Asian Economies, Where Are We Compared to Financial Crisis Sept 15, 2008?

Economics / Asian Economies Oct 11, 2011 - 03:51 AM GMTBy: John_Mauldin

The developed world seems to be focused on Europe, and while the next crisis in indeed brewing there, we must not forget that Asia is a large part of the future and major contributor to world GDP. My friends at GaveKal are based in Hong Kong and have staff in most Asian countries or are in them on a regular basis, so I read their Asian views with interest. Today’s Outside the Box is their latest Five Corners – Asia edition, where they look at China, Thailand, and Vietnam, as well as Asian growth, contrasting it to that of the "developed world."

The developed world seems to be focused on Europe, and while the next crisis in indeed brewing there, we must not forget that Asia is a large part of the future and major contributor to world GDP. My friends at GaveKal are based in Hong Kong and have staff in most Asian countries or are in them on a regular basis, so I read their Asian views with interest. Today’s Outside the Box is their latest Five Corners – Asia edition, where they look at China, Thailand, and Vietnam, as well as Asian growth, contrasting it to that of the "developed world."

It is good for us to remember that not everything rotates around US politics or European sovereign debt. Our crises shall pass, and Asia will still be there and growing. And for what it’s worth, my personal plan is to start visiting Asia a lot more in the future. It looks like I may be in Hong Kong in January, but more on that at some later point.

Your feeling like some Chinese takeout analyst,

John Mauldin

Outside the Box

JohnMauldin@2000wave.com

GaveKal Five Corners—Asia

Where Are We Compared to Sept. 15, 2008?

Joyce Poon, Cathy Holcombe, Gavin Bowring

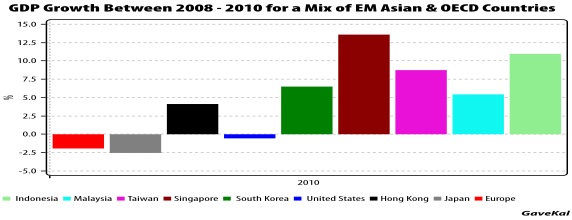

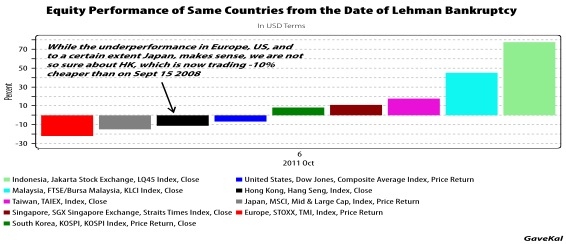

The extreme market movements seen recently in Asia are reminiscent of the dark period that hit the region in late 2008. Lehman’s bankruptcy and the subsequent shock to global trade and demand showed that Asia’s positive fundamentals can disappear in the blink of an eye if OECD economies go awry (see Daily—A Binary World after Fed’s Latest Move). Yet the recovery from crisis also taught the world that Asia is capable of strong growth, even as Western growth remains weak (see chart below). While Asia is still cyclically tied to the developed world through webs of trade and financial linkages, the economic gravity has gradually shifted towards China, whose growth drivers remain solid and relatively immune to global demand.

The Global Financial Crisis also encouraged portfolio rebalancing from the developed world towards emerging markets, in line with widening growth disparity between the two. According to EPFR Global, emerging market funds reported inflows of US$179bn in 2009 and 2010, 25% higher than the aggregate inflows in the five years prior to Lehman. Of course, portfolio rebalancing in emerging Asia is a tricky business, fraught with constraints on liquidity, fears of excess volatility, etc. which means that this rebalancing is not likely to happen in a straight line. But the groundwork has been laid for a different thinking on EM vs. DM allocation.

Putting these together, the current sell-off can be seen as an opportunity, especially for markets which saw significant misalignment between performance and fundamentals. An example could be Hong Kong, which is now trading below the level of the day of the Lehman bust—similar to the markets which are at the epicenter of the current crisis (i.e., Europe and the US). This despite the fact that Hong Kong is able to capitalize on the strength of China’s domestic economy and the ever-increasing cross-border financial integration.

