Can Global Economic Stimulus Stop Deflation?

Stock-Markets / Deflation Oct 07, 2011 - 12:32 PM GMTBy: Clif_Droke

The year 2011 has been a strange and unusual one on many counts. If anything, 2011 can be characterized as the first year since the credit crisis started in which deflation wasn't actively opposed by central bankers and financial regulators.

The year 2011 has been a strange and unusual one on many counts. If anything, 2011 can be characterized as the first year since the credit crisis started in which deflation wasn't actively opposed by central bankers and financial regulators.

In some cases, fiscal policy has been designed seemingly to assist the deflationary trend. In just the past few months, for instance, we've seen the abrupt end of the Federal Reserve's attempt at bolstering asset prices, the dramatic increase in margin requirements for several key commodities, talk of increasing taxes and regulatory burdens on businesses and other pro-deflationary measures. It's enough to make you wonder if perhaps the regulators actually want to introduce a certain level of deflation into the economy and financial markets.

Before continuing with our discussion it's important to understand the roots of deflation. Deflation is the consequence of a debt-plagued economy. It occurs when the velocity (i.e. turnover) of money declines. Velocity slows down dramatically when consumers reach the saturation point in being over indebted and then begin paying down their debt while refusing to take on new debt. Debt contraction can also occur if debtors repudiate their existing debt by refusing to service their obligations, as occurred in the subprime lending crisis of 2008. In both cases, a debt contraction always spells trouble for a consumer economy like the U.S.

Deflation has been the order of the day since 2007 when the subprime lending collapse brought a halt to the 5-year economic expansion and equity bull market. Commodity prices, which had been run up to truly vertiginous heights, also collapsed in 2008, confirming that deflation was to become the new economic reality.

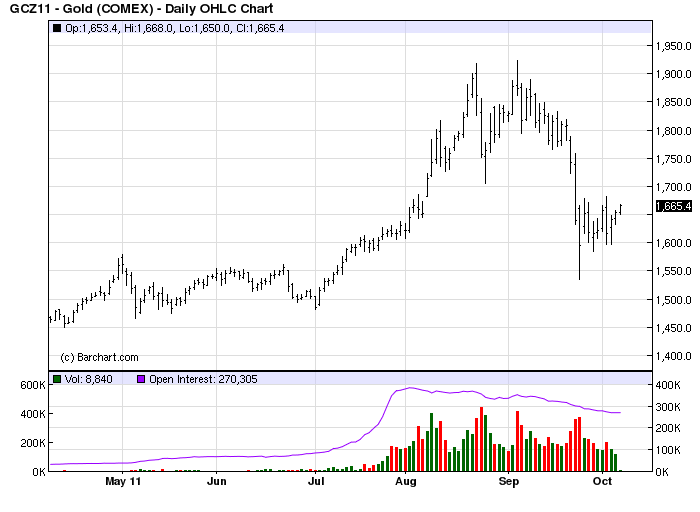

Commodity prices are among the best barometers of inflationary and deflationary pressures. The gold price in particular is of great value in measuring the strength or weakness of the economy. As John Tamny wrote in a recent Forbes article, "Gold is a great predictor of our economic health" because it is "the most constant, objective measure of value in existence." Although gold's fortunes can also be temporarily upset by periodic outbursts of investor panic like we saw in 2008 and again (though in a less extreme form) in recent weeks, it tends to perform well in a hyper deflationary environment since it attracts capital due to its safe haven status.

Although commodity prices can be artificially boosted for a time by monetary stimulus and momentum chasing hedge fund traders, a decline in economic demand is the chief symptom of deflation and will always tell on commodity prices sooner or later. The commodities crash of 2008 was a major shock to the global economy and instantly produced a decline in the general retail price level. Falling prices are something the world's central banks can scarcely tolerate and so it was deemed necessary to take action to reverse this decline. The U.S. central bank and Treasury responded with an $800 billion stimulus while China's central bank injected some $600 billion into the Chinese economy.

In both cases, the results were less than stellar. Most of the U.S. stimulus money benefited the financial sector with little benefits to the non-financial economy. China's stimulus went most into infrastructure and construction spending. Just how successful was China's stimulus? The best barometer of future business conditions, the stock market, rendered the following verdict on China's outlook.

As you can see, the market was unimpressed with the stimulus and is predicting declining economic fortunes for China. Since the end of the Fed's second quantitative easing program (QE2) in June, the U.S. stock market has also been in an overall downward trend while economic prospects at home are no better than China's. With an important long-term cycle having recently peaked (the 6-year cycle), there is even less natural economic support at home or abroad.

Ben Bernanke is an astute financial historian and possesses a keen awareness of the power of deflation in a highly developed economy like ours. Many observers assume Mr. Bernanke has naively done too little to stop deflation from becoming firmly entrenched. Others believe he is powerless to do anything to stem the flood tide of deflation and should therefore not even try. But Bernanke, who is arguably the world's foremost Great Depression scholar, was hired to be the Fed president at just such a time as this for a reason. His intimate knowledge of how deflation can be combated by monetary policy, as well as the limits of monetary policy, will continue to be utilized in dealing with the ongoing depression.

Bernanke has already achieved a measure of success in preventing deflation from doing its utmost in the first quantitative easing (QE) initiative in 2009. His policy was in alignment with the 6-year cycle bottom of late 2008 and it allowed the financial market to bounce back even more strongly than it would have without QE. It dramatically increased corporate profits, allowing the multinationals to build a cash hoard for the next round of deflation. And while it didn't do much to help the U.S. consumer to rebound, it did at least help the overall domestic economy remain relatively buoyant during a time when, without QE, it likely would have collapsed outright.

