The Unpunctured Stock Market Cycle, The EU Flunks The Test

Stock-Markets / Stock Markets 2011 Nov 02, 2011 - 05:29 AM GMTBy: Submissions

Giuseppe L. Borrelli writes: When is a plan not a plan? Whenever you have politicians involved and a printing press thrown into the mix for good measure. Last week we told you to take the announce-ment of the EU’s “solution” to the sovereign debt crisis with a grain of salt. Today we see the wisdom behind that advice as Greece announced they would hold both a political and popular referendum regarding the EU bail-out/austerity plan. The Greek Prime Minister, George Papandreou, announced the measure last night. Greece will hold a referendum on the deal the government struck with the EU last week, under which private investors will take a 50% write-down on their holdings of Greek bonds. The popular referendum, which will most likely take place in January, creates significant uncertainty about Europe’s efforts to contain the debt crisis, with concerns especially escalating over Italy’s soaring borrowing costs.

Giuseppe L. Borrelli writes: When is a plan not a plan? Whenever you have politicians involved and a printing press thrown into the mix for good measure. Last week we told you to take the announce-ment of the EU’s “solution” to the sovereign debt crisis with a grain of salt. Today we see the wisdom behind that advice as Greece announced they would hold both a political and popular referendum regarding the EU bail-out/austerity plan. The Greek Prime Minister, George Papandreou, announced the measure last night. Greece will hold a referendum on the deal the government struck with the EU last week, under which private investors will take a 50% write-down on their holdings of Greek bonds. The popular referendum, which will most likely take place in January, creates significant uncertainty about Europe’s efforts to contain the debt crisis, with concerns especially escalating over Italy’s soaring borrowing costs.

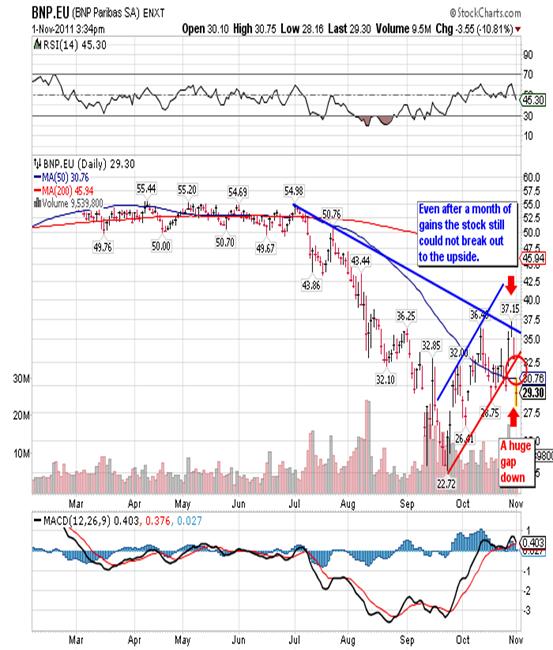

All the stock markets in Europe tumbled on the news and the French and Italian markets were particularly hard hit. The decline of course was led by the EU banking sector, the holders of all that sovereign debt with payments that will never see the light of day. This chart of BNP Paribas (BNP.EU) is particularly telling:

Yesterday opened with a gap down as doubt began to creep in and today saw a huge gap down (red arrow) on the open. In two sessions the share price has given back over 50% of the gains that took a month to accumulate! As bad as the French banks look, the Italian banks look even worse (not shown).

We continue to see slowing in the rest of the world. Peru announced a 19% decline in mineral and agricultural exports for the month of September, Brazil announced a “sharp” decline in production in September and Chile saw a significant decline in mineral exports for that same month. If you look toward the orient you’ll see

that a lot of people pinned their hopes on China bailing out Europe, but I don’t think that will happen. The Shanghai Exchange has been declining for more than two years and recently closed below the July 2010 closing low of 2,361.

