Bush's Housing Subprime Mortgage Bailout Plan - It's ugly, but it's all we have

Stock-Markets / Financial Markets Dec 15, 2007 - 02:07 PM GMT

The Dow Jones Industrial Averages soared 175 points on the day that the Bush Administration announced its housing bailout plan. Wall Street was wrong. It wasn't something to cheer about. The major argument against the bailout plan is that it keeps free market forces from clearing out all the toxic sludge built up in our housing and banking system. It is argued that the bailout will certainly prolong the pain and could exacerbate the housing and mortgage mess over the long haul.

The Dow Jones Industrial Averages soared 175 points on the day that the Bush Administration announced its housing bailout plan. Wall Street was wrong. It wasn't something to cheer about. The major argument against the bailout plan is that it keeps free market forces from clearing out all the toxic sludge built up in our housing and banking system. It is argued that the bailout will certainly prolong the pain and could exacerbate the housing and mortgage mess over the long haul.

But it's all we have. The bailout plan will not help the the sellers of the estimated 2.5 million homes that are not occupied by the owners of the properties – none of which are eligible for the Treasury debt relief plan. Those homes will remain vacant or possibly be sold at much lower prices. The debt relief is aimed at homeowners with FICO credit scores of 660 or below and are still current on their mortgages to “freeze” their interest rate for an additional five years.

The outcry is that the investors in these subprime mortgages will suffer the loss of the additional return they were expecting at the time of reset. The problem with this argument is that we can already see that, without the bailout, they would likely get nothing. This argument has its parallel in bankruptcy law. If a debtor is insolvent, it is better to liquidate the remaining assets under Chapter 7. On the other hand, if the debtor is still solvent and able to make payments, a restructuring under Chapter 11 will provide relief to the debtor and often provides a better value to the creditors. The cost of bringing a foreclosed home back into the market is estimate to be in excess of $50,000, along with the lower price it might bring in a constrained buyers' market. So investors in mortgages would get some relief from this plan as well as stabilize the market for subprime debt.

Another argument against the current plan is that it doesn't help those with higher FICO scores who were suckered into buying a subprime mortgage when they would have been better off owning a house with a conventional mortgage. And those that are insolvent aren't being helped at all. According to them, the plan does too little rather than too much to extend the coverage and scope of the debt relief. But the alternative of doing nothing is far worse.

By easing debt servicing requirements to those who can afford to pay the plan not only reduces the number of homes potentially doomed to foreclosure, but also gives investors some value rather than facing the aftermath of massive defaults. And, so far, it involves no taxpayer money. The days of Bedford Falls where Jimmy Stewart (George Bailey) and the Bailey Brothers Building & Loan offering mortgages to new homeowners is over, if it even existed at all. (Take the time to see “It's a Wonderful Life.”) Wall Street took the home mortgage business to a new level of speculative lending and dishonest selling that has to end. It's too bad that it had to sting a lot of innocent folks in the process.

Apocalypse now?

Of all the times of the year to have a major market setback, this is not considered to be one of them. The seasonality model which avers that you buy in November and sell in May may not apply this year. Market veteran Harry Schultz isn't buying it , either. Shultz's latest letter is absolutely apocalyptic, "A financial tsunami is upon us," he says, caused by lax credit and complications introduced by Wall Street's derivatives craze. He may be right.

Treasury Bonds are also taking a hit.

Today the Department of Labor announces that the Consumer Price Index rose .6% last month. The unfortunate story behind this announcement is that military pay and social security increases have already been set for 2008. The timing of this is a little more than suspect. Why am I so suspicious? The higher inflation rate is a direct consequence of all the liquidity in the economy from lower interest rates, which encourage more borrowing and less saving. I also means that fixed obligations are paid with cheaper dollars. Not a good outlook for bonds.

Today the Department of Labor announces that the Consumer Price Index rose .6% last month. The unfortunate story behind this announcement is that military pay and social security increases have already been set for 2008. The timing of this is a little more than suspect. Why am I so suspicious? The higher inflation rate is a direct consequence of all the liquidity in the economy from lower interest rates, which encourage more borrowing and less saving. I also means that fixed obligations are paid with cheaper dollars. Not a good outlook for bonds.

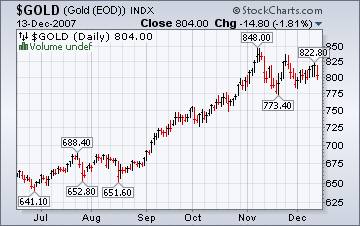

Gold not holding $800.

LONDON, Dec 14 (Reuters) – “ Spot gold slipped to a one-week low in late European trade on Friday after the dollar extended gains on data showing U.S. consumer prices for November came in higher than expected.”

