If They Have a Gun To Their Heads, Do the Banks Lend?

Interest-Rates / Credit Crisis 2011 Oct 03, 2011 - 03:27 AM GMTBy: Submissions

Sam Houston writes: Here we are three years after the financial crisis of 2008. The banks got bailed out. Their junk mortgages now sit on the balance sheet of the Federal Reserve. In exchange the Fed gave them face value in cash for their junk. Where did they get the cash? They created it out of thin air of course.

Then as if some sort of sick joke, the money given to the banks to make them whole on their bad decisions hasn't seen the light of day. It still sits at the Fed as monetary reserves. Why haven't the banks lent out the money ten fold through the magic of fractional reserve banking into new loans? Simple. The Fed is now paying the banks interest to keep their money deposited with them.

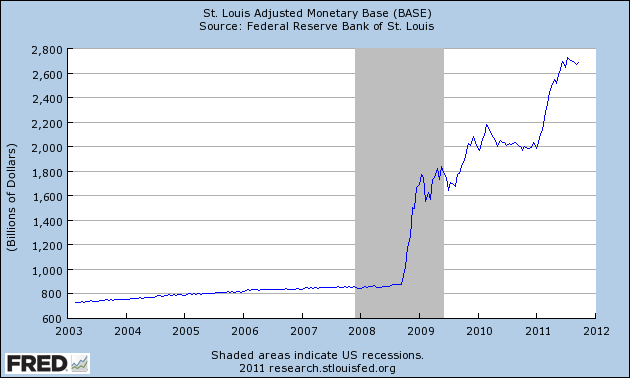

Check out the chart of the monetary base with it's explosion after the crisis begins in 2008.

This is why we have money creation on a massive scale and so far do not have massive inflation. The new money is created, but it hasn't been let out to play yet. It sits there quietly at the Fed as monetary reserves.

The game of slow it all down and hope for the best has now reached the end game. It turns out that holding tight onto the football and running around in the backfield doesn't actually score a lot of points after all. The economy is heading back into recession. What will be the next move?

Interest rates are already as low as they can get. Quantitative easing does nothing for the economy and everyone knows it. That card has been played. The twist is meaningless. What is left to do?

The Fed can lower or eliminate the interest rates they pay banks to park money at the Fed. This will make the banks lend money in search of a yield or risk losing money each and every day. Even a checking account that pays no interest still costs the bank money to operate. Thus the recent announcement by Bank of America that they will start charging five dollars a month for debit card privileges. They see the writing on the wall. Soon those free checking accounts will be a money pit for the banks unless they lend.

If the money sits idle the banks pay transaction costs and don't reinvest the money at a higher yield. It is a recipe for bankruptcy. They are testing the waters for the day soon when the Fed eliminates the interest they pay on reserves. When that day comes the banks know it is put up or shut down. The debit card fees, if they don't cause a consumer revolt, can buy more time.

The reality is though that unless every bank in the industry colludes together to assess these fees, consumers will switch banks. Those that don't switch may work around the fees by holding cash at home instead of using the card. In the end it will have solved nothing. Banks are in business to lend. The fact that they are lending risk free to the Fed instead of to their normal customers means they are scared of making bad loans and losing even more.

So what happens when the Fed eliminates the interest they pay the banks on reserves. Then we find out the answer to the much discussed inflation vs. deflation debate. If the banks lend in search of yield it is inflation and much higher prices lie ahead. If they hold tight and come up with more and more fees to finance their refusal to lend for yield then it is slow grind Japanese style in and out of deflation.

Which way will they go? If they have a gun to their heads, do the banks lend? We may already be at the end of the road for the fiat money experiment. Time will tell.

By Sam Houston

© Copyright Sam Houston 2011

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.