Gold, Exciting Times

Commodities / Gold and Silver 2011 Oct 02, 2011 - 10:29 AM GMTBy: Adam_Brochert

The big picture is shaping up quite nicely now that we have ended another quarter. A nasty cyclical global equity bear market has begun, the third of the ongoing secular bear market for "advanced" Western economies that began in 2000. As an advanced economy, Japan is the odd man out, as they have been mired in a secular equity bear market for almost 22 years now. There are some interesting "big picture" nuances to this cyclical bear as they relate to precious metals that should provide phenomenal profit opportunities for those with cash on hand.

The big picture is shaping up quite nicely now that we have ended another quarter. A nasty cyclical global equity bear market has begun, the third of the ongoing secular bear market for "advanced" Western economies that began in 2000. As an advanced economy, Japan is the odd man out, as they have been mired in a secular equity bear market for almost 22 years now. There are some interesting "big picture" nuances to this cyclical bear as they relate to precious metals that should provide phenomenal profit opportunities for those with cash on hand.

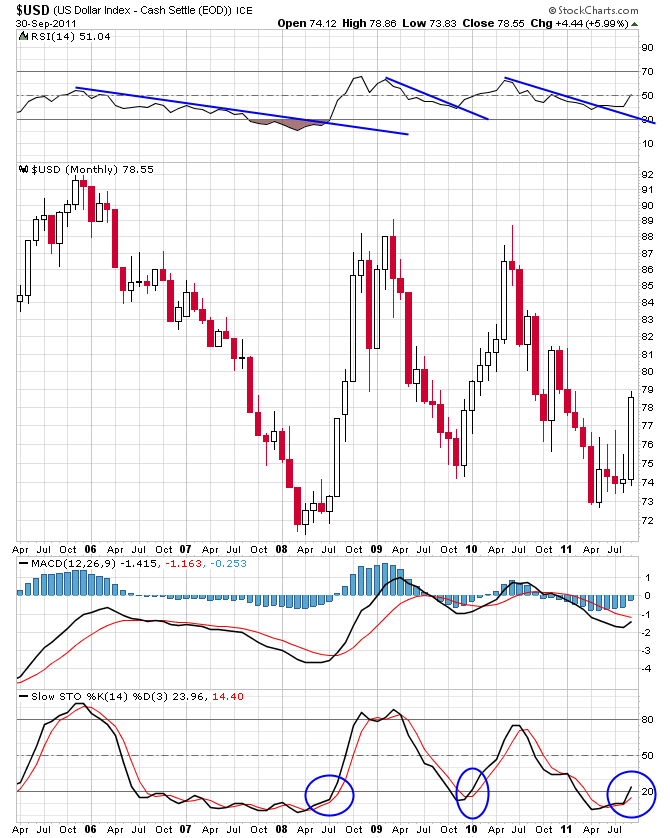

First up, the rally I have been expecting in the US Dollar Index ($USD) has begun. Unlike many Gold bulls, I don't subscribe at all to the "dollar to zero next year" theory. I think cash is a great position right now and I was the opposite of bullish on Gold when Gold hit $1900/ounce recently. I was also bearish on Gold stocks at that time and told my subscribers to avoid them completely, though I wasn't brave enough to short them. For now, when looking at the "big picture," the US Dollar Index rally is absolutely set to continue. Here's a 6.5 year monthly chart of $USD thru Friday's close with my thoughts:

I am not saying the US Dollar (or any fiat currency) is a good long-term investment. Far from it. But the US Dollar is rising based on the same thing that happened in 2008. Many continue to deny that we are going through another 2008 episode and yet it is starting to happen right in front of our eyes. No, it's not exactly the same, but the same principle applies: forced de-leveraging due to a liquidity crisis. This is US Dollar positive and equity and commodity negative. People scream that Bernanke and his interventionalist compatriots around the world would never let it happen, but this is naive at best. Not only are they not as smart as the markets, but they are often far behind the curve when the crunch hits. Additionally, a cynic (realist?) would point out that another crisis would give central bankstaz and governments cover to do what they love to do: print more money, bailout banks and other corporations that contribute the most money to political campaigns, and enact ridiculous new rules and regulations that only benefit their friends.

