Friday After the Stock Market Rally Promising a Very Profitable Christmas

Stock-Markets / Stock Markets 2011 Oct 28, 2011 - 08:16 AM GMTBy: George_Maniere

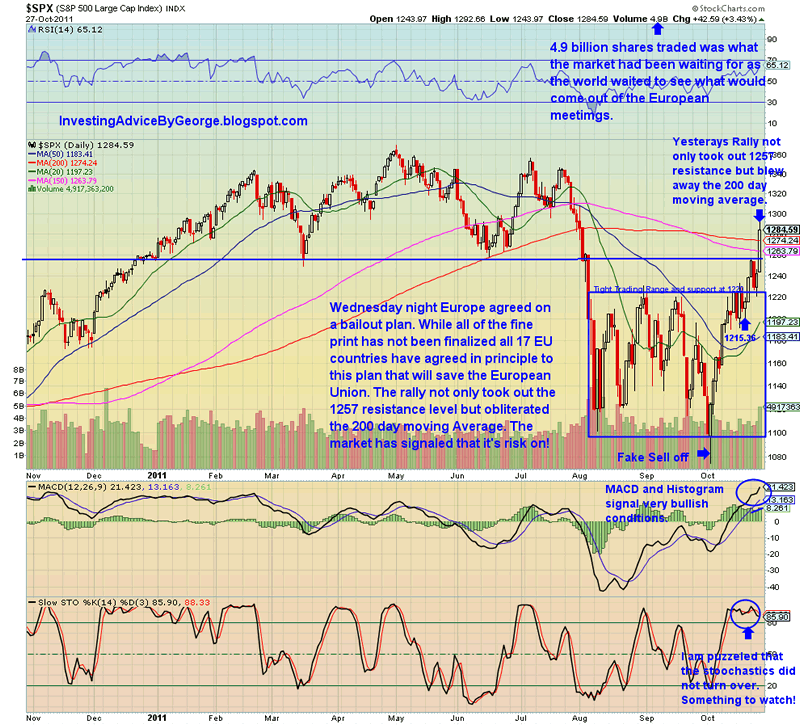

Yesterday on Thursday the market rallied off of a plan that the Euro zone leaders had promised and investors had demanded. That alone came as a relief to markets given how low expectations had fallen. The S&P not only broke the key resistance level of 1257 but blew away the 200 day moving average and closed at 1284.59. The Dow broke the psychologically 1200 level and closed at 12208.55. Sadly, the plan falls short of the comprehensive plan that Euro zone leaders had promised and the best hope is that this deal buys a little more time.

Yesterday on Thursday the market rallied off of a plan that the Euro zone leaders had promised and investors had demanded. That alone came as a relief to markets given how low expectations had fallen. The S&P not only broke the key resistance level of 1257 but blew away the 200 day moving average and closed at 1284.59. The Dow broke the psychologically 1200 level and closed at 12208.55. Sadly, the plan falls short of the comprehensive plan that Euro zone leaders had promised and the best hope is that this deal buys a little more time.

The only significant new element to emerge from Wednesday’s meeting was the decision to ask Greek private bond holders to accept a 50% haircut on their exposures. The Euro zone believes this can be achieved on a voluntary basis, thereby avoiding credit default swaps. When I read this I made me think of the scene from the Godfather where Vito Corleone and Luca Brazzi met with a band leader and told him sign the agreement because either your signature or your brains will be on the paper. I believe that the saga is far from over because the deal that was worked out still leaves Greece with a debt that is 120% of their gross domestic product by 2020, a figure that I feel is far above what any rational person would consider sustainable.

There was even less detail on boosting the European Financial Stability Facility (EFSF). Theoretically the bailout fund will act as an insurer, guaranteeing the first loss on sovereign bonds and could also provide seed capital to special purpose investment vehicles with additional funding from public and private investors. This leaves me somewhat skeptical that this plan will work because it depends on foreign governments such as China agreeing to invest. It’s not clear how much capital might provide but where the Chinese are involved it’s not going to be quid pro quo as history will bear out that they never do anything that is not in their best interest. They have long coveted becoming a major player in the International Monetary Fund (IMF).

So this begs the question is this plan for real or was that a photo op on Wednesday to buy a little more time? The Euro zone is gambling that the market will judge the sum of the parts to be greater than the whole but there is simply no new money on the table. The crucial issue is who bear the losses of the debt crisis have not even begun to be answered. So long as Ireland, Portugal, Italy and Spain’s contagion can be treated as problems of liquidity and not solvency it may not matter but that requires an urgent revival in confidence and economic growth. And that is asking too much of this deal.

Still the market got what it wanted – a plan for containing the European contagion. Whether it has a chance of working we’ll leave for another day. Are the debt deals coming out of this latest summit of EU leaders sufficient enough to address the region's economic woes?

The deal euro-zone leaders hammered out in the early hours of Thursday sparked a world-wide stock rally. But the market moves belied widespread caution about the accord among economists and analysts—and even some of the decision-makers in the debt crisis.

Many pointed out the summit announcements lacked critical details that must be hashed out in the weeks and months ahead, and then put into effect. "The implementation challenge is as high, if not higher, than the design challenge," Mohamed El-Erian, chief executive of Pimco.

So where does this leave our economy and how do we move forward from here? As soon as the deal was announced our dollar sold off and money immediately began to pile back into equities. The Asian and European Markets were all up modestly but the risk play is back on. In the futures commodities are flat while it looks like gold will take a break silver is up over 1%. Please see chart below.

As we can see from yesterday’s chart the S&P not only took out the 1257 resistance but blew away the 200 day moving average. The rally was too strong for a plan that has questions still to be answered but it gave the market what it has been craving – a risk on atmosphere. I have made a shopping list and I will be looking to add CAT, FCX, INTC, EOG, GLD, SLV, AGQ, SLW, MCD and PM. I would like to add LUFK, CLR, JCI, WPRT and USB on any pullbacks.

We are in a strong earnings season, the CPI is up, there seems no chance of another recession and now with the European contagion seemingly worked out it would appear that the market will rally to at least the end of the year. While there will be some speed bumps along the way I will not be surprised to see 1350 by the end of the year. So get out your shopping list and on any pullbacks it’s time to wade into the water. Wednesday Europe promised us a very profitable Christmas. By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.