As far as bailing out Europe is concerned it was reported on Friday that Chinese Premier Wen pledged to fine-tune macroeconomic policies to ensure stable growth in China. His comments indicated that Chinese top policy makers will likely refrain from further policy tightening and initiate policy easing soon. Specifically he wants to see more financial support given to small and medium-sized enterprises and projects that improve people’s wellbeing. He also wants to see more effort put into developing the real economy, especially strategic emerging industries, to reduce the impact of the continuing global economic crisis. In simple English this means Chinese money will be spent in China and Europe won’t see a dime. Apparently the Chinese Premier knows how to read a chart!

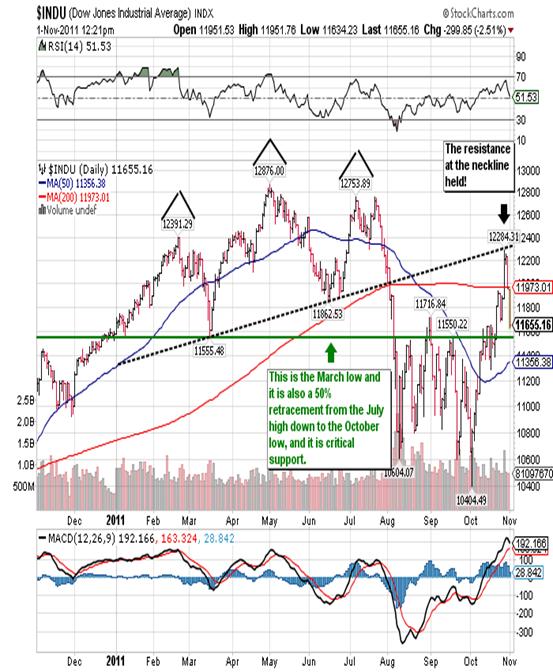

So what does this all mean for the US? Well to start off it means that MS Global went into bankruptcy this morning because they stuffed their portfolio full of Italian debt and there aren’t any takers. It also means that MF Global discovered that they have over US $750 million missing from client accounts! I don’t think I have to say that that’s not a good thing. So last week’s euphoria that drove stock prices and hopes higher turned into this week’s panic. Yesterday the Dow sold off 276 points to close at 11,955 and today it’s down another 300 points as New York goes to lunch. You can see the devil and the damage done on this chart:

The question now becomes is the real market the one that rallied for more than two weeks or the one that turned down yesterday. Before I answer that you need to understand that there has never been a market more driven by news, real and imagined, than this one.

With that in mind we see the large head-and-shoulders formation in the center of the chart, and we see the recent rally came right up to the neckline and then dropped like a stone. Admittedly I did not expect the rally to go up as high as the neckline, but that is the news effect I was talking about earlier. Distortions blow every reaction, up and down, out of proportion. With respect to the down side you must watch the support at 11,555, as it is critical. This is the March low and it is also the 50% retracement from the July high back down to the October low. If you see two consecutive closes below 11,555 you’re almost guaranteed a quick trip down to the October low at 10,404.

Finally, I maintain this is a bear market and the trend is down so the percentages favor a break to the down side. You can only defraud investors so many times with lies, rumors and solutions that resolve nothing. You can bet the Greeks will reject the bailout and Greece will leave the EU and then the dominos begin to fall: Portugal, Spain, Italy and France, until Germany stands alone. Banks in Europe and the US will all go down with them. Today on Bloomberg someone explained that Morgan Stanley owns US $90 billion in European sovereign debt but has it hedged with US $90 billion in credit default swaps. What Bloomberg did not tell you is that 97% of all credit default swaps written in the US are guaranteed by US banks! So US banks are hedging bad debt with US banks. What do they call that? A scam, a fraud, a Ponzi scheme...? Of course the Fed will print like crazy in a futile effort to save the western world, but stocks will tumble and gold will push higher. The “Occupy Wall Street” folks will have their day and there’s no getting around any of this since no real solutions equal no hope!

Giuseppe L. Borrelli

www.unpuncturedcycle.com

theunpuncturedcycle@gmail.com

Copyright © 2011 Giuseppe L. Borrelli

- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.