The Simple Magic of Moving Averages, That Can Alert You to Future Price Expansions

/ Learn to Trade Oct 22, 2011 - 02:13 AM GMTBy: EWI

To a first-time observer, watching a technical analyst spot a major trend change in a financial market before it occurs can seem as mystical as pulling a rabbit out of hat. But once you learn the tools of the trade, you know there are no tricks up the technical analyst's sleeve. What you see, is exactly what you get.

To a first-time observer, watching a technical analyst spot a major trend change in a financial market before it occurs can seem as mystical as pulling a rabbit out of hat. But once you learn the tools of the trade, you know there are no tricks up the technical analyst's sleeve. What you see, is exactly what you get.

On this, EWI's Senior Commodities Analyst Jeffrey Kennedy speaks to one technical indicator in particular: moving averages. In Jeffrey's own words:

"There is no magic in moving averages, the magic comes in finding something that you are comfortable with and applying it. I like it because it consistently works and you can customize it to your individual trading style and time frame."

Jeffrey's appreciation of the measure doesn't end there. In his highly acclaimed Commodity Trader's Classroom eBook, Jeffery expands on the many variations of MA analysis used to identify high probability trade set-ups. Among his favorites: the Moving Average Compression. The excerpt below is a direct quote from Jeffrey's eBook:

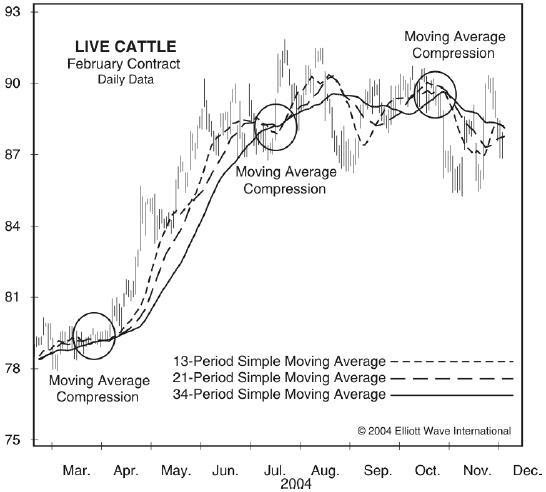

"Moving Average Compression works so well in identifying trade set-ups because it represents periods of market contraction. As we know, because of the Wave Principle, after markets expand, they contract (when a five-wave move is complete, prices retrace a portion of this move in three waves.) MAC alerts you to those periods of price contraction. And since this state of price activity can't be sustained, MAC is also the precursor to price expansion.The Live Cattle chart above demonstrates three different simple moving averages based on Fibonacci numbers 13, 21 and 34. The point at which all of the moving averages become one and form a straight line is what Jeffrey refers to as Moving Average Compression. As you can see, the compression of the moving averages tells us that the market has contracted, and prompts the expansion shown in April and May 2004."

FreeWeek is back!  You can get trading lessons (just like this one), daily video analysis and expert commodity picks -- absolutely FREE! You can get trading lessons (just like this one), daily video analysis and expert commodity picks -- absolutely FREE!

Now until noon Thursday, October 27, you can have complete access to EWI's popular commodity service, Futures Junctures -- only during FreeWeek. Learn more about Futures Junctures and get complete access for a full week >> |

This article was syndicated by Elliott Wave International and was originally published under the headline The Simple Magic of Moving Averages. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.