The Banks That Swallowed Europe, Western Civilization Built on Debt

Interest-Rates / Global Debt Crisis Nov 08, 2011 - 06:56 AM GMTBy: John_Mauldin

Long-time readers will be familiar with Michael Lewitt, one of my favorite thinkers and analysts. He has gone off on his own to write his letter, and I am encouraging him to write even more. I call Michael a thinker because he really does. He reads a lot of thought-provoking tomes and then thinks about them. And then writes, making his readers think. The world needs more Michael Lewitts.

Long-time readers will be familiar with Michael Lewitt, one of my favorite thinkers and analysts. He has gone off on his own to write his letter, and I am encouraging him to write even more. I call Michael a thinker because he really does. He reads a lot of thought-provoking tomes and then thinks about them. And then writes, making his readers think. The world needs more Michael Lewitts.

Today, he roams the world, commenting as he goes, starting of course with Europe. I have permission to use the first half of this most recent letter as today’s Outside the Box, leaving off the investment recommendations that he shares with his subscribers. If you are interested you can subscribe at www.thecreditstrategist.com.

I am back from the Kilkenomics Economics Festival in Ireland, where there was a lot of attendee angst about their banks. They are not happy about taking on private debt with public money, and the mood in Ireland is to tell the ECB to take their debt and (insert your favorite personal expletive). Clearly, the rest of Europe wants the Irish to pay.

I told them to be patient. When the rest of European banks are upside down sometime next year and France, Spain, et al. have to pay, the mood among voters everywhere will be quite different. I said they could probably default on their bank debt at that point and no one would notice, amidst the massive debts that are going to implode on the Continent. My remarks excited a measure of schadenfreude-tinged laughter from the crowd.

Michael Lewitt agrees. Noting this interview with Oliver Sarkozy, the half-brother of France’s Nicholas Sarkozy, he says:

“Institutional funding has a three-year average life, so European banks need to generate more than $800 billion each month to fund maturing institutional borrowings. This is, in Mr. Sarkozy’s words, unsustainable. And the markets are saying so. The CDS market for European banks is back at or above the peak levels seen during the 2008 financial crisis. While Mr. Sarkozy does not come out and say it, TCS will – the likely future for European banks is Dexia SA, which was nationalized by France and Belgium when it ran aground a couple of weeks ago.”

I will write more about what I learned in Kilkenny later this week, but Europe is getting ever closer to imploding, one way or another. There is no end of problems for the markets to focus on. I can only hope that we in the US will observe the increasingly sad state of affairs in Europe and become sufficiently motivated to fix our own problems. If we do not, we will end up in an even worse condition, which will then be worse for the entire world. I remain somewhat optimistic that we will fix what ails us, as not doing so is just too horrible to contemplate.

On that bright note, have a great week. I am off to Atlanta tomorrow and then DC this Sunday, and then home for a few months (more or less).

Your seeing too much to worry about analyst,

John Mauldin, Editor

Outside the Box

JohnMauldin@2000wave.com

It’s All Greek To Me

By Michael Lewitt

“This is a great trap of the twentieth century: on the one side is the logic of the market, where we like to imagine we all start out as individuals who don’t owe each other anything. On the other is the logic of the state, where we all begin with a debt we can never truly pay. We are constantly told that they are opposites, and that between them they contain the only real human possibilities. But it’s a false dichotomy. States created markets. Markets require states. Neither could continue without the other, at least, in anything like the forms we would recognize today.”

– David Graeber, Debt: The First 5,000 Years

For a couple of days last week, European authorities appeared to have settled on a massive monetization scheme that would have eliminated the imminent risk of a collapse of Europe’s banking system. We wrote “appeared to have settled” because less than a week after the plan was announced, Greek Prime Minister Papandreou unexpectedly called on Monday for a public referendum on the plan. The vote wouldn’t occur until January 2012, which would extend the period of uncertainty for two more months. The market reaction to this announcement was dutifully panicked, with European bourses plunging (the DAX and CAC indices were both down 5 percent) while German bond yields dropped 26 basis points to 1.76 percent as investors flocked to safety. Systemic risk was placed squarely back on the table and cut out the legs from the rally that boosted markets out of the upper end of their trading range at the end of last week.

