Stock Market Investors Failing to Recognise Inevitable Credit Contraction Collapse

Stock-Markets / Financial Crash Dec 13, 2007 - 12:04 AM GMTBy: Doug_Wakefield

While observing current events through the lens of history over the last few years, there have been times in which the only conclusion I could draw was that we were beginning a bear market that would prove much more severe than the one from 2000 to 2002. As fiat currency and money supplies have exploded the world over, we have seen a proliferation of products, with varying acronyms, as the financial world tries to distance itself from the risky loans it originated. My experiences, as a researcher and investment advisor, suggest that the root of the problem is in investors' thinking. Between the fall of 2002 and the spring of 2003, multiple markets began bull runs. As 2007 comes to a close, the only lesson most investors learned from the 7 trillion dollar loss of those years is to “hang on” when the market declines.

While observing current events through the lens of history over the last few years, there have been times in which the only conclusion I could draw was that we were beginning a bear market that would prove much more severe than the one from 2000 to 2002. As fiat currency and money supplies have exploded the world over, we have seen a proliferation of products, with varying acronyms, as the financial world tries to distance itself from the risky loans it originated. My experiences, as a researcher and investment advisor, suggest that the root of the problem is in investors' thinking. Between the fall of 2002 and the spring of 2003, multiple markets began bull runs. As 2007 comes to a close, the only lesson most investors learned from the 7 trillion dollar loss of those years is to “hang on” when the market declines.

But while the last five years has produced substantial bull markets in a range of equity classes, it has also produced investors who have failed to read the historic accounts of how rapid credit creation ultimately ends in collapse. The need to slow down and prepare for contracting credit is lost in the fast-paced, unforgiving world of momentum trading. But those who have been reading the headlines since the first of August can plainly see that the world is rapidly shifting from one that embraces risk to one that shuns it. And as historical precedent suggests, since the credit bubble started breaking down just 4 months ago, our government, as well as those of the Europeans and Asians, have sought to intervene.

With several equity markets set to finish 2007 at or near their all time highs, you may be thinking that things are not nearly that gloomy. Two years ago, we released a research paper on short selling, aptly titled “Riders on the Storm: Short Selling in Contrary Winds.” Some thought it foolish to attempt to thwart the gods of modern capitalism, and I must admit it's been a rough ride. Most who hold to my line of thinking have been unheard by family, friends, and associates.

But, once again I write to encourage some and to implore others to suspend judgment for a few minutes until they have critically appraised the evidence. If you come to the conclusion that I am wrong, what has it cost you but a few minutes of your time? But if I am right, it will not matter who wrote what when, but only that, as crowd behavior shifted from greed to fear, you heard an idea that later proved to be extremely valuable.

Heard It All Before?

If we see something one time, and extrapolate that the conclusion will always be the same, we stand a high chance of failure. But, if we watch multiple occurrences of similar patterns unfolding over months, quarters, and years – sometimes fast, sometimes slow – with different degrees of force and destruction, across different nationalities, cultures, and time periods, then those who ignore such data, do so at their own peril. So as you read and try to gain your bearings in this unfolding market, let me share with you two hindrances, in the form of words we think or say, that are barriers to accurate assessments.

Statement #1: “Hey, if you're so smart, how much did you make in the last twelve months?” With the Dow substantially higher than it was when I released our short selling paper, in January of 2006, you know I've heard this statement before. But, this statement reveals a fallacious understanding of how the market, and life itself, works.

First, financial history is littered with the corpses of advisors and investors who thought that things wouldn't or couldn't change. Taking comfort in yesterday's successes, we become less and less inclined to ask the question, “But why were the last 12 months good to my investment strategies?” Without asking this question, those being told they are smart and successful have no idea about how to hold on to that success should the reason for their success change course.

This is a fact that I have learned the hard way. In 1999, with no real knowledge of the history of money and credit, and with no real understanding on technical analysis and crowd psychology, I was convinced that my success was because of my two financial planning degrees and all of the reading I had done. Attending financial planning conferences and sharing success stories with other advisors advanced this belief even more. But, when prices declined rapidly in the bear market of 2000 to 2002, I saw how rare experts really are and how quickly praise can turn to criticism.

And while many continue to look in the rearview mirror as they seek to build their wealth, this practice is foolish and extremely dangerous. While some things are random, certain tendencies prove to be so strong that we call them rules . Though we don't know exactly how something will turn out, or the extremes to which a reaction will reach, we do know that if we mix certain elements together, we will get a specific reaction.

