Emerging Stock Markets Telegraphing Trouble in 2012

Stock-Markets / Global Stock Markets Oct 30, 2011 - 04:25 AM GMT During the last global long wave winter season that occurred in the 1930s and 1940s major economic changes took place that were similar to what the global economy is experiencing today. The big glaring difference at that time was that free market capitalism was losing vast swaths of global markets to communism, dictatorship and stifling socialism. During this long wave winter a new middle-class that numbers in the billions is coming on stream in emerging markets, greatly countering the long wave forces at work. Presently however, stock markets in emerging markets are signaling that investor expectations got ahead of the final long wave turn into a new long wave spring.

During the last global long wave winter season that occurred in the 1930s and 1940s major economic changes took place that were similar to what the global economy is experiencing today. The big glaring difference at that time was that free market capitalism was losing vast swaths of global markets to communism, dictatorship and stifling socialism. During this long wave winter a new middle-class that numbers in the billions is coming on stream in emerging markets, greatly countering the long wave forces at work. Presently however, stock markets in emerging markets are signaling that investor expectations got ahead of the final long wave turn into a new long wave spring.

In the 1940s, hundreds of millions of potentially productive participants in the global market economy found themselves held back and denied the benefits of the greatest economic system ever devised. In spite of these trends, international free market capitalism was able to move into the inevitable booming long wave spring season. In the late 1940s and early 1950s, the global economy entered a period of rapid economic growth and prosperity. In short, a long wave spring had sprung bringing growth and prosperity.

The economic expansion out of the Great Depression was a remarkable feat and testament to the resilience of a global system that rewarded success and punished failure. International free market capitalism produced a rapid rise in the standard of living for anyone willing to put their hand to the plow and find their purpose, serving the needs and demands of a global free market system.

Once again, the global economy finds itself in a troubling period requiring debt deleveraging and plagued by overproduction in most industries. Unfortunately, this time the overproduction in the system, based on current demand and the deleveraging required, may even be greater than the last time around. Emerging markets will greatly assist in soaking up much of this overproduction with new demand, but it will take a bit more time.

For the global economy to escape the worst-case scenario in this long wave winter, emerging markets must play an essential role. Growth of the middle class in key emerging markets is the most important requirement to pull the global economy into a new long wave spring season, but unfortunately, they are not yet able to counter the long wave head winds in the developed world.

Clearly, advanced economies in the developed world are overextended. This is due to bad fiscal and monetary policies that attempted to mitigate the natural deleveraging that needed to occur in the developed world after years of excessive use of debt and overproduction. While the private and the public sectors continue to deleverage in the developed world, emerging market growth is required to pick up the slack. If it stalls, corporate profits that have been rising will reverse course, and could even come to a screeching halt. Corporate profits are essential to continued stock price gains.

Stock prices are one of the best leading indicators for the economy. All the bullish excitement over the rally off the October 4, 2011 lows in the S&P 500 and accompanying rallies in other major developed markets, have ignored a glaring fact. Key emerging markets have not been fully participating in the rally. In fact, they are struggling with anemic rallies from deeper selloffs than the developed world has experienced. This ominous development should be ringing alarm bells in the financial capitols of the developed world, but all eyes have been on Europe's debt disaster.

Remember the mantra coming out of the 2009 lows, as the world dangled over the abyss. In addition to being saved by TARP and the Washington stimulus package, funded with our future, the plan was for emerging markets, especially China, to save the global economy from depression. The rising powerhouse of China is the most important emerging market for global growth. As goes China, so goes the global recovery. The Chinese economy appears to be in trouble, remaining too dependent on infrastructure projects.

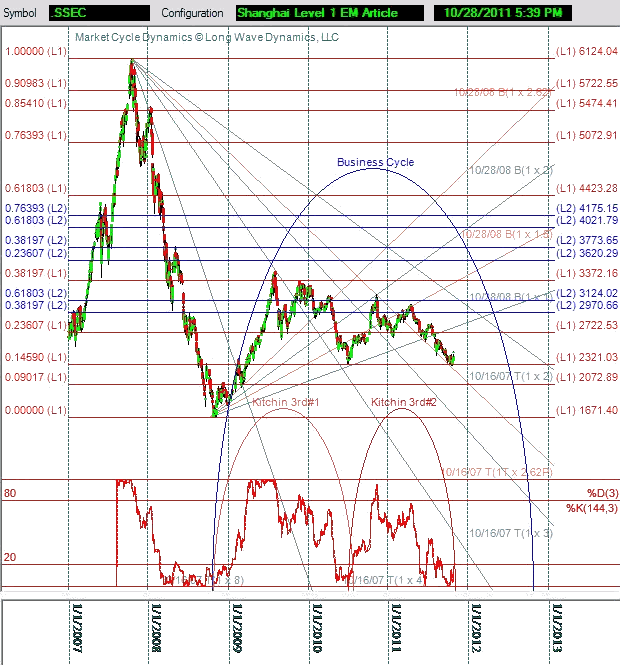

Below is a Market Cycle Dynamics (MCD) chart of the Shanghai composite index (SSEC) in the current business cycle off the 2008 lows the present the price, time and sentiment approach to market analysis as a formula timing plan. The chart demonstrates the first two of three cycles in the business cycle. The second cycle appears to be bottoming presently.

