Some Fat For Stock Market Bulls to Chew On

Stock-Markets / Stock Markets 2011 Nov 03, 2011 - 03:00 AM GMTBy: Adam_Brochert

I am a secular bear on financial assets like stocks. This is my bias. Although I understand we cannot have a replay of the 1930s in America (unlike Prechter), it has already occurred in Greece with an 87% loss from the 2007 peak to recent lows in October (versus 89% for the Dow in the USA in the 1929-1932 bear market). It is different in America because we can use the printing press while Greece cannot, unless Greece decides to leave the Euro. Hard core Gold advocates need to understand that a paper currency can result in deflation, as long as it is not aggressively debased/abused relative to the needs of the debtor (governments that issue currency are almost always wretched debtors with no intention of repaying their debts in nominal terms).

I am a secular bear on financial assets like stocks. This is my bias. Although I understand we cannot have a replay of the 1930s in America (unlike Prechter), it has already occurred in Greece with an 87% loss from the 2007 peak to recent lows in October (versus 89% for the Dow in the USA in the 1929-1932 bear market). It is different in America because we can use the printing press while Greece cannot, unless Greece decides to leave the Euro. Hard core Gold advocates need to understand that a paper currency can result in deflation, as long as it is not aggressively debased/abused relative to the needs of the debtor (governments that issue currency are almost always wretched debtors with no intention of repaying their debts in nominal terms).

I have no concerns that America will fail to debase her currency yet again. I laughed at commentators who said we had a few hawks in the last "fed" (not a government institution) meeting and thus there was hope for the US Dollar. The current meeting today had only one dissenter, and he wanted an EASIER monetary policy. These central bankstazs are almost as predictable as crack fiends. Please keep in mind that I remain bullish on the US Dollar relative to other paper currencies for the intermediate term, but this a game of relativity and trampoline jumping, after all.

In any case, I remain bearish on stocks despite knowing that paper heroin will be dispensed at the first sign of trouble. In fact, "Operation Twist [part 2]" by the "fed" was greeted with a Bronx cheer, as the addiction runs so deep that a promise to keep interest rates near zero for a year or two was not enough to get the financial markets high again (until new lower lows were made). Tolerance is a *****, as any addict can tell you. It used to only require a 0.25% rate cute, but now we are in Wonderland and stronger and stronger doses of currency destruction are needed to keep the party going.

There are some signs that the recent insane rally of 20% or so in less than a month (for US equities) may have been enough to collapse the wall of worry and start the next bear leg down. Seasonals are in favor of us continuing a rally into year end, but these are not normal times. My main concern is that of time. Have we had enough time to correct the bearishness that reigned a short 4 weeks ago? Only Mr. Market knows for sure, but there is data out there that concerns me.

I'll start with two charts from Market Harmonics, a site that provides free sentiment data. First up, the daily "NASDAQ Sentiment Index," a proprietary measure of sentiment for the NASDAQ (when the plot is high, sentiment is bullish and vice-versa):

We're not exactly wallowing in bearishness according to this sentiment indicator, eh? Next up, an intermediate term sentiment indicator related to a ratio of money flows into two Rydex mutual funds dedicated to being bearish versus bullish, respectively. When money flows into bullish funds more than bearish funds, this indicator rises. In other words, this indicator is based not on opinion alone, but on actual money flows from investors/traders. Fading the herd is often a good idea at the intermediate-term extremes:

Wow. New all-time highs for the past decade! I guess everyone is a momentum chaser now, huh? We are all trying to make up for losses over the past 10 years from the monetary inflation foisted upon us by central bankstaz and governments around the globe. The volatility and momo chasing is reminiscent of the Weimar Germany experience (i.e. we're all speculators to make up for purchasing power losses), but that's another story altogether.

