Gold Research Again Proves Gold as “Risk Management Vehicle” and “Store of Wealth”

Commodities / Gold and Silver 2011 Oct 28, 2011 - 08:30 AM GMTBy: GoldCore

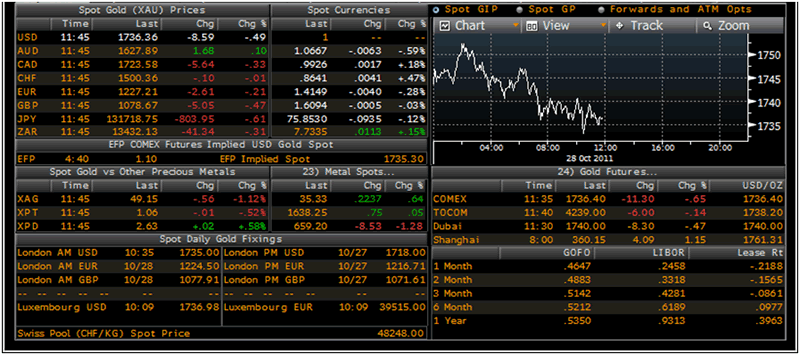

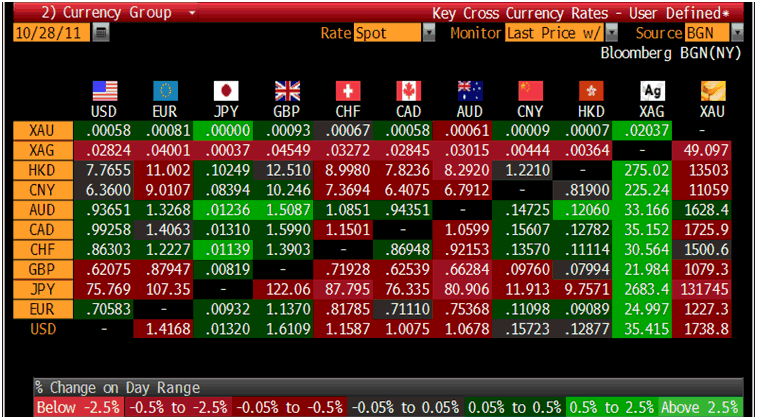

Gold is trading at USD 1,736.36, EUR 1,227.21, GBP 1,078.67, JPY 131,718, ZAR 13,432/oz and CHF 1,500.36 per ounce.

Gold is trading at USD 1,736.36, EUR 1,227.21, GBP 1,078.67, JPY 131,718, ZAR 13,432/oz and CHF 1,500.36 per ounce.

Gold’s London AM fix this morning was USD 1,735.00, GBP 1,077.91 and EUR 1,224.50 per ounce.

Yesterday’s AM fix was USD 1,708.00, GBP 1,067.83 and EUR 1,219.74 per ounce.

Gold Prices, Gold Rates, Gold Fixes and Gold Vols

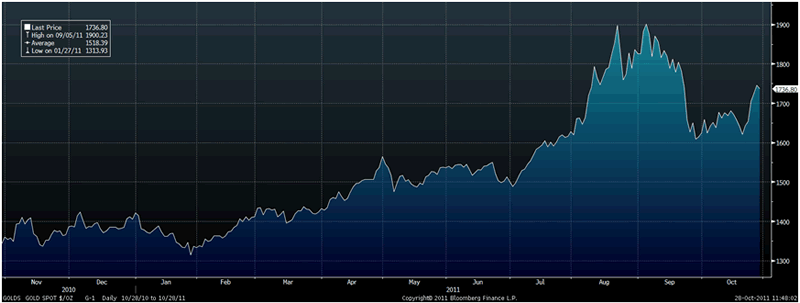

Gold has fallen marginally in most currencies today but is 5.5% higher on the week to date and set for its best week in 33 months. Gold has risen 8.3% since last Thursday when it had an inter day low of $1,604/oz. Silver has surged 13% so far this week and is set for its biggest gain in more than 3 years.

Technically gold is looking on much surer ground and this allied with the continuingly very strong fundamentals suggest that the latest sell off may be over.

Gold in USD – 1 Year (Daily)

Buyers hesitancy has abated with a definite increase in allocations to gold and particularly silver experienced by our trading desk this week, especially since Tuesday when silver has a $50 price move.

Equity indices globally have risen suggesting an increase in risk appetite on the Eurozone ‘deal’ but as ever gold is likely a better barometer of risk and gold’s 5.5% rise week to date suggests that the market remains concerned about the continuing risk of debt contagion and the official response which continues to be currency debasement.

Demand for Gold Remains Global and Broad Based

The bears continue to focus on single issues (such as the recent price fall, the few ATMs globally, George Soros cryptic bubble comments and Nouriel Roubini’s gold bubble suggestion and bizarre fondness for spam over gold) and not look at the big global picture.

