Confessions of a Gold Scammer, Lessons to Learn

Commodities / Gold and Silver 2011 Nov 02, 2011 - 05:20 AM GMTBy: GoldSilver

Last week on Good Morning America, ABC ran an exclusive on the $ 29.5 million Global Bullion Exchange fraud. The piece presented the mastermind behind the gigantic gold and silver scam, Jaime Campany. From 2007 through 2009, Campany and his company's accomplices stole more than 1400 individual investor's savings. The vast majority of these folks will never recoup their losses.

Last week on Good Morning America, ABC ran an exclusive on the $ 29.5 million Global Bullion Exchange fraud. The piece presented the mastermind behind the gigantic gold and silver scam, Jaime Campany. From 2007 through 2009, Campany and his company's accomplices stole more than 1400 individual investor's savings. The vast majority of these folks will never recoup their losses.

The Sun Sentinel ran several articles on this particular fraud, you can read further details about it by clicking any of the links below:

Investors lost $29.5 million when S. Florida company closed, documents say - May 12, 2010

Owner of South Florida gold firms admits to fraud - August 5, 2011

The Global Bullion Exchange scam continued on for years, unnoticed by authorities, without prosecution. The fraud used standard tactics which gold scam and silver scam artists often utilize: playing upon investor greed and investor fear.

Greed

By offering "leverage accounts" investors were sold via greed. They were told that by utilizing additional financing to buy more metals, they could then see more upside and higher returns on their investments. These folks were most probably not warned about their account's liquidation in a short term sell off.

For more information on leverage account scams and how they work, click here.

Fear

Playing on investor fear, most customers never took physical delivery of their investments. A vast majority of the supposed gold and silver which the Global Bullion Exchange sold investors was never purchased in the open market, this created a ponzi-like business structure which was destined to collapse and fail.

Red Flags

Investors in the Global Bullion Exchange had difficulty both selling their "investments" and or taking physical delivery of their holdings.

Most investors were first contacted by outbound boiler room sales calls utilizing high pressure sales tactics.

The company offered "leverage accounts" which is always a red flag for high profit dealer sales vehicles. Reader beware for there are countless dealers in business today who still play upon investor ignorance and eagerness.

Due Diligence is a Must

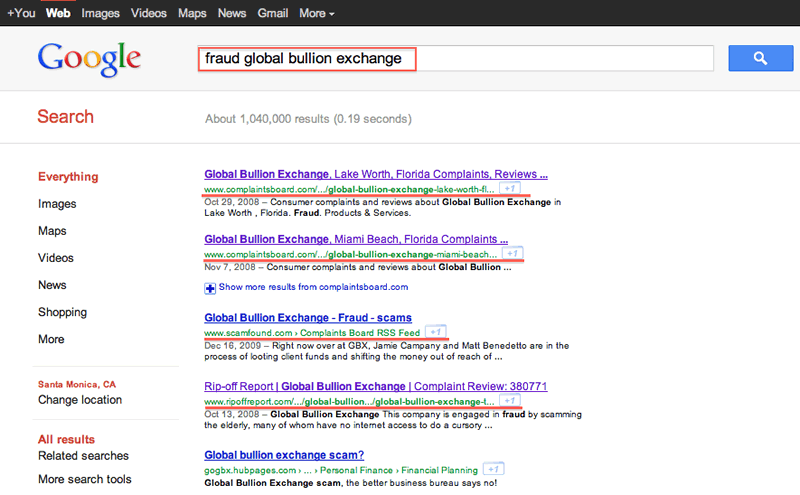

- By running searches online you can find potential complaint boards, company Better Business Bureau BBB record complaints, etc.

- Try utilizing the search words scam, rip off, fraud, etc. along with the company you are investigating. Where you find lots of smoke, chances are high that behind the scenes there is a fire:

Lessons to Learn

- Leverage accounts and collector coins are the 1 - 2 punch for most frauds in the gold and silver industry. We always steer clear of these "investment" vehicles.

- Mike Maloney always says, "If you can't hold it, you don't own it." This is an excellent guideline when considering a third party for bullion storage and safekeeping.

- New investors should first take physical delivery of their bullion investments. Once holdings become too large or unsafe for home, utilize trusted - fully insured - third party - segregated vault storage facilities where you always receive official third party verifications of your holdings.

- When selecting third party vault facilities, physical delivery should always be available without limitations or barriers. Liquidation of holdings should be an easy, secure, and expedient process.

- The fundamentals for gold and silver bullion investing speak for themselves. Outbound boiler-room phone calls should never be entertained. You should never allow yourself to be hard sold into any investment, ever.

Sadly, the Global Bullion Exchange fraud will undoubtably not be the last nor the largest gold or silver fraud to unfold in the years ahead. On our current radar of potential gold and silver investing pitfalls are the following: pool accounts, various ETFs or exchange traded vehicles, fractional-reserve based gold and silver future exchanges, leverage accounts, gold passbooks, silver passbooks, and more.

Here at GoldSilver.com we will continue to keep our customers apprised of potential gold and silver investment frauds and scams. Please stay tuned.

Mike Maloney is the owner and founder of GoldSilver.com, an online precious metals dealership that specializes in delivery of gold and silver to a customer's doorstep, arranges for special secured storage, or for placement in one's IRA account. Additionally, GoldSilver.com provides invaluable research and commentary for its clients, assisting them in their wealth building endeavors.

© 2011 Copyright GoldSilver - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.