Can Germany Support The Eurozone Without Nuclear Energy?

Commodities / Uranium Oct 25, 2011 - 02:41 AM GMTBy: Jeb_Handwerger

Germany (EWG) has taken the path away from nuclear following Fukushima by shutting down their reactors and importing natural gas from Russia (RSX) and nuclear energy from France(EWQ). This move away from nuclear is no way to run a modern industrial nation which has heretofore been the strongest economy in the Eurozone area continuously bailing out their debt ridden neighbors. After this move we hear news that the once burgeoning German economy is grinding to a halt due to a "sharp drop in energy production after the government shut down eight nuclear plants after the Fukushima reactor disaster in Japan."

Germany (EWG) has taken the path away from nuclear following Fukushima by shutting down their reactors and importing natural gas from Russia (RSX) and nuclear energy from France(EWQ). This move away from nuclear is no way to run a modern industrial nation which has heretofore been the strongest economy in the Eurozone area continuously bailing out their debt ridden neighbors. After this move we hear news that the once burgeoning German economy is grinding to a halt due to a "sharp drop in energy production after the government shut down eight nuclear plants after the Fukushima reactor disaster in Japan."

This is not a surprise we were aware of this potential black swan. Merkel buckled to the demands of environmentalists run amok by halting nuclear power generation thereby causing a large drop in domestic energy production causing rising prices in other energy venues. Industries closed up shop as Merkel abandoned economic growth for a few votes. Germany's leading companies have been protesting as they are being strangled by increasing costs that has consistently risen for the past decade.

Germany was the first major country to abandon nuclear power following Fukushima. Merkel's move is in contrast with the U.S., China , Turkey, India, Russia and many other countries who are continuing full speed ahead with safe and next generation nuclear reactors.

China (FXI) just concluded a nationwide safety inspection following Fukushima of nuclear plants and will begin approving new reactors as they seek to multiply their energy capacities. China finished the inspections post Fukushima one month ahead of schedule indicating their eagerness to satiate increasing energy demands from its growing economy. China will likely adopt the AP 1000 design being the first to adopt next generation standards that are safer, economical and efficient.

Germany must understand that a modern industrial nation must utilize nuclear power to satisfy its energy needs. Now we are witnessing the consequences of Merkel's move away from nuclear and how it may be a serious blow to future of the Eurozone. Germany, the once industrial giant has become a client nation as domestic energy production dropped in the second quarter impacting negatively their GDP.

Eurozone banks are in serious danger of collapsing. Unfortunately Germany is involved in financing these troubled entities. The question arises, how will the Eurozone survive with Germany's economic future in doubt?

Deutschland's experiment is a failure and now the world has observed the economic consequences of abandoning nuclear. Months ago the leaders of German Industry wrote an open letter stating, "that the ending of German Nuclear Energy with such unprecedented haste gives us increasing worry." Merkel may have destroyed Europe's most advanced modern industrial machine as the only country supporting the Euro finally succumbs self destructively.

Germany is swimming against the tide as the rest of the world says, "Yes" to nuclear energy. There are 443 operating reactors, which does not include new plants coming online. There are currently 62 modern and efficient power plants being built all over the world including 27 in China, 5 in India, 11 in Russia and even 2 in Japan among many others that have elected to continue turning on nuclear power. In fact, uranium is fast approaching a supply-demand deficit and there is a possible shortage in uranium ore which may benefit uranium miners(URA).

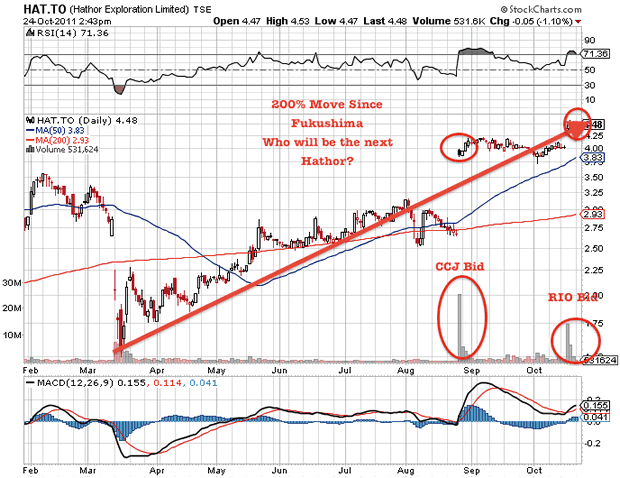

The prolonged basing period in uranium is rapidly approaching its conclusion. Last year we saw major demand in uranium as prices soared and many nuclear miners made large gains during the fourth quarter. Now many of the uranium miners are drastically oversold reaching long term support. This year we are experiencing a prolonged basing period due to the aftermath of the millennial tragedy in Japan and The Western Sovereign Debt Crisis. An extended consolidation leads to powerful up moves. There are signs the rise in uranium miners may begin shortly. There is a nuclear renaissance globally especially in North America. Witness the recent announcement by Rio Tinto (RIO), who is making a "Friendly" offer on top of Cameco's (CCJ) "Hostile" bid on Hathor (HAT.TO).

The feeding frenzy for Hathor is only the beginning of major mining interests who recognize that nuclear is a logical and economical energy source for America's future electricity. Expanding nuclear into the energy equation will diversify our power demand and produce inexpensive electricity for our nation far into the future. Our homes, businesses, and environment will be the beneficiaries.

By Jeb Handwerger

© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.