It can be argued that Bernanke went too far in commencing a second QE program last November, leading as it did to dramatically higher commodity prices and boosting retail price levels as a consequence. But perhaps we're not giving Mr. Bernanke credit enough, for its possible he did this with an eye toward achieving a sort of "equilibrium" in the general price level. Knowing that periodic outbursts of deflation can quickly collapse price levels across the board like we saw in 2008, it can be surmised that Bernanke purposely over-stimulated commodity prices in late 2010/early 2011 to pave the way for yet another strong recoil rally following the inevitable price collapse.

Indeed, many commodities suffered major declines in the second half of 2011 and some of them are now trading at their lowest levels in two years. The commodity exchange regulators seemed to be complicit in bringing about these declines by their incessant increases of margin requirements on many key commodity futures contracts. In the case of silver, a dramatic increase in margin requirements catalyzed a price collapse earlier this year. More recently, the CME Group has raised margin requirements on copper futures by 15 percent despite copper coming off a major low. CME Group previously raised margin requirements on copper by 18 percent on September 24, and on gold futures by 21 percent. More recently, CME also raised margins for platinum futures by 29 percent on Oct. 4.

Crude oil prices have also been on the decline in recent months. A falling oil price has a widespread effect on lowering prices of a broad spectrum of consumer prices and is thus deflationary in a sense. Could it be that regulators are actively aiding and abetting a general deflationary trend in order to put prices down to a certain level in order to take away the political will to protest a third stimulus attempt? There has been a tremendous grassroots uprising this year from those who don't want another stimulus. The fear behind this protest is that further attempts at bailing out the economy will only push retail prices higher and further weaken the dollar, as well as lowering bond yields. A significantly lower commodities price level could weaken this protest and give the Fed the political excuse it needs to commence another stimulus.

In light of the evident failure of the Fed's QE2 program, there seems to be a consensus among analysts that a third QE program would do little to ease the deflationary trend in the real estate market, nor improve the labor market - the two areas where deflation is most evident. But what of a coordinated stimulus by several of the world's central banks and governments? Since the U.S. remains the world's premier consumer, the fortunes of the global economy still largely depend on the health of the U.S. economy. Would it not make sense, therefore, if the world's central banks made a joint effort at reversing the effects of deflation of 2012? A coordinated stimulus program, if it were big enough, might at least temporarily stem the deflationary forces from making the economy much worse during the politically important year 2012. This would be a last gasp effort at reversing the economic contraction that has been underway since 2008 before the fierce currents of the 120-year cycle hit hard in 2013-2014.

The gold price meanwhile would stand to benefit from such a policy. Any attempt at monetary stimulus would almost certainly weaken the dollar, which in turn would boost the gold price.

While there isn't much in the way of cyclical long-term support for another round of stimulus, the last yearly cycle currently in its peak phase before the 120-year cycle bottoms in 2014 is the 4-year cycle (also known as the Presidential Cycle). It's scheduled to peak next year and while it has little meaning against the decline of the other long-term year cycles, it could theoretically provide at least a background of support for a coordinated stimulus program in 2012.

It's doubtful that even a globally coordinated stimulus measure would be very successful in fighting deflation. The best that can be hoped for by such an attempt is a temporary abeyance of deflationary pressures in stock and commodity prices and perhaps a modicum of support for the economy. It's extremely doubtful that such a stimulus would do much to relieve the current jobless rate or significantly stimulate the U.S. consumer economy. It's equally unlikely that residential real estate would reverse its downtrend. At best, a coordinated global stimulus would be maybe a 1-year or so insurance policy to prevent an outright deflationary collapse until the downward force of the long-term cycles becomes irresistible in 2013 and 2014.

Gold & Gold Stock Trading Simplified

With the long-term bull market in gold and mining stocks in full swing, there exist several fantastic opportunities for capturing profits and maximizing gains in the precious metals arena. Yet a common complaint is that small-to-medium sized traders have a hard time knowing when to buy and when to take profits. It doesn't matter when so many pundits dispense conflicting advice in the financial media. This amounts to "analysis into paralysis" and results in the typical investor being unable to "pull the trigger" on a trade when the right time comes to buy.

Not surprisingly, many traders and investors are looking for a reliable and easy-to-follow system for participating in the precious metals bull market. They want a system that allows them to enter without guesswork and one that gets them out at the appropriate time and without any undue risks. They also want a system that automatically takes profits at precise points along the way while adjusting the stop loss continuously so as to lock in gains and minimize potential losses from whipsaws.

In my latest book, "Gold & Gold Stock Trading Simplified," I remove the mystique behind gold and gold stock trading and reveal a completely simple and reliable system that allows the small-to-mid-size trader to profit from both up and down moves in the mining stock market. It's the same system that I use each day in the Gold & Silver Stock Report - the same system which has consistently generated profits for my subscribers and has kept them on the correct side of the gold and mining stock market for years. You won't find a more straight forward and easy-to-follow system that actually works than the one explained in "Gold & Gold Stock Trading Simplified."

The technical trading system revealed in "Gold & Gold Stock Trading Simplified" by itself is worth its weight in gold. Additionally, the book reveals several useful indicators that will increase your chances of scoring big profits in the mining stock sector. You'll learn when to use reliable leading indicators for predicting when the mining stocks are about o break out. After all, nothing beats being on the right side of a market move before the move gets underway.

The methods revealed in "Gold & Gold Stock Trading Simplified" are the product of several year's worth of writing, research and real time market trading/testing. It also contains the benefit of my 14 years worth of experience as a professional in the precious metals and PM mining share sector. The trading techniques discussed in the book have been carefully calibrated to match today's fast moving and volatile market environment. You won't find a more timely and useful book than this for capturing profits in today's gold and gold stock market.

The book is now available for sale at: http://www.clifdroke.com/books/trading_simplified.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter. Published twice each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.