Excavators and Liquidity Squeezes in China

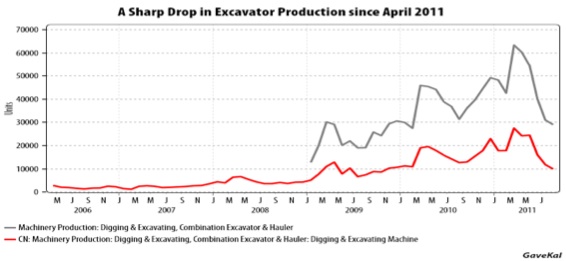

The liquidity squeeze in China has placed a number of companies in very tenuous operating conditions, as reflected not just in rising bankruptcies, but in the abrupt changes in production. The recent sharp drop in excavator sales is a case in point:

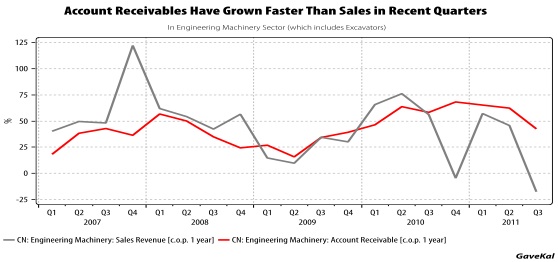

Broadly speaking, the chart above shows that heavy industries are facing macro headwinds. But the collapse in excavator sales since April does not just tell the story of slowing economic growth and tightening credit. It is also an example of what may be a pattern of Chinese companies making risky vendor-financing decisions in a bid to keep sales growth running high. This is particularly true in the machinery sector, which tends to have a higher accounts receivables-to-sales ratio than other industrial sectors in China.

Easy financing terms can help companies win business and market share when investment growth is strong. However, it also means a reversal can be nasty. As the chart below indicates, the machinery sector’s accounts receivables have grown faster than sales in recent quarters (something that has worried a lot of clients). Given the leverage in the system, a mild slowdown in demand coupled with tight funding conditions could easily end with a collapse in production, such as the one seen in the last five months of excavator production. In addition, railway builders are reportedly delaying payments amid safety inspections and funding freezes.

As Janet noted in the latest DragonWeek, while there was a notable increase in the machinery sector’s accounts receivables in June to August, according to the latest industrial survey, the rest of the industrial sector looks in healthier shape. However if Beijing continues to curb growth in shadow financing without balancing the impact with selective loosening policies, then we may see a lot more charts that look as jolting as the ones above.

The "Defensive" Nature of China’s Riskiest Sectors

Among the growing concerns of a Chinese hard landing (not our core scenario), investors have shied away from what is conventionally believed to be the riskiest sectors—banks, property and (due to corruption and safety fears) rail. Ironically, however, in case of serious downturn in the Chinese economy, these are probably also the sectors that Beijing would feel the need to support aggressively—banks, real estate and property are sectors that have broad economic reach, and add to China’s long-term structural growth story:

• Financials:China’s banks are trading at their lowest price-to-book values ever on fears of an explosion of non-performing loans—but would China really let its banks implode? History would indicate that the banks could be protected against an NPL crisis. In the past 12 years, China has transferred RMB5.5trn (US$860bn at today’s rates) in bad loans to state-run asset management companies; in other words, they have repeatedly bailed them out. As Arthur pointed out in The Magic Debt-Shrinking Machine, bailouts makes sense from a macro-perspective at this stage of China’s development, with a growth rate high enough to "amortize" bank losses over time. The costs of allowing a financial crisis would likely be higher.