LONDON, Dec 14 (Reuters) – “ Spot gold slipped to a one-week low in late European trade on Friday after the dollar extended gains on data showing U.S. consumer prices for November came in higher than expected.”

Say it ain't so! According to the experts, gold should be rallying at the news of higher inflation. It looks weak to me.

There goes the neighborhood. Japan is declining too.

(Japanese) Investors also found few reasons to buy after the central bank's latest survey showed business confidence fell in the fourth quarter on worry about rising costs, their impact on profits, and further fallout from the subprime loan crisis.

Before the open, the Bank of Japan revealed the results of its Tankan Survey, which reports on business confidence. The survey reports that business confidence fell for the first time in three quarters.

Are Chinese being driven to drink?

SHANGHAI, China — “Chinese stocks rose Friday, led by strong gains in liquor makers who are expected to benefit from higher food prices. A rebound in property developers also helped buoy the market.”

…Or could it be that more Chinese are drinking after the 18% sell-off the Shanghai Composite has seen since mid-October? Oh, those animal spirits!

The U.S. Dollar is gaining respect.

Even before the Consumer Price Report was released, the market was expecting a higher than average CPI . The thinking on Wall Street is that, with higher inflation, the Federal Reserve doesn't have the leeway it needs to cut interest rates. Inflation is a big worry overseas, too. This is keeping the European banks vigilant about their interest rates as well. But if the economies across the globe are slowing down, the U.S. Dollar is still the safest haven.

Even before the Consumer Price Report was released, the market was expecting a higher than average CPI . The thinking on Wall Street is that, with higher inflation, the Federal Reserve doesn't have the leeway it needs to cut interest rates. Inflation is a big worry overseas, too. This is keeping the European banks vigilant about their interest rates as well. But if the economies across the globe are slowing down, the U.S. Dollar is still the safest haven.

Greenspan says, “Housing bubble caused by inflation expectations.”

Alan “I didn't do it!” Greenspan has an article in Wednesday's Wall Street Journal that comes awfully close to admission of the truth…but he flubbed his chance. Instead, he blames it on the old saw, “inflation expectations.” He denies that the lowering of short-term interest rates and the introduction of teaser rates based on them would have made any meaningful difference in the outcome. The problem is, some pretty respectable thinkers closely follow Alan's remarks. In this case, his remarks don't fly.

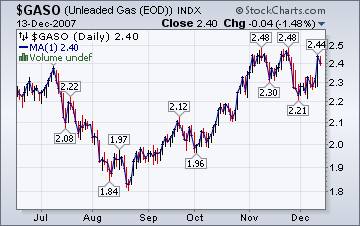

Expectations of lower gasoline prices?

The Energy Information's Weekly Report says, “Expectations about growth in global demand have been lowered by most analysts over the last few months. Concerns here in the United States about the housing market and tightening credit conditions have led some economists to worry about the possibility of a recession on the horizon. Concern about the U.S. housing market has been one of the factors the Federal Reserve has cited for lowering the Federal Funds interest rate. With strong global demand one of the key factors driving oil prices higher over the last few years, any significant lessening in demand growth could put downward pressure on oil prices.”

Prepared for peak heating.

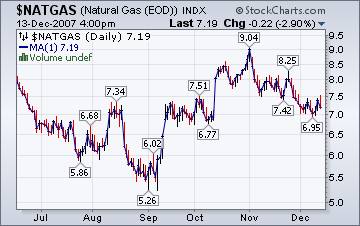

The peak heating season has begun and with it some additional pressure on natural gas pricing. A Nor'easter over the New England states will certainly increase usage, but the supplies are in place. Meanwhile, ExxonMobil is planning a huge floating liquefied natural gas terminal off the coast of New Jersey that will service the New York area, one of the largest markets for natural gas in the world.

The peak heating season has begun and with it some additional pressure on natural gas pricing. A Nor'easter over the New England states will certainly increase usage, but the supplies are in place. Meanwhile, ExxonMobil is planning a huge floating liquefied natural gas terminal off the coast of New Jersey that will service the New York area, one of the largest markets for natural gas in the world.

No More Bubbles to Bail out the Housing Bubble

By Bill Fleckenstein , a contrarian that thinks as I do.

The negatives keep growing, this time unchecked. The stock market, the real estate market and the economy will get in sync on the downside -- it's just a matter of when.

Beam me up, Scotty.

There are still no signs of intelligence on Wall Street. Kevin Duffy has a good article, too.

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I have had a running commentary on the markets again this week. John may be gone this Friday, but Tim and I will attempt to give a summary of what we see in the markets. You may listen to our comments by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.