Silver Breakout Rally to Continue

Commodities / Gold and Silver 2011 Oct 31, 2011 - 02:40 AM GMTBy: Clive_Maund

Last week the weight of the evidence suggested that silver was late in a base building process, and our judgement that this was the case was vindicated by subsequent action, when it broke out upside from the intermediate base pattern during the week in response to the inflation positive news out of Europe. This is discussed in some detail in the Gold market update, but suffice it to say here that Europe has decided that it will attempt to print its way out of trouble, just like the US, which is great news for holders of inflation hedges like gold and silver.

Last week the weight of the evidence suggested that silver was late in a base building process, and our judgement that this was the case was vindicated by subsequent action, when it broke out upside from the intermediate base pattern during the week in response to the inflation positive news out of Europe. This is discussed in some detail in the Gold market update, but suffice it to say here that Europe has decided that it will attempt to print its way out of trouble, just like the US, which is great news for holders of inflation hedges like gold and silver.

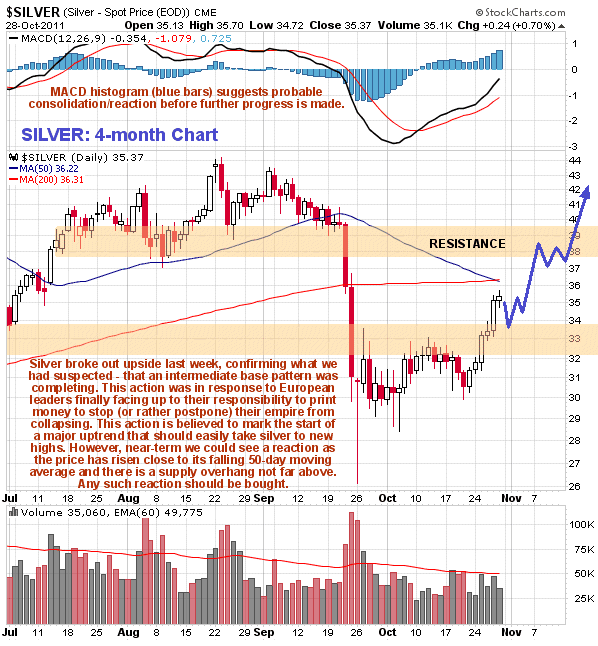

On its 4-month chart we can see how silver has broken out above the resistance at the upper boundary of its base area, and has advanced towards the higher more concentrated zone of resistance towards the lower boundary of the range of trading between July and September where a lot of trapped and traumatised traders are waiting for the chance to "get out even", hence the resistance in this zone. Some of them are prepared to sell for a slight loss which is why we can expect resistance to kick in before the price gets up there, and on Friday silver got up close to its falling 50-day moving average, and after 6 up days in a row it is looking short-term overbought, as shown by its MACD histogram (blue bars at the top). So it is reasonable to expect a reaction early next week, or at least some consolidation. If it does react, which could perhaps take it back to about $33.50, it will be a buy, for last week's breakout from the base area and advance is viewed as being the first leg of a major uptrend that should take silver comfortably to new highs.

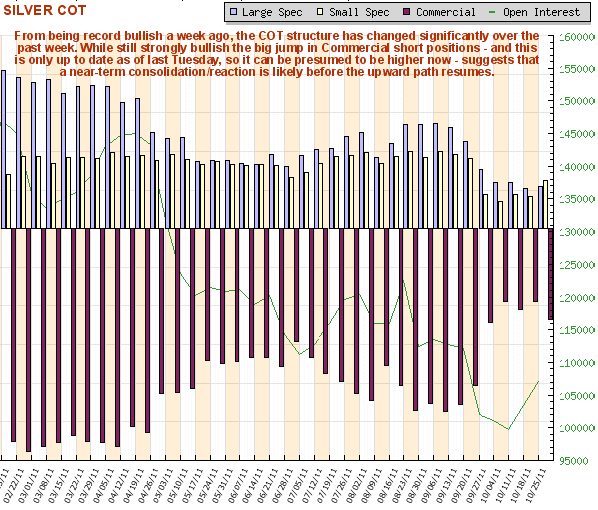

Last weekend's COT chart for silver was very bullish indeed, which was a factor leading us to expect a rally. This week's figures show a sizeable jump in Small Spec long positions and in Commercial short positions and as these figures are only up to date as of last Tuesday night's close, we can surmise that the jump was bigger still after the rise by silver through Friday. However, this is certainly not bearish given they they are rising off very low levels. What it does suggest though is an increased likelihood of a short-term pullback next week, which should be bought for renewed advance.

By Clive MaundCliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2011 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.