Silver Beaten Down by Strong U.S. Dollar

Commodities / Gold and Silver 2011 Oct 05, 2011 - 01:27 PM GMTBy: George_Maniere

Yesterday, I had several readers ask if it was possible that my theories on silver going to $50.00 to $60.00 by year’s end were wrong. I told them yes, It might go to $100.00 by mid March. I have often stated that I believe that silver is incredibly undervalued. While this sounds like an outrageous claim, silver is actually rarer than gold.

Yesterday, I had several readers ask if it was possible that my theories on silver going to $50.00 to $60.00 by year’s end were wrong. I told them yes, It might go to $100.00 by mid March. I have often stated that I believe that silver is incredibly undervalued. While this sounds like an outrageous claim, silver is actually rarer than gold.

This is because silver has industrial applications and every day our technologies require more and more silver to operate. Silver that is above the ground has been diminished by 91% since 1980, while the stockpile of gold has grown 600%. Indeed most of the industrial silver that is used ends up in landfills and I believe that one day this will be a source recycled silver.

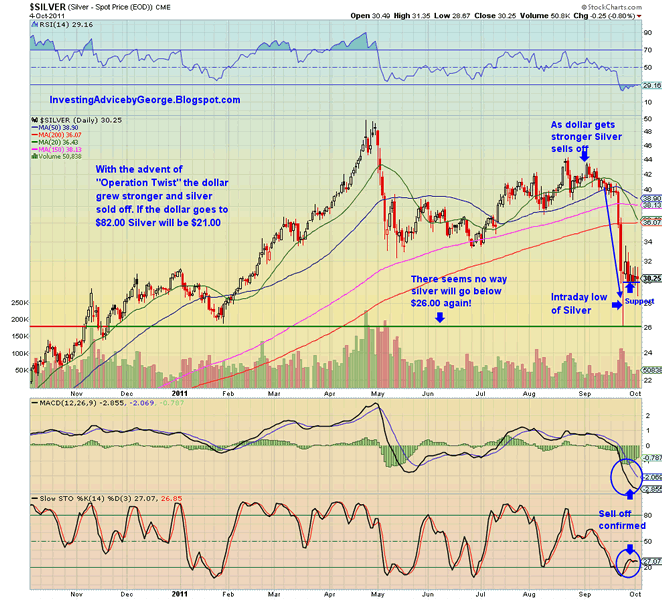

Most readers would rather own 40 ounces of silver rather than one ounce of gold. See Chart Below.

That begs the question, are there other places people can go for safe havens? They asked because it is hard to look at the board everyday and see silver getting beaten down. Today the Dow was as low as 240 points in the red. This should be a time for gold and silver to shine.

The answer to my readers is that now treasuries and the US Dollar are perceived as the safe havens. The astute investor, the one that understands that the dollar only looks good is because the Euro looks so bad is the one that realizes that the dollar is just temporarily the best. It is the best house on the worst block. What madness to put your dollars in treasuries or hold dollars. Every day you do so you lose value. I will, once again, remind my readers that as Gerald Loeb taught us it is not the amount of dollars you have it is the value of the dollars you have.

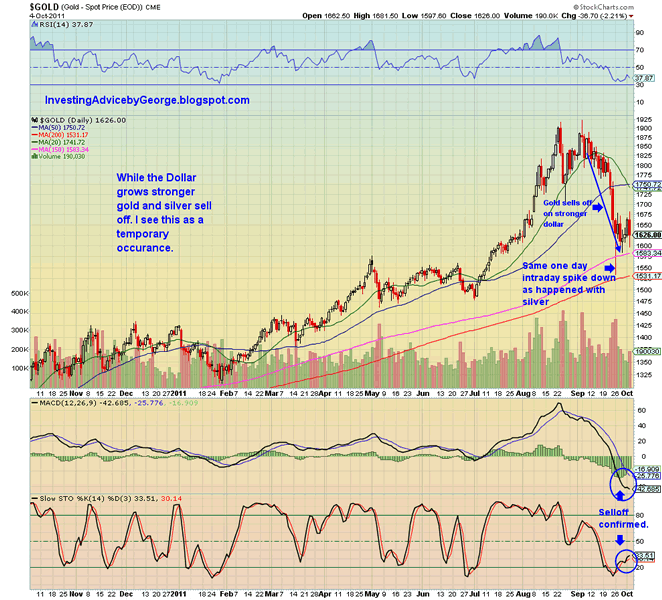

I would like to point out two differences in the spot prices gold and silver. I do not believe gold will go much lower than $1500.00 an ounce. Silver however, despite being a hedge against the weak dollar also has industrial uses. If the economy continues to weaken silver could fall as far a $21.00 an ounce but a look at the chart below will show that silver has seemingly put in a firm level of support at $26.00.

I am not saying that it is out of the realm of possibility for us to test $21.00 silver least we forget that it was in 2008 that I was buying silver Morgan for $15.00 an ounce. What I am saying is that you would not be able to buy silver for $21.00 an ounce. There would be margin hikes and premiums from the sellers and dealers. Indeed, last weekend I visited three very reputable distributors, AMPEX, Gainesville and Northwest Territorial Mint and all three of these dealers were mysteriously out of stock on one ounce silver coins. I can only conclude that they are willing to sit on them until the price of silver goes back up.

So why has silver mysteriously fallen in price? In my opinion it is because the dollar has grown so strong. Please take a look at the chart below.

As you can see the dollar has risen from $73.00 to $79.43 in less than a month. There have been reports of JP Morgan shorting 3.3 billion ounces of silver and I’m sure that has not helped the cause but the fact remains that gold and silver have remained weak because of the strong dollar.

In conclusion selloffs should not be feared but rather embraced. We have been given an opportunity to by silver and gold at possibly once in a lifetime opportunities. Lest we forget the miners my favorite is Silver Wheaton (SLW). Today I was able to pick up a nice position in this company for $26.00 a share. For goodness sakes, it has only broken $32.00 4 days ago and two weeks ago it was trading in the $40.00 range. I would suggest that positions be acquired in physical silver and then buy the paper trades like SLV, PSLV and AGQ which I bought today at $98.00 and sold three hours later at $108.00.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.