The markets thought they could step back from the brink on the news that the European Financial Stability Facility (EFSF) would be leveraged by 400 percent and European banks had agreed to write-off 50 percent of their Greek debt. These measures had convinced the market that Armageddon would have to wait for another day. Now the markets are not so sure. Counting on byzantine Greek politics to deliver certainty is a dubious proposition to say the least. But the plot thickened even further as money managers around the world were pulling out their remaining strands of hair. On Tuesday, November 1, shortly after European markets closed, reports surfaced that the Greek referendum was off. As I wrote to one of my friends, every time I tried to put this issue to bed, more news came out of Greece that made it impossible to know exactly what to say. At this point, I am starting to feel like Sybil, the girl with 27 personalities (and now we’ve learned –like we didn’t already know – that she was a complete fabrication in the first place). Nonetheless I will do my best to wade ahead with the limited number of personalities I have left.

At best, the proposed bailout plan would have been/will only be a temporary solution to a long-term structural problem that requires an entirely different set of solutions than monetization and leverage. Our initial reaction to the plan was decidedly positive, however. We believed it would lead to a strong rally because it would remove systemic risk through the end of 2012 even though it did not provide a permanent solution. TCS wrote the following last month: “If the plan ultimately takes the form of leveraging the EFSF, the markets will likely rally and ignore the fact that such a program would at best place a Band-Aid on the underlying wound. Even a flawed plan will be perceived to be better than no plan at all. Unfortunately, such a plan would only create the illusion of stability while allowing the underlying imbalances and flawed policies to fester”(The Credit Strategist, October 1, 2011, “Confidence Games,” p. 1). The markets were desperate for a genuine solution but would have settled for stopgap measures. Now, unfortunately, they aren’t even being granted the latter.

In terms of the substance of the plan, it is obviously designed to cover Italy’s and Spain’s collective €1.5 trillion of borrowing needs over the next three years as well as those of Greece, Portugal and others. In that respect, however, it leaves little, if any, margin of error. After all, the EFSF is not an actual pool of money but merely a collection of IOUs that have to be fulfilled by 17 European states, at least two of which (Italy and Spain) are unlikely to keep them. As a result, one can expect further strains in the arrangement and market volatility resulting therefrom if the plan actually proceeds. If the plan does not proceed, investors will be begging for volatility as a welcome alternative to what they could be facing.

As one who has written that there is little chance of a long-term solution to these problems without a radical rethinking of global economic policy, the Europeans still have little choice once they peer over the cliff to realize other than to step back and buy some time before taking the inevitable leap. For, in the end, they have no other options than to jump. If they can squeeze a favorable vote out of Greece in January, they will then face the test of trying to implement meaningful pro-growth economic policies as their banks absorb their Greek losses. Skeptics are certainly correct to raise questions about the prospects for long-term solutions, but investors were not being reckless in acting as though systemic collapse was a worry for another day. They were wrong-footed by the announcement of a Greek referendum, which came as a surprise to us and to many others. But the removal of imminent systemic risk was a reasonable short-term buy signal for those with short-term investment horizons.

European economies are facing severe economic contractions in late 2011 and 2012 with little clarity on pathways toward growth. This is not news to the markets. Italian 10-year bond yields took little time to blow back through 6 percent and have now widened by 225 basis points this year. The European Central Bank might as well thrown money down a rat hole as purchased Italian bonds earlier this year. Yet, while Italy seems to be getting most of the attention of both the media and European political leaders pressuring its Prime Minister to implement budget cuts, Spain is starting to experience alarming degrees of economic pain.

In the third quarter, Spain’s unemployment rate reached the highest level in 15 years –an abominable 21.5 percent. The number of households without any income also reached a record level – 559,900, or 3.2 percent of all families. This is a result of the exhaustion of unemployment benefits for a growing number of Spaniards. In Spain, these benefits end or decline significantly after 24 months, compared with 3 to 5 years in some other European countries. While the Spanish government is looking for ways to stimulate job growth through government spending, the European Union is pressuring the country to reduce its budget deficit from more than 9 percent of GDP to 3 percent by 2013. The struggle between the government safety net and budget discipline will be increasingly painful across the union for the next few years.