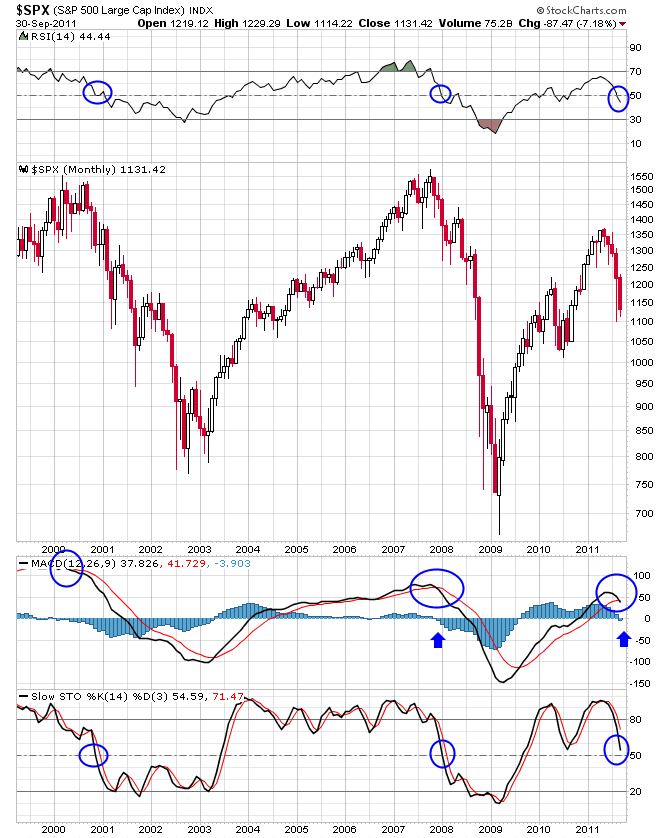

In the meantime, the S&P 500 US stock market has all the classic markings of a new bear market. And this is one of the healthiest advanced economy stock market charts out there! Stocks are dangerous here and should be avoided in my opinion. Here's a 12.5 year monthly chart of the S&P 500 ($SPX) thru Friday's close:

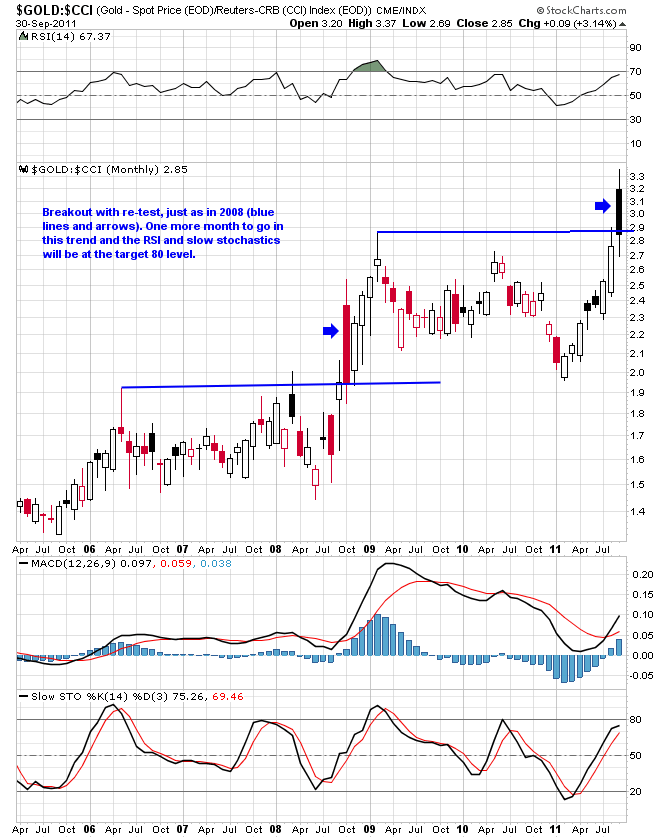

During this emerging period of turmoil, however, the fundamental fuel to fire the next leg higher in Gold stocks is evolving right on cue. I believe that physical Gold held outside the banking system is a safer and better long term buy and hold opportunity compared with Gold stocks. However, I like to trade the miners when I think they are going to provide leverage to the Gold price (note to Gold stock bulls: they often don't). We are fast approaching one of those good times to be long Gold stocks. The Gold to commodities ratio (or Gold to oil ratio if you wish) gives us an idea of whether the operating margins for producing Gold stocks are expanding or contracting, all other things being equal (and all other things are never equal, but this is a "macro" sector analysis data point). If the Gold price is rising faster than the variable costs of getting Gold out of the ground (e.g., energy), this is good for profit margins. When profit margins are expanding, it is rare that stock prices don't eventually follow suit, although the timing is the tricky part for traders.

In any case, here is a 6.5 month chart of the Gold ($GOLD) to commodities (using $CCI as a proxy) ratio using a monthly plot of $GOLD:$CCI:

The future's so bright for Gold miners that they've gotta wear shades according to this chart. And I don't think the move higher in this ratio is done yet. I see an explosive move off the bottom once it comes for Gold stocks, but I don't think we're there yet. However, soon we should see yet another epic buying opportunity (a la 2008) in the Gold mining sector. We may have already seen the bottom in the Gold price, but we will likely need to re-test it, whether the re-test ends up being slightly lower or higher than the recent low near $1550. The speculative fever in Gold has been broken for the short to intermediate term, a healthy thing. Trust me when I tell you that this fever will come back into the Gold market soon and eventually rage out of control. Are you buying Gold now while prices are low or will you wait until prices are higher again and then kick yourself for not buying while there was a sale?

The Dow to Gold ratio will hit 2 before this secular cycle ends, and we may well go below 1 before this mess is over. Specific trading recommendations reserved for subscribers.

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2011 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.