The chart presents the Level 1 and a few Level 2 Fibonacci drill-down grids, a price analysis methodology developed through years of Fibonacci research. Notice that the Shanghai composite has also been sliding down the 1X2.618 Fibonacci fan line, a new method adapting Gann fan methods using Fibonacci ratios. The intersection of fan lines and drill-down grid lines regularly trigger turns in every market and security you care to observe. The Fibonacci and Gann fan features demonstrated in this chart are still in testing and have not been released in the Market Cycle Dynamics (MCD) software.

The Shanghai index has just hammered the latest Level 1 target in a timeframe that suggests a possible cycle turn. This has occurred while the stochastics are in a seriously oversold condition and in the window for the cycle ending. This is also occurring just as the Fibonacci fan line from the 2007 high is intersection the Level 1 grid line, pinpointing price and time. Using price, time and sentiment you can triangulate high probability cycle turns in any market or security.

Look for the Shanghai composite to rally back toward the 23.6% Level target at 2722 in the grid in the third and final Kitchin 3RD#3 in this business cycle. Price, time and sentiment are suggesting a strong rally is in the offing, before the final downturn of the business cycle into 2012 in emerging markets. This includes China, which will likely set new price lows in 2012.

Emerging markets are supposed to be the lifeline that helps the entire developed world overcome the demand depression the world is going through, but the consumer demand in China is shrinking, while empty infrastructure expands. The burgeoning middle class of the emerging markets was supposed to stop saving so much money, open their pocket books, create a middle-class over 2 billion strong, and buy from the developed world. This is not yet occurring.

Something appears to be going wrong with the global game plan. Emerging markets appear to be telegraphing a new unfolding shock that will soon hit the global economy. Decades of Keynesian financial engineering in the developed world is turning into a demand depression. The economic contraction in the developed world appears to be spreading to emerging markets. Fast growing companies in emerging market are going to take a hit to revenues and profits as the developed world exports its economic and financial crisis.

The cycles in developed markets such as the S&P 500 in the U.S. and DAX in Germany have recently had key cycle turns several months behind those in the emerging markets. This means developed markets may roll over to one more low, after the latest European debt intervention euphoria wears off. Investors and traders need to be tracking the cycles and the Fibonacci support and resistance targets to identify optimal entry, exit and stop targets in these volatile markets. The cycles in emerging markets may test recent lows, or even drop to new lows as cycles in the developed world put in new lows in the current cycle.

The global economy and financial markets are a complex system. The Internet bubble and the housing bubble in the developed world appear to have also juiced economies in the emerging markets beyond their natural stage of development. Although growing, emerging markets are not growing fast enough to save the developed world from their bad fiscal and monetary policy that has made the long wave winter worse than it had to be.

A strong rally in emerging markets from current cycle lows is expected. More trouble is then coming to emerging markets as exports to a developed world tank. The long wave winter will get a lot colder in the developed world and emerging markets next year. New lows are expected in emerging markets along with the developed world in 2012-2013. Following the coming bottom of the final business cycle of the long wave in the next eighteen months, emerging markets will lead international free market capitalism into the next long wave spring. A new golden age of rapid growth and prosperity is coming, but first we must pay the long wave winter piper for the global debt binge.

David Knox Barker is a long wave analyst, technical market analyst, world-systems analyst and author of Jubilee on Wall Street; An Optimistic Look at the Global Financial Crash, Updated and Expanded Edition (2009). He is the founder of LongWaveDynamics.com, and the publisher and editor of The Long Wave Dynamics Letter and the LWD Weekly Update Blog. Barker has studied and researched the Kondratieff long wave “Jubilee” cycle for over 25 years. He is one of the world’s foremost experts on the economic long wave. Barker was also founder and CEO for ten years from 1997 to 2007 of a successful life sciences research and marketing services company, serving a majority of the top 20 global life science companies. Barker holds a bachelor’s degree in finance and a master’s degree in political science. He enjoys reading, running and discussing big ideas with family and friends.

© 2011 Copyright David Knox Barker - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.