Intermarket Bond Analysis, Why E.U. is Now a Full Blown Crisis

Interest-Rates / Global Debt Crisis Nov 07, 2011 - 06:30 AM GMTBy: Capital3X

Keying in on our earlier analysis on “Return of fear in Nov”

Keying in on our earlier analysis on “Return of fear in Nov”

We look at key bond market spreads to understand ground trends on the Euro and risk rally which we have already termed it as a major fake.

There should be no doubt that the crux of the EU zone crisis will be fully revealed as and when Italian debt hits the market in 2012. There can be no hiding as the behemoth of an under performing country comes to tap the markets to roll over it debt.

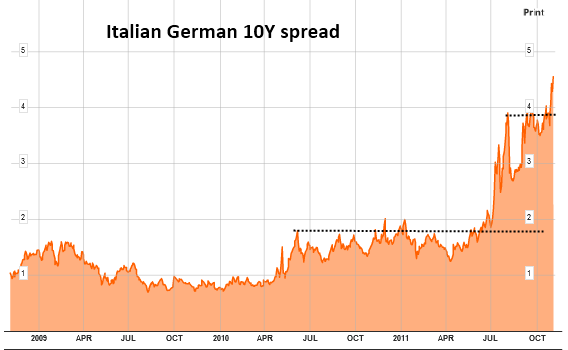

Italy – German 10 Y yield spread

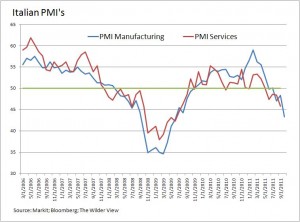

The Italian- German 10 Y spread has crossed 450 bps as they consolidate at all time highs. Bond markets continue to demand a higher risk premium from the Italians as they fidget around with austerity measures and falling growth prospects are not helping the matters either. The ~2 trillion economy dominated by Service industry is set to fall into a recession as Services PMI comes in at 44.

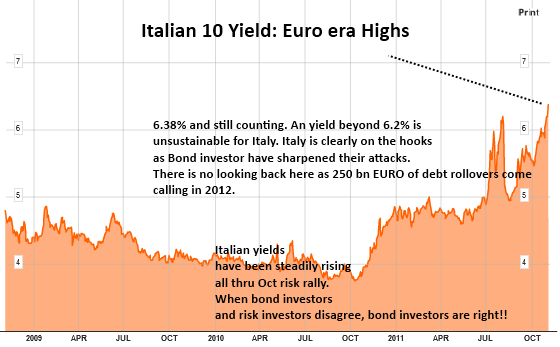

Italy 10 Y yield

The Italian 10Y yield, a key benchmark, has crossed 6.2% and has closed the week at 6.38%, an euro era high. The stunning breakout of Italian yield is now forecasting a massive loss of confidence in the Italian bonds (1.9 trillion market). The breakout yield could not have come at a worse time for Italy as nearly 250 bn euros are set to be rolled over the next 8 months.

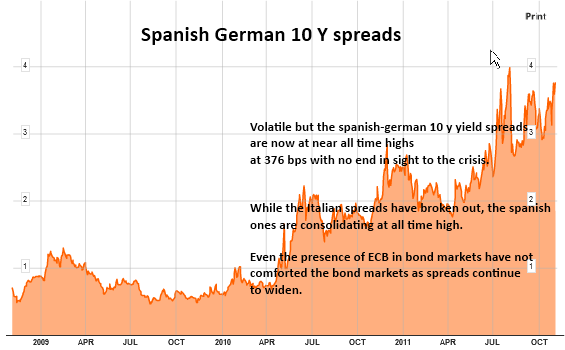

Spain – German 10 Y yield spread

The EU zone is now nearly a full blown crisis with both Greece and Italy in the eye of the hurricane. Unfortunately, even marginally healthier economies like Spain are now about the dragged into the crisis. For a comparison, Spanish debt (public) still stands lower that of UK but the lower growth prospects ahev forced the rating cut on its premier bond issuances. Spain has overall external debt of over 2 trillion euros.