Imagine walking up to a young soldier about to be deployed to Iraq or someone who has recently lost a love one, and saying, “It will be like it was last year.” No. Life does not offer any of us a promise that last year's journey, however pleasant or painful, will be duplicated in the next. When the yellow dash light is flashing, “low fuel,” who expects to stay in their warm car and not stop for gas because the last 100 miles have allowed them this luxury?

Suggestion #1- If your financial strategies have presented you with very positive returns and higher asset values over the last few years, right now, ask yourself, “ Why did my numbers go up in the last few years, and what will need to happen in the next few years to keep these numbers rising? If you're unwilling to address these questions initially, you will likely be forced to do so in the future.

Statement #2: “Our capital markets are huge. We have so many government and private sector experts; they will fix any foundational problems that threaten my plans and financial well-being. The next year or two may be a little rough, but the experts will make sure the markets unwind slowly.”

This statement is born out of a lack of understanding of complex societies and their attendant problems. We grow to depend on more and more experts and a bigger and bigger socialistic state to intervene to make certain that our god-given rights, to a college education for the kids and a comfortable retirement, are taken care of.

Any serious student of the Great Depression will see hundreds of parallels with the men and women of today. They watched a new era of credit explode – giving the public the illusion that they were “wealthy.” This massive amount of credit showed up in a new instrument called a car loan, and for the first time ever, an entire generation of American farmers took out farm loans.

Few ever stopped to ask, “How did we come into all of this newfound wealth?” No one was being told that, while our federal debt remained flat from the final days of the Civil War until Woodrow Wilson's first year in office, between 1913 and 1920, it had exploded from $2.9 billion to $25 billion. Was this “random?” Should we really be surprised at how exploding debt changes a society's perspectives? The record speaks for itself. People liked the feeling of success that debt and credit produced. Most financial leaders of the 1920s enjoyed this easier lifestyle and watching their balance sheets grow. The government “experts” enjoyed the  praise they received. All of this new wealth was “justly due.”

praise they received. All of this new wealth was “justly due.”

We all know what happened. The fundamental problems went unaddressed. In an effort to keep market prices (the core of the wealth illusion) up in and after 1929, the Federal Reserve tried desperately to flood the money supply, cutting interest rates repeatedly and increasing their holding of government securities from $485 million to $2,432 million in just 4 years.

Ignoring the fact that it was their policies of the last two decades that had produced our nation's pain, the government presented numerous “solutions” to declining assets values. The public didn't question their newfound wealth on the way up; in the same way, they looked to government and finance leaders' promises as a means to get their prosperity back.

[ www.stockcharts.com Dow Jones Industrial Avg. '17-‘47]

Ultimately a new monetary scheme, built upon a less stable foundation, was presented to the public as a “rescue.” And, the same basic thing occurred in August of 1971, when, for the first time in history, all the major currencies of the world floated solely on trust, with nothing to slow up credit and debt expansion. Though history had shown time and again the destructiveness of such a course of action, the gold-exchange standard was abandoned and paper money ruled the day.

In examining national and international experts' speeches over the last several years, we see a recurring theme: as the “almighty” Dollar goes the way of all fiat currencies, how should global capitalism prepare? Since our tendencies are the same today as they were in the 1920s and 1930s, we should expect to endure many failed government attempts at sticking duct tape on the wings of this plane. As the natural forces of science and psychology collide with financial engineering over trillions of dollars of debt, the government will continue to try to help every one of their “major supporters” through one more day. As they try to rescue us with some new scheme for the world capital markets, we're sure to see government's role expand. And since the world's capital markets have made us more dependent on each other than those living in the 1930s, the next market and currency “solution” will be global, rather than national, in scope.

So, does all of this support the hypothesis of prices unwinding slowly? Let me answer with some charts clearly illustrating that standing on the wrong side of a Tsunami is already proving extremely destructive to the plans of millions. First, we see how prices can change in two of the largest holders of mortgage paper in the U.S.

Next we see what can happen to two of our nation's largest bond insurers.

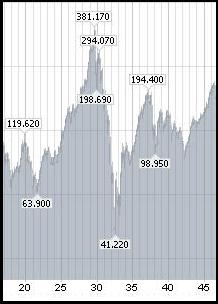

And in case, the last few years have made us forget how fast an entire market indices' value can change, consider the following.

Twelve months ago, most investors surmised that only a slow unwind, not a sharp plunge, was in the cards. Besides, planning for such extreme conditions was only being espoused by “gloom-n-doomers.”

All the Kings Horses

Yesterday, less than two hours after the famed wizards of modern finance spoke, the Dow shed more than 300 points. Today, December 12, 2007, the morning after the Federal Reserve cut the Fed Funds Rate for the third time this year, the Dow opened up almost 300 points from yesterday's close before rolling over to fall more than 300 points during the day. Was there anything that could be learned prior to these swings? Were these purely random events? Or could those who understand the way banking and finance works have factored these swings into their investment strategy and thinking, before the headlines sought to explain what happened?

