Gold Trading in Hong Kong on 'Triple Demand' - China Positioning CNY as Reserve Currency

Commodities / Gold and Silver 2011 Oct 17, 2011 - 07:19 AM GMTBy: GoldCore

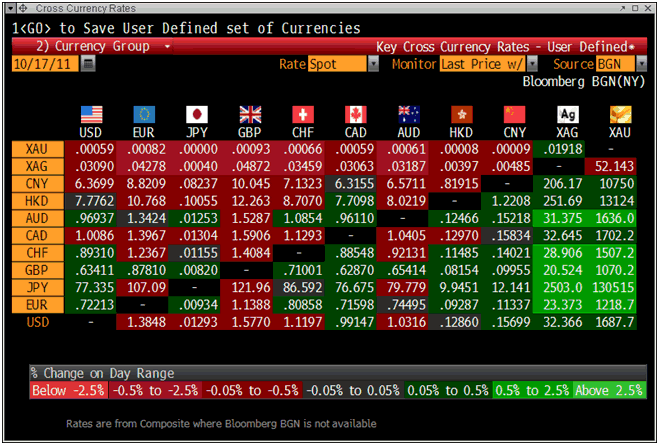

Gold is trading at USD 1,686.70, EUR 1,218.80, GBP 1,069.29, JPY 130,327.94, AUD 1,634.84 and CHF 1,506.12 per ounce.

Gold is trading at USD 1,686.70, EUR 1,218.80, GBP 1,069.29, JPY 130,327.94, AUD 1,634.84 and CHF 1,506.12 per ounce.

Gold’s London AM fix this morning was USD 1,689.00, GBP 1,069.33 and EUR 1,217.65 per ounce.

Yesterday’s AM fix was USD 1,676.00, GBP 1,062.31 and EUR 1,214.31 per ounce.

Cross Currency Table including Yuan (CNY)

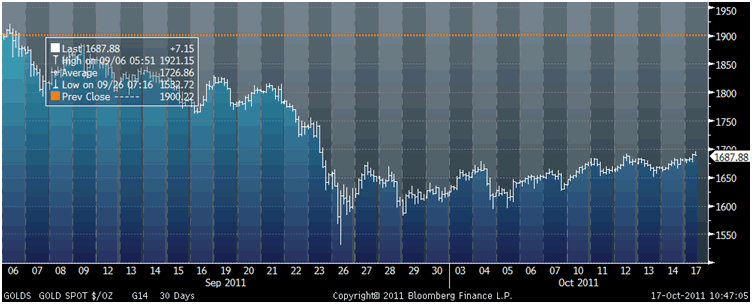

Gold has broken through resistance at $1,690 and may challenge the $1,700 level after last week’s biggest weekly gain since early September. Many investors remain nervous that contagion in the euro zone may not be averted ahead of the European Union debt crisis summit this weekend.

Gold in USD – 30 Day (Tick)

CFTC data shows that hedge fund managers, large speculators and gold and silver traders increased their net-long position in New York gold and silver futures. Speculative positioning in the market remains at very low levels after sharp liquidation which suggests gold may have bottomed and should rise from these levels.

Hong Kong, the world's third-largest gold trading centre, has become the world's first place to offer gold trading in yuan, further positioning the yuan or renminbi as a potential global reserve currency.

Hong Kong’s Chinese Gold & Silver Exchange Society, a century old bullion bourse, has introduced gold trading quoted in Chinese yuan, making it more convenient for Chinese people and high net worth individuals (HNWs) holding yuan to invest in the precious metal and opening a new way to hedge.

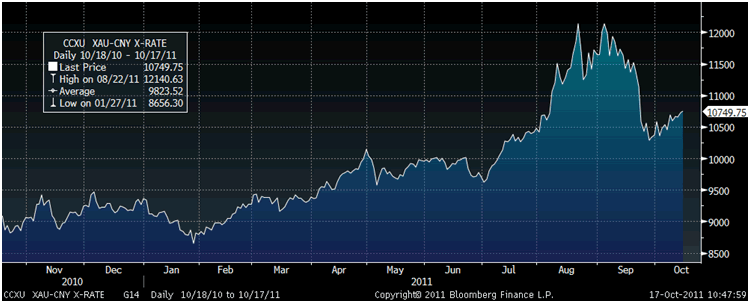

Gold in CNY (Yuan / Renminbi) – 1 Year (Daily)

The move comes amid the continuing push by Chinese authorities for a more international role for its currency and as an alternate reserve currency to the embattled dollar and euro.

With gold now traded in yuan, it is only a matter of time before oil is traded in yuan thereby positioning the yuan as ‘petro yuan’ and a rival to the petrodollar’s status as the global reserve currency.

The move reinforces Hong Kong’s status as an offshore hub for the Chinese currency and as a rival to New York, London and other cities as a global financial capital.

The Chinese Gold & Silver Exchange said that the service, dubbed "Renminbi Kilobar Gold," is targeting retail and institutional investors. The product is among the latest offerings designed to tap the fast-growing pool of yuan deposits within Hong Kong banking system.

"By attracting both local and international investors, the Renminbi Kilobar Gold is a significant step towards internationalizing the renminbi," said Haywood Cheung, president of CGSE.

From inception the contract may generate a very significant HK$6 billion ($770 million) in trades a day, exchange President Haywood Cheung said in an October 14 interview. Daily bullion trading volume at the bourse, which has 171 active members, has surged to HK$136 billion this year from last year’s HK$31 billion on appetite for gold as a safe haven.

“There’s triple demand for this yuan product,” said Cheung late Friday. “Investors can enjoy the bull market in gold, the yuan’s appreciation and hedge gold denominated in other currencies against the yuan.”

“The uncertainties in the global economy are supporting gold”, Cheung said.

“It’s still the right timing,” Cheung said. “With the depreciation of the dollar and problems in the Eurozone, investors realize they want some other currencies that are safer like the renminbi. Gold can be a way for people to bet on the yuan, even it’s not yet fully convertible.”

The society, started in 1910, will consider trading silver in the Chinese currency later, Cheung said, declining to identify the timeframe. The society has imposed a daily ceiling of 300 kilos for physical delivery of gold denominated in yuan to avoid depleting the currency pool in Hong Kong, he said.

“The sudden influx into gold bars may take away half of the yuan liquidity in Hong Kong,” Cheung said.

Should even a small amount of traders of the new yuan denominated gold contract attempt to take delivery of physical gold bars it may create supply issues in a marketplace that is already experiencing supply constraints.

SILVER

Silver is trading at $32.28/oz, €23.39/oz and £20.50/oz

PLATINUM GROUP METALS

Platinum is trading at $1,571.70/oz, palladium at $627/oz and rhodium at $1,525/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.