Greece is mired in a depression that is getting worse by the day as it is forced to meet its northern neighbors’ austerity demands in order to receive aid that still won’t get it out of the bottomless economic pit it has dug for itself (the country needs to exit the EU, something that may be addressed in the referendum – if there is one). Banks taking 50 percent haircuts on Greek debt will now have to raise additional capital either in the public markets (highly unlikely) or via the EFSF, which will further dilute their already washed out stocks and divert them from the business of lending into recessionary economies (see below for more on European banks). The rating agencies are licking their chops in anticipation of dunning France’s AAA-rating, and Germany is only slightly further behind on their list for downgrade (for more on Germany’s credit rating, see below). The costs of fiscal union are proving to be somewhere between excessive and prohibitive.

One of the rabbits that the Europeans succeeded in pulling out of their hats is deeming the 50 percent write-off of Greek debt something other than a “credit event” that would trigger payment under the credit insurance contracts governing Greek debt. According to The Wall Street Journal, only a relatively small amount of money would have actually changed hands had a “credit event” been deemed to have occurred - $3.7 billion. But European leaders were able to convince holders of the debt to accept a “voluntary” write-down, which does not trigger a payment under the insurance contracts (known as credit default swap contracts, or CDS). The concern raised by market participants is that CDS will lose its utility as a hedge if parties are able to negotiate around it as they did in this case. A number of bankers were fretting in the media that this would result in higher borrowing costs for sovereigns by making it harder for buyers of sovereign debt to hedge their positions. To a limited extent that argument may have some merit, but for the most part CDS is used to speculate and not to hedge. If these self-interested bankers are really concerned about lowering sovereign borrowing costs, they should simply support a ban on naked sovereign CDS. That would leave investors with the ability to hedge, which would lead borrowers to lower their yield demands, and eliminate the pressure on rates placed by speculators who sell short sovereign credit without actually owning it. One of the reasons European leaders were so focused on not invoking a “credit event” in a Greek debt restructuring was to prevent speculators from profiting from Greece’s troubles.

European Banks

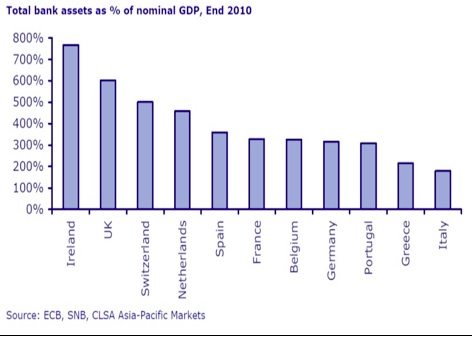

Figure 1

The Banks That Swallowed Europe

A key part of the European rescue plan is leveraging the EFSF so that banks will be able to take the write-downs of their Greek debt holdings and then access capital so they will not be rendered insolvent (although since the entire edifice is built on debt it is unclear how they will be able to pull that off: It would seem that some non-traditional financing structures are going to be required for European banks. Among the structures that should be considered are bonds with warrants and convertible securities. Lenders will be taking equity risk and should be compensated accordingly. They should also be granted appropriate covenants that limit the ability of managements to make the same kind of stupid decisions that got them into their current messes). Nonetheless, the dilemma facing Europe’s banks is truly formidable. Banks represent a much larger presence in European economies than they do in the United States, as Figure 1 illustrates above.

In an appearance on CNBC’s Squawk Box and in an important essay in the Financial Times, Oliver Sarkozy, the half-brother of France’s Nicholas Sarkozy, laid out the challenges facing the sector. (Oliver Sarkozy, “Europe’s dithering over banking risks 2008 again,” Financial Times, October 25, 2011, p. 9.) Mr. Sarkozy notes that Europe’s banking sector has $55 trillion of assets, four times larger than the U.S. sector. As a result, European banks are funded through institutional (what he calls wholesale markets, which he describes as much less stable and much more fickle than depositors. European banks rely on institutional markets for about $30 trillion of their funding, about 10 times more than U.S. banks. In the third quarter, this market was essentially closed to European banks, leaving them with only internally-generated sources of cash to repay institutional funding as it rolls off. Institutional funding has a three-year average life, so European banks need to generate more than $800 billion each month to fund maturing institutional borrowings. This is, in Mr. Sarkozy’s words, unsustainable. And the markets are saying so. The CDS market for European banks is back at or above the peak levels seen during the 2008 financial crisis. While Mr. Sarkozy does not come out and say it, TCS will – the likely future for European banks is Dexia SA, which was nationalized by France and Belgium when it ran aground a couple of weeks ago. Figure 2 below shows the horrible performance of European bank stocks over the past few years and since January 2011(readers will note that TCS has been recommending that investors short European banks all year).

