Stock Market Index Ramped Higher by Vested Interests Pre Fed Rate Cut

Stock-Markets / Market Manipulation Dec 12, 2007 - 10:59 AM GMTBy: Brian_Bloom

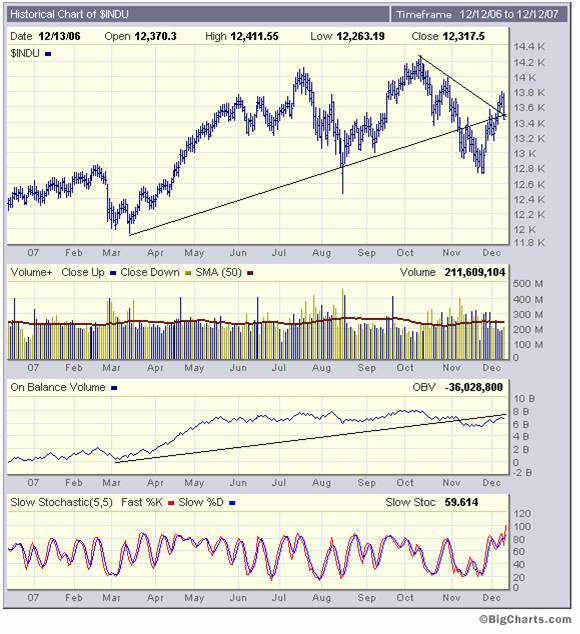

The chart below provides evidence that the industrial equity market was “ramped” by vested interests in anticipation of the Fed rate decision.

Note how, following the Fed decision, the Dow Jones fell back below the intersection of the two trendlines – which is roughly where the technical resistance was before it was ramped.

The On Balance Volume chart is still showing a technical reaction back to the rising trendline through which it broke down in early November, and the slow stochastic is in seriously overbought territory.

Technically speaking, this is not a market that is going to rise from here unless it is artificially stimulated. How will that be achieved?

Not shown here are other oscillators which are all pulling back from overbought territory.

I remain convinced that we are facing a very dangerous period ahead. The key will be the OBV. If it falls below the 6 billion share mark on the 12 month daily chart, that will represent a serious “sell” signal.

Frankly, I cannot bring myself to believe that the bad news is all known. Logic dictates that the sub-prime debacle will have a cascading effect, and the markets tried (and failed) to put a good face on all this. Logic dictates that the subprime debacle was not an isolated event. It was symptomatic of a mindset which pervaded the entire financial industry across the planet. The financial engineers were doing mental gymnastics to generate “clever” products where “risk” was for someone else's account. In the real world, that kind of mindset reflects dishonesty, lack of ethics and, at the margin, downright criminal intent to defraud. I expect the bad news to keep coming, and the spin and bullshit artistry to keep escalating.

The harsh re ali ty, in my view, is that the Fed has run out of wriggle room. If any more bad news starts to manifest they have nothing left in their arsenal. If the last rate cut didn't work, and this one didn't work, why should the next one work? In short, I continue to expect a cascading Bear Mark et. Hopefully, it will drift sideways and slowly downwards but I'm not holding my breath

Finally, look at how the gold price reacted. I am still bullish on gold – but I think the speculators have to be taken out first.

By Brian Bloom

Author's comment : If you would like to see how the whole jigsaw puzzle fits together – such that the pathway forward becomes visible also to you – please register your interest to acquire a copy of my novel at www.beyondneanderthal.com . It is being targeted for publication towards the end of March 2008.

Copyright © 2007 Brian Bloom - All Rights Reserved

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.