The Fed is Less Optimistic about Growth and Employment, But Stands Pat

Interest-Rates / US Interest Rates Nov 03, 2011 - 02:25 AM GMTBy: Asha_Bangalore

The Fed left current policies intact and opted not to take any action today after implementing far reaching policy changes at the August and September FOMC meetings. Fed President Evans of the Chicago Fed cast the dissenting vote and would have preferred to provide more monetary policy accommodation. This is in stark contrast to the three dissents in August and September when Fed Presidents of Dallas, Minneapolis, and Philadelphia voted against the decision to hold the policy rate unchanged until mid-2013 and to undertake the maturity extension program of $400 billion dollars. Fed President Rosengren of Boston had cast a similar dissent in December 2007 arguing for a larger cut of the federal funds rate when the Fed lowered the policy rate by 25 bps to 4.25%.

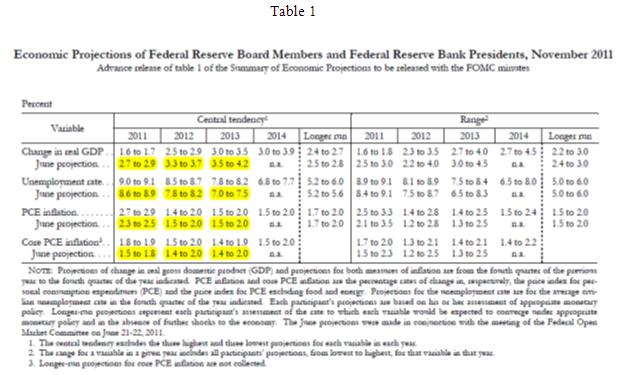

The opening sentence of the policy statement cast the Fed's assessment of the economy in a slightly more positive tone. Today's statement noted that "economic growth strengthened somewhat in the third quarter" compared with the Fed's evaluation in September which indicated that "economic growth remains slow." The Fed also added that growth reflects "in part a reversal of the temporary factors that weighed on growth earlier in the year." The central tendency of the Fed's forecast of real GDP for 2011-2013 was lowered (see Table 1). As a result of slower projected economic growth, the unemployment rate was raised for the each of the three years compared with the projections in June (see Table 1). Putting these two aspects of the predictions together, it was a downgrade of economic conditions. However, the Fed failed to take action to lift economic activity.

Source: http://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20111102.pdf

The Fed expects "inflation to settle, over coming quarters, at levels at or below those consistent with the Committee's dual mandate as the effects of past energy and other commodity price increases dissipate further." The Fed's forecasts of inflation for 2012 shows only small revisions and there was no change in the language from the September policy statement. The Fed continues to hold that "there are significant downside risks to the economic outlook, including global financial markets." It is also noteworthy that the Fed projects the economy to grow at or above 3.0% in 2013 and 2014 but inflation is projected to hold in a benign range of 1.5%-2.0%.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.