Gold Signals The End…

Commodities / Gold and Silver 2011 Oct 13, 2011 - 02:38 AM GMTBy: Hubert_Moolman

Gold remains our best means of economic measurement. It is not a perfect or 100% consistent measure of wealth, but it is our best. Due to its monetary properties, gold can be used to measure wealth across generations. Just like we have the sun and moon to discern the times and seasons, I believe, we have gold to discern changes in wealth. It is interesting that the sun is often compared to gold, and the moon to silver. Just like a day in the Middle Ages is comparable to a day in this century, an ounce of gold in the Middle Ages is comparable to one today.

Gold remains our best means of economic measurement. It is not a perfect or 100% consistent measure of wealth, but it is our best. Due to its monetary properties, gold can be used to measure wealth across generations. Just like we have the sun and moon to discern the times and seasons, I believe, we have gold to discern changes in wealth. It is interesting that the sun is often compared to gold, and the moon to silver. Just like a day in the Middle Ages is comparable to a day in this century, an ounce of gold in the Middle Ages is comparable to one today.

Currently we use fiat currency, like the dollar, for economic measurement. However, this creates a huge distortion due to the fiat currency being highly unstable. Can you imagine what would be the effect on our planet if we did not use the normal cycles that the sun and moon provides us with? Our ability to produce food for example, could be severely disrupted, leading to famine or possible extinction of mankind.

By using a highly unreliable measure like the US dollar, our ability to make proper economic decisions is severely impaired, since we (the common man) are not easily able to distinguish between a real increase or decrease in wealth , for example. This causes a great misallocation of wealth and will lead to a severe economic depression.

When you look at a chart of the average day’s wages in dollars compared to the average day’s wages in gold ounces, with some analysis, you will understand why the dollar cannot be used as an economic measure. These charts show that the average daily wage for Americans, have gone from about $28 in 1964 to about $152 in 2010, whereas in gold it has fallen from just short of 60% of an ounce of gold in 1964 to just 12,67% of an ounce of gold in 2010.

Gold is telling us that people are now earning less money than they did in 1964, whereas the dollar is telling us the opposite. Which measure is telling the truth? This bizarre situation is evident in our “economic” and “accounting” language, when we talk about a real and nominal increase in prices. An example would be when an economist tells you that house prices has increased in nominal terms, but decreased in real terms. What? How can something go up and down at the very same time? Using a proper measure, there would be no need to have a “nominal” as well as a “real” analysis.

These bizarre and illogical concepts in our economic language are as a result of the bizarre measure of value called fiat money. We have to look at the right signs to discern the times. I prefer to look at the “behaviour” of gold to discern the economic times.

What is gold’s “behaviour” telling me?

Gold Rallies and Debt

Since 1900, we have had three major rallies in the gold price. The first started during the Great Depression, the second since about 1968, and the current since about 2001. Note, the gold price went up during the Great Depression, since most things as measured in currency (gold) depreciated. Further to that, in 1933, due to increased demand, the gold price was increased from $20.67 to $35. During the first two rallies, there were major economic declines. The economic decline during the Great Depression was much worse than that of the 70s. This is mostly due to the difference in debt levels during the two periods. The debt level during the great depression was far greater than that of the 70s. The greater number of defaults, due to the bigger debt, took a bigger chunk of value out of the economy.

The current gold rally is still in progress. Debt levels now are greater than during both the previous major gold rallies. It is believed that in 2008, total debt as a percentage of GDP in the US stood at more than 340% compared to 265% during the great depression. At some point during the great depression, debt levels collapsed, causing a major economic decline. The rally in gold is a way reflection of how debt levels collapse. The current major rally in gold is thus telling me that we are likely to have an economic decline far greater than that of the Great Depression, in the US and most parts of the world. This economic decline has already started, and is about to intensify.

New Monetary Order

In 1933, Franklin D. Roosevelt changed the monetary order in the US, with Executive Order 6102. Fundamentally the dollar changed its nature due to this order, and was therefore no longer backed by gold – for US citizens. As mentioned earlier, this and the revaluation of gold was done, due to the increased demand for gold. The principle is: people became aware that there were far more claims on gold (read dollars) issued than the gold available, and therefore demanded their gold. This was mainly the result of the increase in credit during the 20s. As explained above, this run to real money (gold) is basically the flipside of the contraction of credit or debt.

So, the revaluation of gold was done to halt or slow the debt contraction, with those who handed their gold to the government, paying the bill for this decrease in debt contraction. Also, it prevented the banking system from leaking more gold, due this increased demand for gold. The system was recharged, and ready to go, as we know, another 38 years.

The late 60s to early 70’s (start of the second gold rally) brought the same problem, however, this time it was sovereign nations that became aware that there were far more claims on gold (or dollars) circulating than the gold that the US had available. Some nations requested their gold because of this fact, and the US banking system was once again leaking gold like it did during the Great Depression.

Like in the 30s, the US new that it would not be able to deliver the demand for gold, due to this “gold run”, and it therefore decided to close the “gold window”. Just like the US citizens, nations could no longer exchange their dollars for gold. This stopped more gold from leaking out of the US reserves, and the system was yet again recharged. The bankruptcy of the US was now well hidden, and it seemed like the perfect con. No more demand for gold from neither citizens nor sovereign nations that might expose the bankruptcy (too many dollars), too few ounces of gold.

Dollar could now be printed without any accountability to those users of dollars (basically the whole world). They have done it: the perfect con. Or have they?