• Property:Investment currently makes up 47% of GDP in China—if there is a sharp slowdown, Beijing will need to boost investment in some way. Construction of housing is one quick and useful way to boost growth. And despite all the talk of empty high-rises and "ghost towns" etc., in China, the fact is that mass housing infrastructure is in need—much more so than upgrades are needed to China’s impressive system of ports, airports, highways, etc. In addition to the 100mn new urban households that will be created over the next 20 year, the country has large potential demand for housing from existing urban households. Now one can argue that this is not a great comfort to commercial developers, since according to the current state-planning agenda, nearly half of all new supply in 2011-2015 will come from social housing. However the burden of social housing financing is mostly local—and if the commercial property market collapses, local governments will lose an important source of revenue. While we believe Beijing is eager to impose some pain on developers which have overleveraged and evaded austerity restrictions, if the going gets tough, then authorities will have to ease up the commercial property sector…

• The railway sector: The current crackdown on railway sector corruption and bad practice happens to coincide with a tightening cycle. In the event of a hard landing, rail is another area that may get the green light again. This is because despite the many problems in the sector, there are genuine capacity shortages and real structural benefits that would come from moving forward with the country’s RMB5trn long-term rail build-out program. China’s intensity of rail use is double India’s and more than a dozen times higher than the EU’s. A World Bank study in 2008 estimated capacity shortages of 10-20% in both freight and passenger. That said, there is much uncertainty about which firms will benefit the most if the delays in rail are lifted. For example, will China lower its ambitions in terms of technology (e.g., high-speed trains)? And will the recent safety troubles lead to more or less participation of foreigners? Here we point readers to an interesting article in the WSJ, which reported that the signaling system used in the Wenzhou crash in July included some circuitry from Hitachi; however the Hitachi components had been installed by a Chinese company, and were "blackboxed" to prevent reverse-engineering and copying. More openness to foreign participation may have prevented this problem.

Because we remain convinced that there will be no hard-landing in China, we believe the easing on the property and financial sector will come only gradually, and that companies in other sectors, such as consumer goods, will have an easier time of it in the next year. But the above sectors have the benefit of being ultimately defensive in a worst-case scenario—and because of their beaten-down valuations, they should rally as well if a "soft landing" consensus re-emerges—Heads I win, tails I don’t lose.

The Return of Thaksinomics

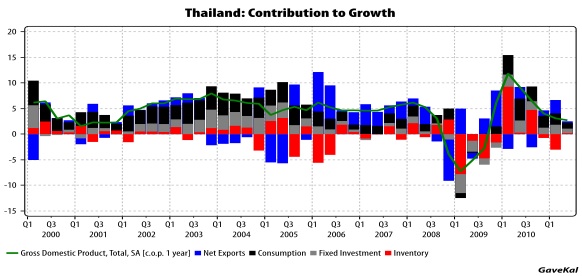

With the Thaksin firmly behind the new Puea Thai (PT) government, facets of the former Prime Minister’s management style, branded "Thaksinomics", have resurfaced. These policies emphasized less reliance on the export-led, cheap labor model, and tried to stimulate domestic demand and entrepreneurship, backed by state-directed credit schemes. While this helped Thailand achieve fast growth during Thaksin’s rule from 2001-2006, we are less comfortable with the applicability of "Thaksinomics 2.0" in the current environment. Consumption spending powered growth for three years (see chart) under Thaksin, and this solidified Thailand’s recovery from the 1997 crisis. However, some of the funding came through selling of partial stakes in state owned enterprises—a very messy process that saw perceived Thaksin cronies reaping outsized gains, and thus not likely to be repeated. Meanwhile, both private and public debt rose during this period; average household debt quadrupled between 2001- 2004.

Today, the PT government is adopting a similar strategy, flooding the rural north with money to boost consumption and reward supporters. However:

• This style of stimulus may not be as effective as in 2001. With unemployment at 0.5%, there is less scope for positive multiplier effects of stimulus without triggering inflation (see Five Corners). Meanwhile bank lending and property prices are not starting from lows as they were in 2001, and neither Thaksin nor the PT have the political clout to drive a centralized industrial policy.

• Many pro-consumption policies have been hastily prepared and may be counterproductive. The rice pledging program has been heavily attacked both in theory (see Thailand Development Research Institute), and in practice (see allegationsof corruption and smuggling), particularly now that bad flooding has damaged 10% of the rice crop. Meanwhile some government programs are being scaled back or delayed, e.g. amendments to the first home scheme, civil service incomes, minimum wage law.

