Platinum, The Cheapest Precious Metal…

Commodities / Platinum Nov 14, 2011 - 09:37 AM GMTBy: Willem_Weytjens

Historically, precious metals (such as Gold & Silver for example) had an important role as currency, but are now regarded mainly as investment and industrial commodities. Gold, silver, platinum, and palladium each have an ISO 4217 currency code.

Historically, precious metals (such as Gold & Silver for example) had an important role as currency, but are now regarded mainly as investment and industrial commodities. Gold, silver, platinum, and palladium each have an ISO 4217 currency code.

With the ongoing crises in the Western World, precious metals are regaining their role as "currency", as they cannot be printed out of thin air unlike fiat money.

The best-known precious metals are the coinage metals gold and silver. While both have industrial uses, they are better known for their uses in art, jewellery and coinage. Other precious metals include the platinum group metals: ruthenium, rhodium, palladium, osmium, iridium, and platinum, of which platinum is the most widely traded.

The demand for precious metals is driven not only by their practical use, but also by their role as investments and a store of value. Historically, precious metals have commanded much higher prices than common industrial metals.

These days, gold is trading near all-time highs, while platinum is trading about $700 below its all-time high reached in 2008.

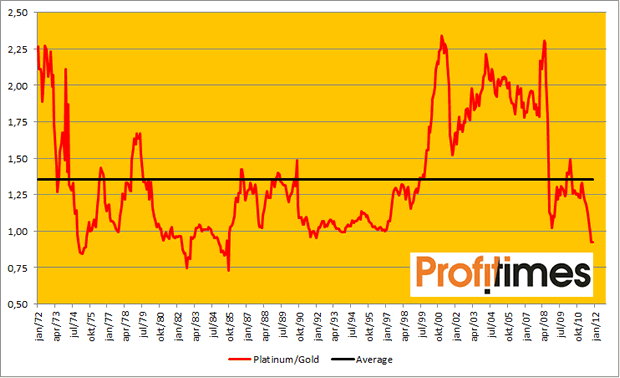

Since 1972, Platinum traded at about 1.35 times the price of Gold on average. Right now, Platinum is even cheaper than gold, trading at only 0.92 times the price of Gold. As we can see in the chart below, this is a rather "rare" situation. It only happened in the early 80′s and for a short time in 1974. In 1972, 2000 and 2008, it even traded as much as 2.30 times the price of Gold (monthly basis).

Based on this ratio over the last 40 years, we can say that Platinum is "cheap" relative to Gold.

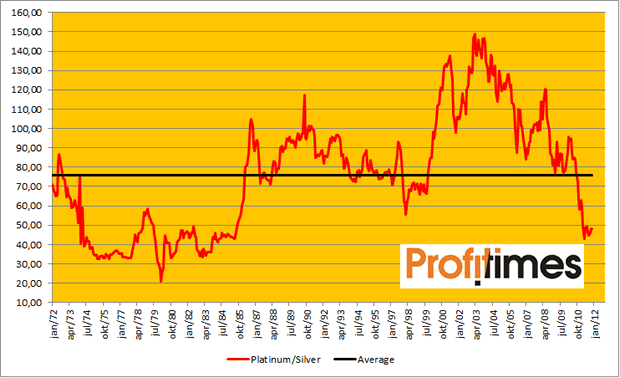

I also made the calculations for Platinum relative to Silver.

Over the last 40 years, Platinum traded at about 76 times the price of Silver (monthly average). Right now, it is trading at only 47.26 times the price of silver, far below the historical average ratio. In 2003, it even traded as high as 150 times the price of Silver.

In 1979 however, it traded as little as 20 times the price of Silver, but that was rather an "exception", as silver jumped from $6/oz to $48.70/oz, as the Hunt Brothers tried to corner the silver market. Taking out this exception from the chart below, I think it's fair to say that Platinum is also cheap compared to Silver:

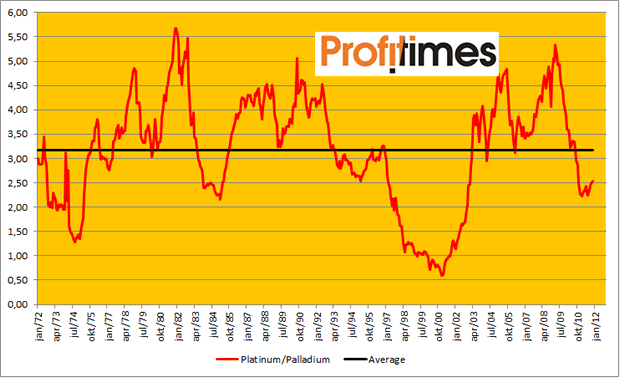

A similar thing can be said about Platinum relative to Palladium.