No, there might be no one that will be able to bring the bankruptcy to light, due to the seemingly faultless plan; however, it is the natural laws that will bring this con to an end.

How? Debt levels are once again at historically high levels. The level of debt that this system can carry is limited. The level that it is limited to might not be known, however, one can look at natural laws in order to estimate a possible limit. It is my believe that the natural cycle (limits) for these type of systems (man-made systems) are linked to the human cycles of 40 years , 70 years and 80 years, as per the Holy Scripture.

The period of 40 years is associated with middle age, judgment, as well as a generation. The period of 70 years is associated with a life-time and judgment. The period of 80 years is associated with an extended life-time, two 40 year periods and also judgment.

The history of this dollar monetary system appears to follow these natural cycles with an almost scary accuracy. From the period of the Great Depression (gold revaluation) to Nixon closing the gold window is more or less 40 years. That is the period of 1929 to 1933 to 1971.

The period from 1929 peak in the Dow – when the stock market crash, as well as the peak in the Dow/Gold ratio – to 1999 when the stock market made a peak (1st of 2 peaks), and the Dow/Gold ratio peaked, is 70 years. Remember, the Dow/Gold ratio is a significant indicator of the extent to which claims on real assets exceed the actual real assets; therefore, it is an extremely important signal when determining turning points in the current fiat money system.

The year 2014 will be 70 years since the Bretten Woods agreement that brought about the current monetary system, with the dollar as reserve currency. This is how the relationship with the US and the gold of other nation states in the US came about.

We are already in the period that marks 80 years since the Great Depression. The year 2013 will mark 80 years since the 1933 gold revaluation. It is currently 40 years since the closing of the gold window.

The point here is that the natural cycles appears to be very relevant to this man-made monetary system, and that it is very likely that we are extremely close to the end.

The end of the monetary system is likely to come before a peak in gold, if by decree (creation of a new monetary system), but still forced by natural law. If the system is ended by natural law, then it is likely to come at the peak in gold or after. The peak in gold I refer to is gold as measured against other real assets (not paper money).

Another possibility to keep in mind is the fact that gold could also be outlawed by most governments. I am not saying that this will happen, however it is a possibility, and should be watched for. If this comes to being, I believe we have entered the period when this might happen.

Again, the nature of gold allows us to keep track of the times and seasons of this corrupt system, by studying the behaviour of gold.

Gold Fractal Analysis

Based on the above analysis and long term fractal analysis, it appears that we are close to a top in gold (in terms of fiat currency and real assets). However, let this not confuse you to think that we are close to a top in the price of gold in terms of the dollar or other currency amount.

We are close in terms of time (as early as the end of 2012 to the beginning of 2013), but $ 1920 is not close to $10 000, should $10 000 be the peak in the gold price, for example. It is also likely that gold will not have a peak in fiat currency as such, but instead, just discontinue trading in fiat currency. That means we might come to a point where gold will only be exchanged for real assets.

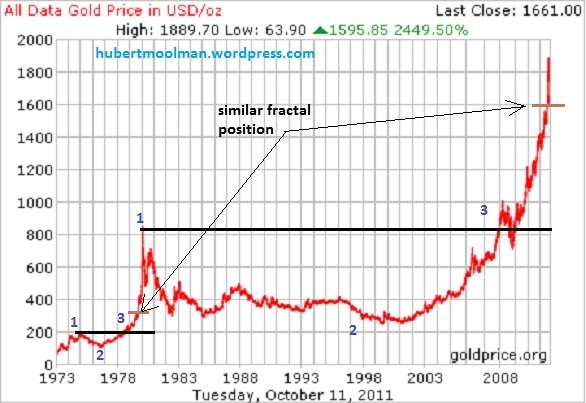

Below is a 38yr gold chart (thanks to goldprice.org):

I have done some fractal analysis on this chart. I published this analysis the first time when gold was well under $ 1200 dollars. The fractals indicated have astonishingly continued to keep its similarity as we have progressed during this gold bull market.

On the chart I have indicated two patterns marked by the numbers 1 to 3. The first pattern (fractal) forms a small cup between 1974 and 1978, compared to the second pattern which forms a big cup between 1980 and 2008. If the bigger pattern continues it similarity to the smaller pattern, then the parabolic (based on a long-term scale) move in gold should continue, taking gold to multiples of the current price. I have indicated the point in the 70s that is similar to point where we are at now.

What I wanted to highlight here is the fact that according to my fractal analysis, it appears that gold has reached a critical point where it is expected to rise really fast. Also, this analysis suggests that we could peak as early as the end of 2012 to 2013, and we should as a minimum reach $ 4000 by then. This is consistent with the above analysis regarding gold and the monetary system.

Please note, the above fractal analysis is just a very big picture analysis, as well as a simplistic analysis prepared for this article. One has to also look at the context in which both patterns exist as well as look at confirmation standards.

My premium subscription service and long term fractal analysis report provides more usable information regarding the price of gold and silver. Please contact me for details as well as a free current edition of my premium service.

Other Important Points

I believe there are enough signs that indicate that we have entered a period where we should expect the worst. We should thus prepare for the worst, with the hope that we would be able to cope with whatever comes our way.

Due to the great probability that the fiat money system might come to an end soon, it is not desirable to exchange physical gold and silver for fiat money. Where possible it is better to exchange them for real goods and services and productive assets.

An economic depression is virtually assured due to the bankrupt monetary system as well as the extreme debt levels.

For more analysis, subscribe to my blog or premium service.

Warm regards

Hubert

Please visit my blog and website for more of my work and premium service. http://hgmandassociates.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2011 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.