• It may not solve lingering structural issues. This week, the central bank governor urged the government to save budgets for next year, saying Thailand’s saturated economy was not in need of extra stimulus, and should focus instead on public investment (logistics, job training and energy efficiency) if the goal is to wean Thailand off its export dependence (see Bangkok Post). Indeed, in Thaksinomics 1.0, public investment-to-GDP declined from 8.5% to 6.5% and has not recovered since. And since Thaksin’s first term in 2001, Thailand has become more, not less, dependent on exports, which went from 50% of GDP in 2000 to 65-70% by 2005, where they currently remain.

The bottom line is that investors should not expect the same results of Thaksinomics this time. Financials and real estate may therefore be a better bet than outright consumer plays in the medium-term.

Vietnam— Small Big Steps to Economic Reform

Vietnam, once a magnet for investors, has been off the radar for a while, suffering from chronic inflation, a run on the currency and a deflating property bubble. There have been headline defaults at state-owned enterprises, which account for 50% of capital investment but only 15-20% of GDP and 5% of employment. SOEs accessed cheap financing and invested in sectors unrelated to core business, becoming huge conglomerates with self-financing arms that operated as slush funds. All this has triggered tremendous political pressure for the Communist Party to reform the economy or risk undermining its legitimacy, which explain recent moves:

• According to official proclamations, SOEs no longer have cheaper costs of funding than the private sector, nor any implicit government guarantees or automatic subsidies.

• SOEs are now limited to investing no more than 15% of paid-in cap on non-core businesses. This has already triggered a wave of divestments by SOEs.

• Banks must now have a minimum capital of US$150mn (compared to no requirements previously), a capital adequacy ratio of 9% (previously 8%), liquidity ratios of a minimum 15% of liquid assets (compared to none previously).

These reforms have been combined with a hawkish monetary policy and credit caps. Lending to the property sector has been squeezed, credit growth ordered to stay below +20% annually, lending rates hiked to 20-25%, and bank branch expansion curtailed. Currency reform is also key, because the (involuntary) –25% devaluation of the Dong since 2008 has exacerbated domestic inflation. Households actively shift between gold, Dollars and Dong to hedge their savings against currency shocks, and gold hoards in Vietnam are some 50% of GDP (gold stocks rose +25% YoY in 2010 alone), while private gold and USD savings amount to 65% of GDP. Since the last devaluation in February 2011, the VND has remained relatively stable. This is partly due to increased confidence on the back of reforms, and also because Hanoi launched a major crackdown on gold smuggling.

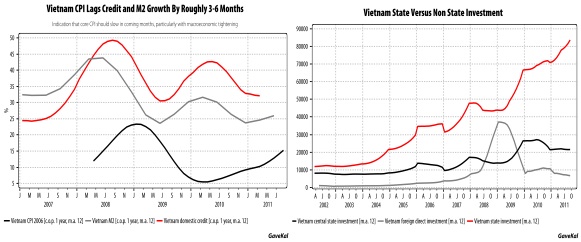

Hanoi’s reform and tightening program is now starting to show some results. Vietnam’s investment-to-GDP fell from 45% in 1H10 to 38% in 1H11, while the SOE share of GDP has fallen from 43% to 34%. Credit and M2 growth has slowed substantially, as have imports, and there are solid expectations that inflation— currently one of Asia’s highest—may have peaked (see chart on left). Policymakers have been willing to risk a fairly serious level of pain to achieve this—e.g., commercial property prices in Ho Chi Minh are roughly half the levels in 2007-08, while luxury apartment prices have fallen –15% since early 2011.

While heavy SOE-sector debt will continue to be a structural threat to the economy, the improved macro management has helped support a more sustainable long-term course. And we have already witnessed short-term results. Vietnam’s latest quarterly GDP growth was up +5.8% YoY, while in September exports rose +35.4% YoY and industrial production +12% YoY. With expectations that government policy easing may come in 2012, investors may yet bring their money back to this fundamentally promising market.

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2011 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.