Figure 2

The Heart of the Problem

Mr. Sarkozy suggests that European banks will require $2 trillion of recapitalization, twice the amount that is provided for in the plan announced by European leaders.TCS would like to ask what type of financial prestidigitation is going to be required to transmogrify EFSF borrowings into bank equity. Either way, the problem is enormous and is unlikely to be solved by what the Europeans have proposed thus far.

U.S. Economy

Fears of a double dip recession can placed on the back burner as the U.S. economy grew at a respectable 2.5 percent annual rate in the third quarter. After six months of below one percent growth, this was a welcome recovery. The main contributors to growth were personal spending, which increased by 2.4 percent (adding 1.7 percent to annualized GDP) and business fixed investment (which added 1.5 percent to annualized GDP). Inventories subtracted 1.1 percent from GDP growth and government spending was flat. If readers are puzzled by the contribution of personal spending in the face of 9.1 percent unemployment and a persistent housing crisis, we are too. The will-to-spend of the American consumer is something to behold, and apparently the addition of even a disappointing 100,000-125,000 jobs per month is sufficient to keep it afloat. But it should also be recognized that personal spending remains below the levels of previous recoveries (as does pretty much every other sign of economic health). Business spending is responding to decent demand in the emerging world, but there are indications that this is starting to slow. The point to be taken from these numbers is that the U.S. would do well to maintain growth in the 2.5-3.0 percent range going into 2012. This is a growth rate that is going to have to be proven; it is not something to bank on.

The Global Debt Albatross

In a late August interview on Bloomberg television with Tom Keane, I argued that one of the major factors suppressing economic growth in the U.S. is the enormous weight of debt throughout the economy. Debt service is a drag on economic growth today because much of this debt was not incurred with respect to productive activities. Instead, much of this debt is related to either housing (which is an unproductive asset) or financial speculation in the markets. Accordingly, economic actors are required to commit their capital to service debt that didn’t contribute to productive economic growth.

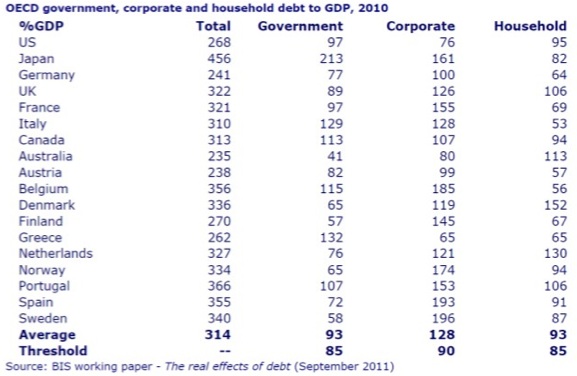

Figure 3

A Civilization Built on Debt

There is also increasing evidence that the sheer amount of debt has reached the point where it is retarding growth and that additional debt will place additional downward pressure on the economy. TCS came across confirmation of its argument in the always indispensable writings of our friend Christopher Wood. Mr. Wood wrote in the October 6, 2011 issue of GREED & fear that: “the evidence increasingly suggests that the Western world has now reached a point where further increases in total aggregate indebtedness are bad for growth even if it is assumed, optimistically, that the authorities are successful in triggering private-sector deleveraging.”

Mr. Wood cited a Bank of International Settlements (BIS) Working Paper written by Stephen Cecchetti, M.S. Mohanty and Fabrizio Zampolli entitled “ The real effects of debt.” This paper was presented at the August meeting of central bankers in Jackson Hole, Wyoming. The authors of this report analyzed data for 18 OECD countries for the 30-year period 1980-2010. Their findings are disturbing (though hardly surprising). First, the ratio of debt-to-GDP (total government, corporate and household debt but excluding financial sector debt) has risen from 167 percent to 314 percent during that period. Second, regression analysis showed that debt becomes sufficiently large to slow economic growth as follows: government debt – 85 percent; corporate debt – 90 percent; household debt – 85 percent. Needless to say, the United States has exceeded those levels today with no diminution of the debt burden in sight. U.S. government debt is at 97 percent and household debt is 95 percent. Only corporate debt, at 76 percent, is below the threshold. Figure 3 above shows these statistics for all of the countries studied. It is not a pretty picture.

