central banks (particularly the Federal Reserve and Bank of England) have lost control of monetary policy and the monetary system. Residential and commerical property prices continue to fall and the credit crisis appears to be deepening and spreading to consumer and wider economy.

The Telegraph reports that in the UK, Peter Spencer, chief economic adviser to the Ernst & Young Item Club, said: "The fact of the matter is that the market rather than the Bank is now dictating monetary policy - and not from the point of view of controlling inflation, but from the point of view of a random walk. It is behaving in a way which is totally rational for individual banks but adds up to a major deflationary issue.

"I think this is a very grave situation indeed - and not just for the 1.5m [households due to renew their mortgages next year]. If this problem is not sorted out in the next two to three months we are looking at major insolvencies in UK plc."

The sense of fear in the City was compounded by the severity of the Bank's brief accompanying statement, which said: "Conditions in financial markets have deteriorated and a tightening in the supply of credit to households and businesses is in train, posing downside risks to the outlook for both output and inflation further ahead."

Inflation of the money supply causes economic booms and asset bubbles and the inevitable consequence of economic booms and asset bubbles is recessions and the bursting of the bubbles. Recessions are not the "end of the world" rather an integral and unfortunately necessary part of the economic cycle. They are necessary as they are the market and economies natural mechanism of undoing the misallocation of resources present during the boom or inflationary phase. Mishandling of the money supply, wholesale credit creation and money printing on an unprecedented scale (not too mention highly irresponsible lending and banking practices) have caused the problem and the notion that simply reducing interest rates will solve it is bogus. It is akin to giving a heroin addict further daily injections when what he really needs is a period of cold turkey which while painful in the short term will likely save his life in the long term.

Silver

Silver is trading at $14.64/66 at 1200 GMT.

PGMs

Platinum was trading at $1464/1469 (1200 GMT).

Spot palladium was trading at $346/350 an ounce (1200 GMT).

Oil

Oil rallied above $90 a barrel in US trade yesterday and remains above $90 today.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.