Over the last 40 years, the average Platinum-to-Palladium ratio was 3.17.

Right now, it is 2.53. In 2001 however, it was a low as 0.60 (Palladium was trading much higher than Platinum, because of rumours that the Russian Stockpile of Palladium was almost depleted).

Leaving this "exception" of 2001 aside, I think it's fair to say Platinum is cheap relative to Palladium, based on this ratio of the last 40 years:

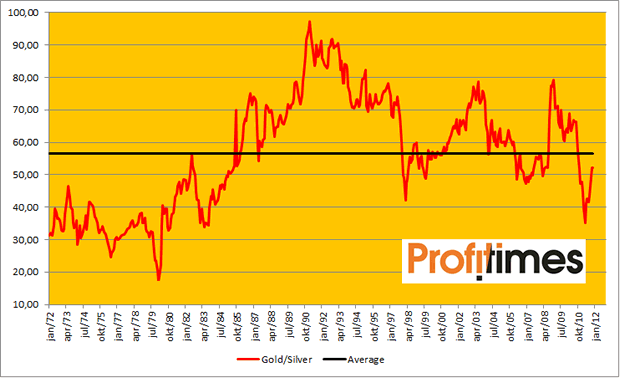

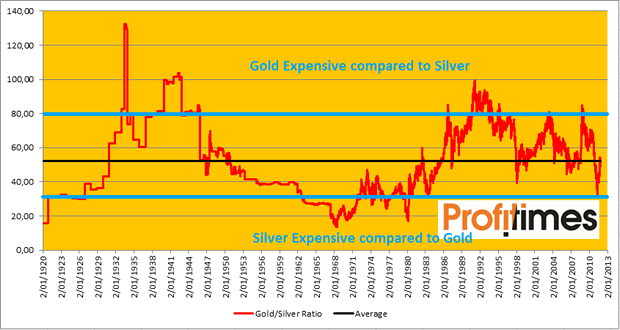

Now let's have a look at the "Gold-to-Silver" ratio. Many argue that the Gold-to-Silver ratio is headed back to 15, a level not seen since 1979. However, as explained above, this move in silver was rather "exceptional", as the Hunt Brothers tried to corner the market.

When we look at the historical average of the Gold-to-Silver ratio over the last 40 years, we can see that the ratio now (51.60), is just slightly below the monthly average of the last 40 years (56.42). This means Gold is not cheap, nor expensive compared to Silver.

When we look at the daily Gold-to-Silver ratio going back to 1920, we can see that the daily average (52.32) doesn't differ that much from the monthly average of the last 40 years (56.42). This tells me that 55 is a good estimate of the average Gold-to-Silver ratio.

In the chart below, we can see that Gold was expensive compared to Silver when the Gold-to-Silver ratio was higher than 80, and that Silver was expensive to Gold when the ratio dropped below 30′ish. In April earlier this year, the ratio dropped towards 30, meaning Silver was getting expensive relative to gold, and has now reversed sharply, back towards its 90 years average.

Based on the charts in this article, we can conclude that:

- Platinum appears to be cheap relative to Gold

- Platinum appears to be cheap relative to Silver

- Platinum appears to be cheap relative to Palladium

- Platinum thus appears to be the cheapest Precious Metal discussed in this article.

However, this all doesn't mean Platinum is CHEAP.

I am just saying that when we look at historical averages, platinum looks cheap relative to the other precious metals.

When the precious metals bull market would come to an end, it is very well possible (and even likely) that Platinum will drop along with other Precious Metals.

However, if this Precious Metals Bull Market continues over the next couple of years, I think one would do well by diversifying some of his/her assets in Gold/Silver into Platinum.

Investors have different options:

- invest in the physical metal by buying Platinum coins/bars

- buying an ETF that tracks the price of Platinum (PPLT for example)

- stocks of companies that mine Platinum as one of their main products (Anooraq Resources, AngloPlatinum, Stillwater Mining, etc to name a few)

For more analyses and trading updates, please visit www.profitimes.com

Willem Weytjens

www.profitimes.com

© 2011 Copyright Willem Weytjens - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.