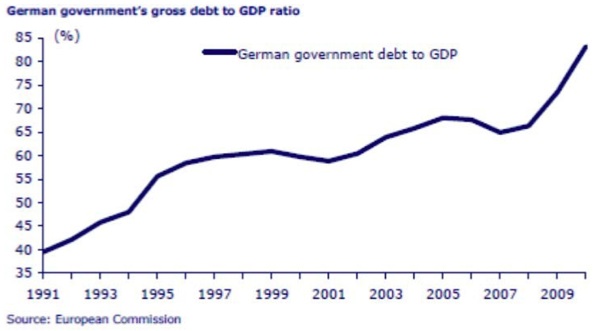

One thing to focus on in Figure 3 above and in Figure 4 below is the fact that Germany, the country on which the economic fate of Europe largely rests, is itself heavily indebted. Germany carries a total non-financial debt-to-GDP ratio of 241 percent (government – 77 percent; corporate– 100 percent; household – 64 percent). One can see why it is far from certain that Germany will have the economic or political wherewithal to bail out its weak European neighbors even if it musters up the political will to do so.

Figure 4

Germany– Going, Going, Gone?

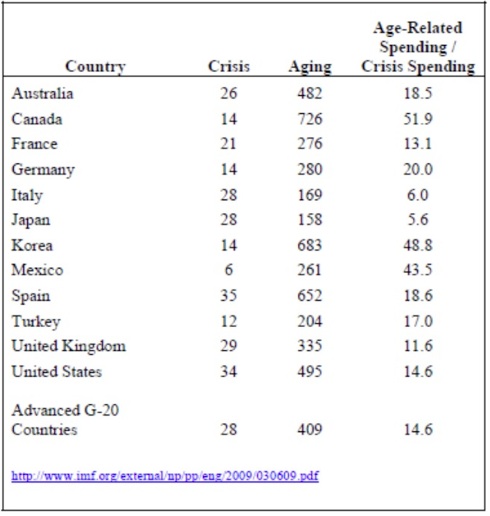

One of the other points made in the BIS paper – something TCS discussed in the Introduction to The Death of Capital – is the enormous impact that aging populations will have on countries throughout the world. Figure 5, which appears on the next page (it appears on page 24 of The Death of Capital), was developed by the International Monetary Fund to show that spending on the 2008 financial crisis, which was in the trillions of dollars, is dwarfed by the projected costs of caring for aging populations. On average, aging populations will cost the advanced G-20 countries 14 times more than the financial crisis.

The point made in both the BIS study and my book is that it is incumbent upon advanced economies to bring their debt under control. Otherwise, the world is at risk of not having the resources to deal with the problems that they are going to face in the future. These problems include natural disasters (like Japan’s tsunami); environmental degradation and climate change; nuclear proliferation; terrorism; military conflict; pandemics, and hunger and poverty. Each one of these poses a potential threat to human survival (and is precisely the type of Black Swan for which most investors are not prepared). To continue to run our economies like a bunch of drunken sailors is incredibly reckless in the face of these future challenges.

Figure 5

Debt May Kill Us Before Old Age Does

It should also be noted that China, the Great Hope of the global economy, is hardly a paragon of fiscal rectitude. China’s total non-financial debt-to-GDP ratio is 174 percent (government debt –44 percent; household debt – 19 percent; corporate debt – 111 percent. This does not include the massive amounts of debt hidden on the balance sheets of opaque Chinese banks. China is concealing its own debt problem and the opaque nature of the situation renders it a bit of a wild card in the global economic picture.

Zuccotti Park

The “ Occupy Wall Street” movement has received more than its fair share of media attention. There is no doubt that the protestors are emitting a primal scream against the system of “ capitalism for the poor, socialism for the rich” that characterized the steps that both led to the 2008 financial crisis and those that were taken to stem it. A growing percentage of the citizenry is coming to believe that a system that privatizes profits and socializes losses lacks legitimacy.