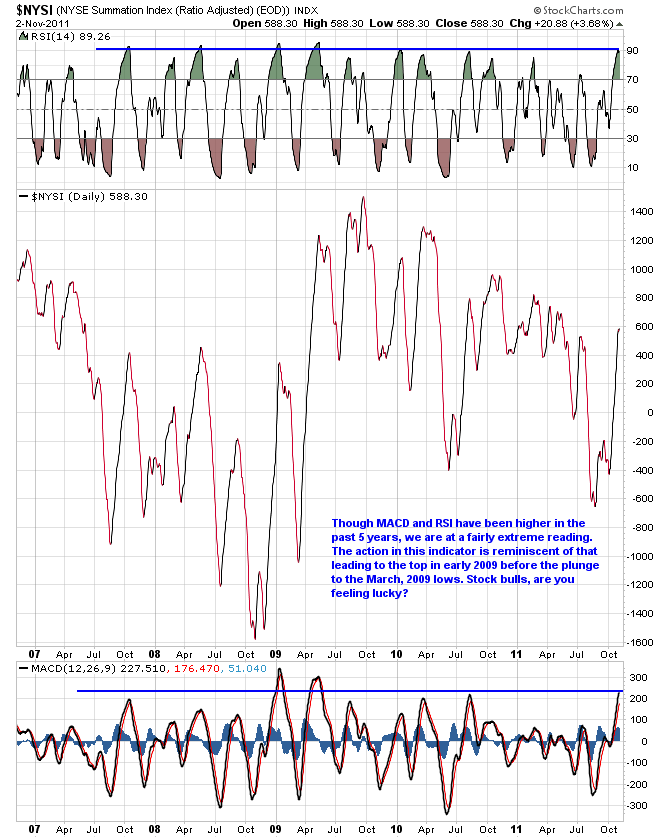

The $NYSE Summation Index ($NYSI) is also a decent indicator for medium term trend and suggests at least a period of consolidation here if not a significant move to the down side for common equities:

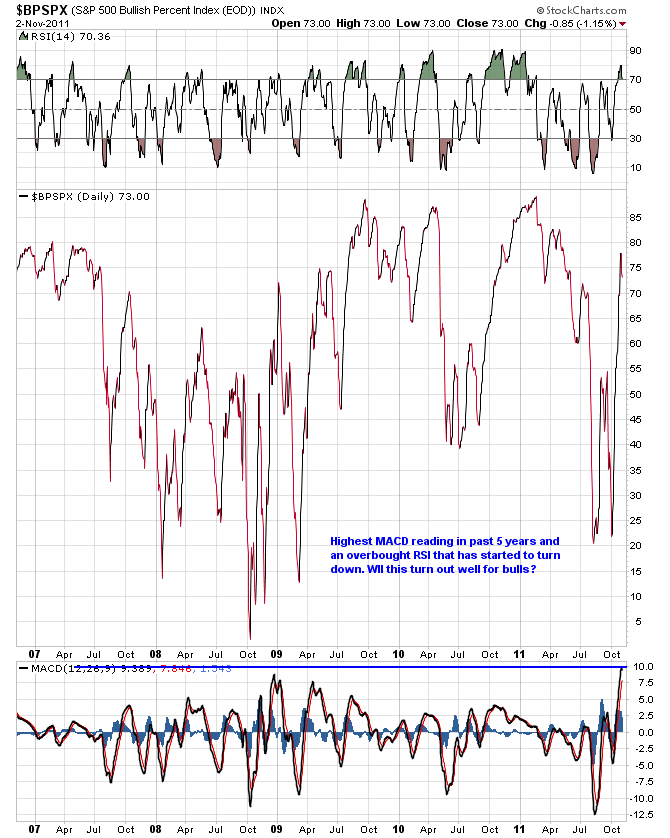

The bullish percentage index for the S&P 500 ($BPSPX) also suggests the need for a rest here if not a new leg down in equities:

In the meantime, Gold is getting set to have yet another year of positive gains. So boring and predictable that paperbugs can only decry its volatility now, which is far less than the volatility for common equities. The so-called "bubble" in Gold can only pop once paperbugs like Krugman capitulate and realize that Gold can save the state from itself. As James Rickards points out, the USA is the Saudi Arabia of Gold, so why wouldn't we play our trump card when the poop hits the rotating blades? Gold remonetization will save the day for the US government and those who hold physical metal outside the banking system will be rewarded for having the knowledge of history required to escape the current slow-motion implosion of the international monetary system taking place right before our eyes.

If you are crazy enough to try and trade in this environment, consider subscribing to my trading service. Otherwise, buy physical Gold, store it outside the banking system and enjoy the fireworks.

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2011 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.