Exceeding its speed of ascent during the August 16 th to October 11 th run, the Dow has moved up over 1000 points in less than 11 trading days. Evaluating the Dow's speed of ascent and descent would have warned investors and advisors that something unhealthy and unsustainable was developing. Those who look at the markets' reactions through the lens of history know that today's central banking actions are not natural and sustainable but unnatural and unsustainable. A December 12 th Bloomberg article states:

“The Federal Reserve, European Central Bank and three other central banks moved in concert to alleviate a credit squeeze threatening global growth, in the biggest act of international economic cooperation since the Sept. 11 terrorist attacks. Central bankers took the action after interest-rate reductions in the U.S., U.K. and Canada failed to allay concerns that banks will reduce lending, sending the U.S. into recession and hobbling growth abroad. Borrowing costs have climbed as mounting losses on securities linked to subprime mortgages caused lenders to conserve cash.”

In our August issue of The Investor's Mind, quoting an August 10 th Yahoo Finance article, we noted the same thing. “The Federal Reserve pumped 38 billion dollars into the banking system Friday, marking its biggest operation since the week of the 9/11 terror attacks, as it vied to shore up the US financial system. The US central bank acted after injecting 24 billion dollars Thursday into the market, amid sharp falls on global stock markets which were triggered by fears over the multi-trillion dollar US mortgage market and a related credit crunch.”

And again with an August 9 th Financial Times article, we quoted: “ The European Central Bank scrambled to head off a potential financial crisis on Thursday by pumping an emergency €94.8bn ($131bn) into the region's banking system after liquidity in the interbank market started to dry up, threatening banks' access to short-term funds. The cash injection was the biggest in the ECB's history, exceeding the €69bn provided the day after the terrorist attacks of September 11 2001. The ECB also made an unprecedented one-day pledge to meet 100 per cent of all funding requests from financial institutions”

But as I stated in the beginning of this article and in Herb Greenberg's May 10 th , 2007 Wall Street Journal column, the real problem lies in our natural tendencies: “The reason we don't believe the markets will crash is because we do not want to. Simply put, we enjoy the illusion of wealth that easy credit creates. And who wouldn't? With easy credit, there is no need to work for years and save, no need for politicians to ever say no, and no need to wait and do without. We don't have to look below the surface and examine the foundation of our markets and economies. If the system is experiencing a problem, liquidity is always the answer. If we encounter a slowdown, just add more liquidity. After all, it's been working for years. And the longer this arrangement persists, the more this belief is reinforced.”

Though most financial professionals know very little of Ludwig Von Mises, in his 1952 edition of The Theory of Money and Credit , he says as much. Originally written in German, in 1912, one year prior to the establishment of the Federal Reserve, Von Mises observes:

“If one wants to avoid the recurrence of economic crises, one must avoid the expansion of credit that creates the boom and inevitably leads into the slump.”

After the close of World War I, in his 1919 work, The Economic Consequences of Peace , even good old John Maynard Keynes agrees:

“Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch the currency. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless: and the process of wealth-getting degenerates into a gamble and a lottery.”

So if what we are watching is more of a casino, what should we do? One week prior to yesterday's rate cut by the Federal Reserve, Clive Brialt, Managing Director of Retail Markets for the Financial Service Authority , the English equivalent of the FDIC or the SEC, stated:

"You need to consider contingency plans against the worst outcomes. These plans might include the very practical issue of how you would cope with an upsurge in retail deposit withdrawals, both from your branches and over the internet; how you could access emergency funding; and the circumstances in which you might need to curtail or wind down your business. Again, any such plans need to be considered well before you are engulfed by a crisis since by then it will almost certainly be too late to develop practical responses. ” [Italics mine]

I would like to extend a special thanks to Dr. Mark Thornton, of the Ludwig Von Mises Institute , for his assistance regarding Von Mises.

If you're interested in what various experts, from a variety of disciplines, have to say about finance, you should consider becoming a part of The Investor's Mind and benefiting from the research and views of some of the most experienced individuals in the world of money. To get a feel for the educational material we've presented to our readers since January of 2006, click here . We continue to gain recognition for our 154-page industry paper on short selling, Riders on the Storm: Short Selling in Contrary Winds , which can be obtained with a subscription to The Investor's Mind. To learn more about our mission, as well as our educational and advisory services, visit our website .

By Doug Wakefield with Ben Hill

President

Best Minds Inc. , A Registered Investment Advisor

Copyright © 2005-2007 Best Minds Inc.

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.