The Spanish-German 10Y yield spread widens to 350/400 bps but has largely consolidated in this range over the last 2 months. We expect this range to break upwards once Italian auction hits the markets in 2012.

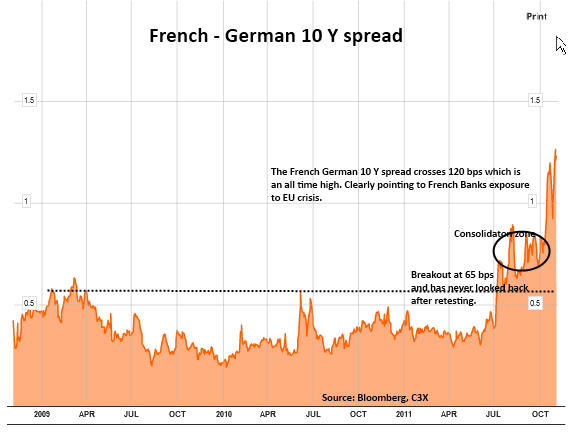

French German 10 Y spread widens

Tracking the crisis level in EU zone and worried about French bank exposure to Greece and Italian debt, the French 10 Y spread over the German widens to 125 bps, an all time highs. The EU summit nor the G20 has provided any comfort to the bond investors. So even while risk crowd was buzy riding the momentum rally, bond markets provide a sobering reading.

Over the weekend there have been no key updates but a few headlines are noted below:

1. G20 Summit ends without any conclusions

2. Greece continues to fidget as Mr. Paparedrou threatened to hold a referendum. The bonds market do not find it amusing. If Greece dares to get out of the EURO, we can reliably say that it will be the end of Greece as a sovereign country. Alexander will be turning in his grave as he watches the proceedings.

3. Goldman Sachs believes that PIIGS will exit the euro something which we do not entirely disagree.

Telegraph:

Jim O’Neillsaid that countries as diverse as Portugal, Ireland, Finland and Greece could pull out of the single currency rather than have to operate under a single eurozone treasury.

“For [them] it is not a bad idea – these countries have always had some kind of tight fixing of exchange rates and are very intertwined. For all the rest that originally joined – Spain, Italy, Portugal, Ireland, Finland – it is actually questionable.”

Mr O’Neill said that because Finland and Ireland were adjacent to non-eurozone countries – the UK and Sweden – they might prefer to quit the euro. He said the single currency might be stronger as a result.

4. Bundesbank being asked to load its Gold at ECB but was rejected almost immediately by the Germans.

Reuters:

Germany on Saturday rejected media reports that Bundesbank reserves would be used to fund the euro zone’s rescue facility after German newspapers said Group of 20 leaders had discussed the idea of tapping central banks.

The Frankfurter Allgemeine Sonntagszeitung (FAS) reported that Bundesbank reserves — including foreign currency and gold — would be used to increase Germany’s contribution to the crisis fund, the European Financial Stability Facility (EFSF) by more than 15 billion euros ($20 billion). The European Central Bank (ECB) would own the reserves, according to the paper, citing sources at the G20 meeting held in Cannes this week. The Welt am Sonntag newspaper, citing similar plans, said 15 billion euros would come from special drawing rights (SDR) that the Bundesbank holds.

“We know this plan and we reject it,” a Bundesbank spokesman said.

On the Macro side, Italian PMI have shrunk to shocking levels

Both the Manufacturing and Sevices PMI sink below 50 almost indicating the leading EU economy is now all set to fall into a sharp recession.

We conclude therefore that Euro has enough crisis left in it as the currency will fall in line with the bond markets at some point. There is far too much damage in the bond markets which needs significant address before euro can reliably trend upwards.

We continue to watch the price action and will update our premium subscribers with new analysis and charts. Our trade portfolio (Forex, SPX Emini, Crude, Gold, Silver) is visible to our premium subscribers

Our feeds: RSS feed

Our Twitter: Follow Us

Kate

Capital3x.com

Kate, trading experience with PIMCO, now manage capital3x.com. Check performance before you subscribe.

© 2011 Copyright Capital3X - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.