At the same time that protestors are railing against the current capitalist regime, and European leaders are doing everything in their power to perpetuate it, legal authorities in the United States are doing their part to insure that little will change. The recent insider trading prosecutions have properly attacked a flagrant and distasteful underside of the capital markets, although someday it will have to be explained how it is not insider trading when a well-known investor is permitted to accumulate a position in a company before publicly disclosing it and watching it soar in value. Leaving that aside, however, there is another legal assault that raises far more important systemic questions that the insider trading prosecutions. TCS is speaking of the lawsuits against the nation’s largest financial institutions for their sales of toxic mortgage securities. Last August, the Federal Housing Finance Agency sued 17 major Wall Street and European banks for selling more than $200 billion of these mortgage securities to Fannie Mae and Freddie Mac. At the same time, a number of state attorney generals are suing mortgage servicers for various abuses. Finally, there are a number of specific ongoing investigations (and a lawsuit or two) against specific underwriters for transactions similar to the Abacus abortion that brought so much shame on Goldman Sachs (and might one say that the Gods have exacted their revenge this year on John Paulson for his profiteering from that dirty business?). Where these legal proceedings will ultimately end up is anybody’s guess (although one can say with certainty that they will enrich the attorneys working on them).

TCS would like to raise a broader issue. The people camping out in Zuccotti Park are evidence of societal unease about the legitimacy of the current form of crony capitalism that has contributed to this country’s economic difficulties. Contributing to this unease has been the often-heard complaint that virtually nobody has gone to jail for causing the financial crisis. There is a very good reason for that, however. And that reason is not the one we heard from the U.S. Attorney with respect to its failure to bring charges against the incompetents who ran Washington Mutual, that the evidence did “ not meet the exacting standards for criminal charges.” Of course there was no evidence of criminality – the perpetrators of the conduct are on the same side of the table as the prosecutors! The reason that blatantly dangerous and unethical behavior cannot be prosecuted under our current system of laws is that there is no independent, third party, arm’s-length arbiter of behavior for the system. The system is worse than one in which the fox is guarding the henhouse. In our system, the fox is the architect that designed the henhouse!

Our justice suffers from a design flaw. It requires an independent investigative/prosecutorial arm that is part of the judicial rather than the executive or legislative branch of government. The only individuals that have truly stepped up and challenged the status quo that governs the political-financial ascendancy are federal judges such as Jed Rakoff. Judge Rakoff has given hell to the Securities and Exchange Commission over its bogus settlements with the large banks over settlements that are obvious political accommodations rather than true holdings to account. The judicial branch, which is certainly less beholden to large financial interests than the legislative branch (our bought-and-paid-for Congress) and the Executive Branch (our bought-and-paid-for President and Justice Department), is well positioned to serve as an independent arbiter of financial wrongdoing. It therefore offers the best opportunity to restore legitimacy to a system that has lost any right to judge its own conduct.

The Devolution of Wall Street

During the final segment of CNBC’s Strategy Session (which TCS will miss), David Faber made a very compelling comparison between two financiers – Michael Milken and John Paulson. Mr. Faber made the point that when he began his career as a Wall Street journalist (he started in the same year that I joined Drexel Burnham Lambert, Inc. –1987) the most highly compensated financier of the era was Michael Milken. Today John Paulson wears that crown. Mr. Milken famously earned $550 million in1987 (which pretty much sealed his legal fate regardless of the validity (or lack thereof) of the charges brought against him) while Mr. Paulson earned an astounding $5 billion in 2010 (and a couple of billion more in 2009 from his bet on subprime mortgages). Mr. Faber then went on to point out that Mr. Milken created the high yield bond market, which has expanded into a major economic force that financed many new businesses such as telecommunications (MCI), cable television (John Malone), and casinos (Steve Wynn and others). In contrast, Mr. Paulson has created nothing and instead profited from mere speculation. The difference between how these two men made their fortunes not only says a lot about how Wall Street has devolved over the last 25 years, but also how the U.S. economy has deteriorated during that period.

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2011 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Igor

10 Nov 11, 16:43 |

Is Nadeen XXXX Maudlin?

I have never seen Nadeem rate a single one of Mauldin's articles below diamond despite the fact that most deserve silver, he doesn't write most of them, he uses his articles to promote xxxx, etc. |

|

Nadeem_Walayat

10 Nov 11, 21:01 |

Article Ratings

Hi His 2nd to last was rated Gold - http://www.marketoracle.co.uk/Article31390.html The ratings of articles is transparent : http://www.marketoracle.co.uk/FAQ-id_cat-7.html Each article is rated on its own merit, independant of author. Best NW |