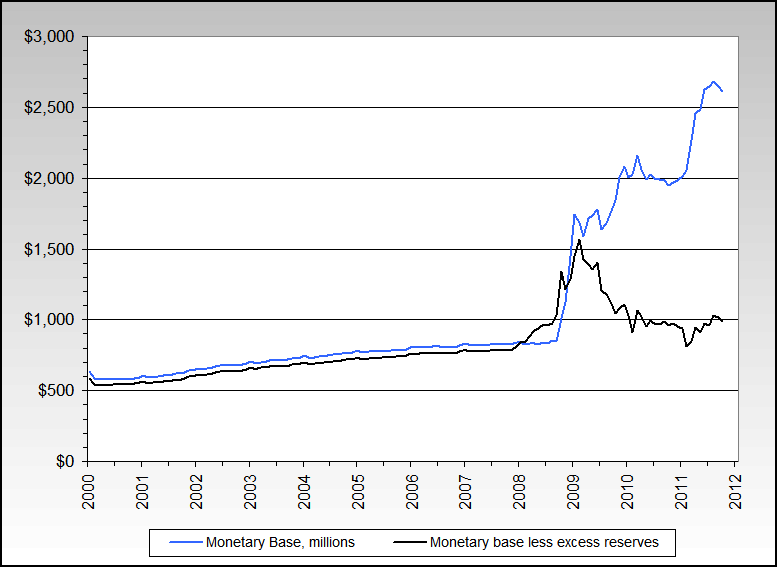

Adjusted U.S. Monetary Base Less Excess Bank Reserves

Interest-Rates / US Debt Oct 11, 2011 - 01:30 PM GMTBy: Jesse

Thanks to my friend Gary at NowandFutures.com for this chart.

Thanks to my friend Gary at NowandFutures.com for this chart.

I like to think of the expansion of the monetary base as it has been implemented this time, versus 1933 , as a large animal passing through the body of a python.

Who knows what might come out after the banks are done digesting it.

In the second version I have merely added a simple trendline.

Absent lending and a velocity of money the added liquidity at cheap rates, is perhaps little more than a subsidy and crutch to the zombie Wall Street banks.

More simply, the expansion is an artifact of the bank rescue and the assumption of bad debts and others financial obligations at above market prices, and not a program targeting the real economy. It is a variation on the efficient market and trickle down theory. Give the banks plenty of liquidity and they will lend it. No, they will take the Fed's riskless interest for the most of it, and gamble with the rest, demanding more guarantees, subsidies and benefits every step of the way.

Yes, the Fed has a 'blunt instrument,' but it is not as blunt and clumsy as Greenspan put forward, for example. The Fed has been primarily concerned with the banking system and its prosperity, both as monetary policy center and in its key role as regulator, and repeatedly allowed and even led the financially naive into trouble.

And they too often have responded to legitimate criticisms and questions from the Congress and the people with appeals to secrecy and snarky misdirection, abuse of their jargon, and the other things that serve to hide their actions.

So with the Fed inflating selectively on the banking side, without exercising vigorous oversight on the financial system, and the median wage languishing in the real economy, a forecast of stagflation, which is always and everywhere the outcome of policy error or exogenous shock, appears probable.

"Significant changes in the growth rate of money supply, even small ones, impact the financial markets first. Then, they impact changes in the real economy, usually in six to nine months, but in a range of three to 18 months. Usually in about two years in the US, they correlate with changes in the rate of inflation or deflation.

The leads are long and variable, though the more inflation a society has experienced, history shows, the shorter the time lead will be between a change in money supply growth and the subsequent change in inflation."

Milton Friedman

This is much more than a liquidity trap. The financial system is broken. It is corrupted and distorted, and it is acting like a weight on the real economy. And the banking system has been broken since 1990's. Perhaps broken is not quite the right word since it implies some accident and not a willful campaign of intent.

You can pour monetary stimulus into this corrupted system as the Fed did in the first decade of this century, and the results will be the same: financial asset bubbles, corruption, fraud, increased public debt, and a widening gap between the wealthy few running the system and the public who are paying for it. The only thing good about stimulus is that it is better than austerity, if both are intended to sustain the unsustainable.

Stimulus without reform is a waste, but austerity without reform is insane cruelty.

The message of OccupyWallStreet is fairly clear, but the status quo cannot hear the message: 'The Emperor has no clothes.' And today on Bloomberg the response was, 'They hate us for our prosperity.' What the protesters are saying is that the system is broken, we have lost confidence in it, and we want the change and reform that we voted for in 2008 and were never given.

To paraphrase Tacitus on the status quo of empire, "To ravage, to slaughter, to usurp under false titles, they call freedom; and where they create a desert, they call it prosperity."

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2011 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Monte Haun

12 Oct 11, 15:40 |

Monetary Base

Do mean that the Monetary Base in your graph is between 1.5 to 2.0 Billions? Don't you mean Trillions? Monte Haun mchaun@hotmail.com |