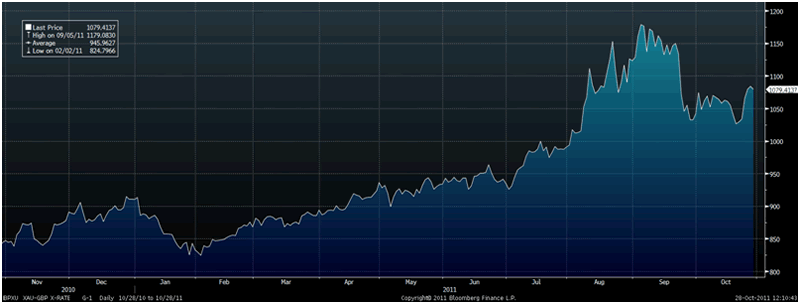

Some assert that ‘if’ and ‘when’ the EU solves the debt crisis, gold prices will fall. Others assert that gold will fall sharply in the event of a recession or a bout of risk aversion and volatility in markets as was seen in 2008. It is worth noting that even in 2008 and the ‘Lehman Brothers moment’, the recession and 'deflationary spiral' which saw stocks fall sharply globally, gold rose 5.8% in USD, 12% in EUR and 44% in GBP.

What the bears and or those with a bias against gold continue to fail to understand is the degree of broad based global demand being seen for gold.

What is vitally important is the fact that the bull market of the 1970’s was primarily only participated in by investors in the US and Europe.

In the globalised world of 2011, with massive new middles classes throughout the world (including over 2.3 billion people in India and China alone), it is myopic to look solely at western markets and western demand. As it is wrong to simply look at one form of demand and then deduce that gold is a bubble.

Massive middle classes in these emerging markets are only one source of demand. They also have a large and growing number of HNW millionaires and billionaires and their own hedge funds, banks and other institutions – many of which are buying gold. As are most of their central banks.

Gold in EUR – 1 Year (Daily)

Despite record high nominal prices and the price spike seen in July and August to over $1,900/oz, global demand is set to remain strong – especially from Asia.

Chinese demand continues to surprise to the upside as does Indian demand.

Indian demand in recent months has again surged to record levels.

The Indian government recently released its export figures. According to import and export data released by the Indian government for April to September, imports of gold and silver rose by a very significant 80% to $31.1 billion during the six months.

With Diwali over, Indian demand is expected to fall off from the high levels seen in recent weeks. However, Indians celebrate the wedding season in November and early December and this should lead to continuing demand from the subcontinent.

India’s gold import could rise by 30-40%, year on year in Q4 as consumers become more comfortable with prices at these levels, according to Barclays Capital.

The President of the Bombay Bullion Association, Prithviraj Kothari, said that “silver imports by India -- the world’s largest bullion consumer-- may rise by 50% year on year in the Oct-Dec quarter to 250-300 tonnes taking total imports for the year in excess of 4000 tonnes.”

Longer term investors and store of wealth buyers continue to buy gold and silver at these prices leading to robust demand throughout Asia.

Gold Again Proven as “Risk Management Vehicle” and “Store of Wealth” in ‘Gold: Alternative Investment, Foundation Asset’

The World Gold Council has produced another excellent piece of research entitled ‘Gold: Alternative Investment, Foundation Asset’. The research looks at diversified portfolios which contain non-traditional assets such as private equity, hedge funds, real estate and commodities and finds that such portfolios can be enhanced by a “discrete allocation to gold as a foundation.”

‘Gold: Alternative Investment, Foundation Asset’ can be read in its entirety on www.gold.org (requires log in) or on the GoldCore website.

Gold in GBP – 1 Year (Daily)

In the current economic environment, low real yields around the globe incentivize investors to look for additional sources of return, while increased uncertainty and market volatility have increased the importance of risk management.

‘Gold: Alternative Investment, Foundation Asset’ shows that “a proper allocation of gold can preserve capital and reduce risk without diminishing long-term returns."

Part of the reason for this is gold's easy liquidity and past record of outperforming other assets during times of economic turmoil.

Those investors who have incorporated gold bullion into their portfolios for some time now will have seen noticeable growth as gains in gold will have shielded them from losses elsewhere.

Cross Currency Table

The report provides strong evidence for the inclusion of gold in any portfolio, showing that portfolios that include gold bullion perform better than those that do not.

In summary, the report suggests that even if investors hold alternative assets, they are no substitute for the protection that a distinct allocation to gold can offer.

The research demonstrates that portfolios with an allocation to gold of between 3.3% and 7.5% (depending on the risk tolerance of the investor and the currency of reference) show higher risk-adjusted returns while consistently lowering Value at Risk (VaR).

The debate over whether gold is a bubble or not has been taking place for some years and may continue for many more years should gold’s bull market continue.

The real debate which has not been had yet is the crucial, empirically proven, importance for all investors to have an allocation to gold bullion.

Financial experts should focus on gold’s importance as a diversification rather than simply its price and valuation.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

SILVER

Silver is trading at $34.98/oz, €24.69/oz and £21.71/oz

PLATINUM GROUP METALS

Platinum is trading at $1,626.20/oz, palladium at $652/oz and rhodium at $1,525/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.