The European Bank Run Downward Spiral, Final Phase Of Goldman’s World Domination Plan

Interest-Rates / Global Debt Crisis Nov 20, 2011 - 10:39 AM GMTBy: PhilStockWorld

Courtesy of ZeroHedge. View original post here. Submitted by Tyler Durden.

Courtesy of ZeroHedge. View original post here. Submitted by Tyler Durden.

"Nervous investors around the globe are accelerating their exit from the debt of European governments and banks, increasing the risk of a credit squeeze that could set off a downward spiral. Financial institutions are dumping their vast holdings of European government debt and spurning new bond issues by countries like Spain and Italy. And many have decided not to renew short-term loans to European banks, which are needed to finance day-to-day operations. "

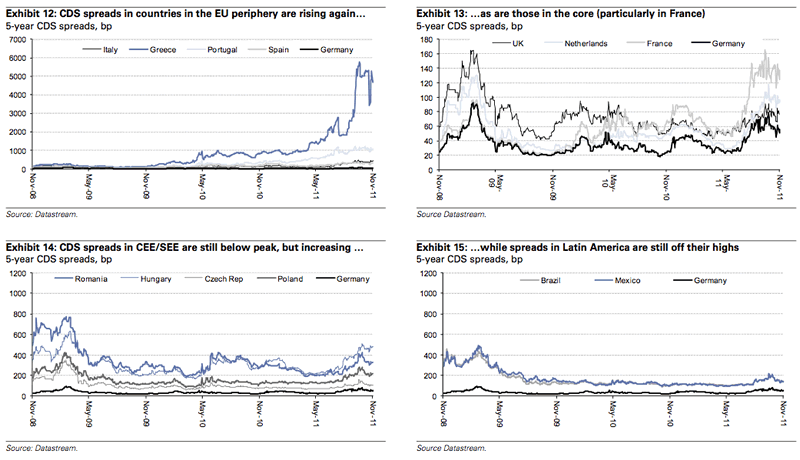

So begins an article not in some hyperventilating fringe blog, but a cover article in the venerable New York Times titled "Europe Fears a Credit Squeeze as Investors Sell Bond Holdings." Said otherwise, Europe’s continental bank run in which virtually, but not quite, all banks are dumping any peripheral exposure with reckless abandon is now on. Granted, considering the epic collapse in bond prices of Italian, French, Austrian, Hungarian, Spanish and Belgian bonds which all hit record wide yields and spreads in the past week, and furthermore following last week’s "Sold To You": European Banks Quietly Dumping €300 Billion In Italian Debt" which predicted precisely this outcome, the news is not much of a surprise. However, learning that everyone (with two exceptions) has given up on Europe’s financial system should send a shudder through the back of everyone who still is capable of independent thought – because said otherwise, the world’s largest economic block is becoming unglued, and its entire financial system is on the edge of a complete meltdown. And just to make sure that various fringe bloggers who warned this would happen over a year ago no longer lead to the hyperventilation of the venerable NYT, below, with the help of Goldman’s Jernej Omahan, we bring to our readers the complete annotated and abbreviated beginner’s guide to the pan-European bank run.

But first some more details from the NYT:

The flight from European sovereign debt and banks has spanned the globe. European institutions like the Royal Bank of Scotland and pension funds in the Netherlands have been heavy sellers in recent days. And earlier this month, Kokusai Asset Management in Japan unloaded nearly $1 billion in Italian debt.

At the same time, American institutions are pulling back on loans to even the sturdiest banks in Europe. When a $300 million certificate of deposit held by Vanguard’s $114 billion Prime Money Market Fund from Rabobank in the Netherlands came due on Nov. 9, Vanguard decided to let the loan expire and move the money out of Europe. Rabobank enjoys a AAA-credit rating and is considered one of the strongest banks in the world.

American money market funds, long a key supplier of dollars to European banks through short-term loans, have also become nervous. Fund managers have cut their holdings of notes issued by euro zone banks by $261 billion from around its peak in May, a 54 percent drop, according to JPMorgan Chase research.

Is this setting familiar to anyone? It should be: "Experts say the cycle of anxiety, forced selling and surging borrowing costs is reminiscent of the months before the collapse of Lehman Brothers in 2008, when worries about subprime mortgages in the United States metastasized into a global market crisis."

Ah, but there is one major difference: last time around, the banks were not all in on the wrong side of the world’s worst poker hand (as described by Kyle Bass earlier). Now they are. And should Europe’s banks begin a domino-like spiral of collapse, there will be nobody to bail out first Europe, then Japan, then China, then the US and finally the world.

But lest someone suggest this is merely the deranged ramblings of yet another blogger, here is Goldman Sachs with a far more cool, calm and collected explanation for why we should all panic (which comes at the sublime moment: just as Goldman takes over all the key political locus points of the European continent: more on that in the conclusion…)

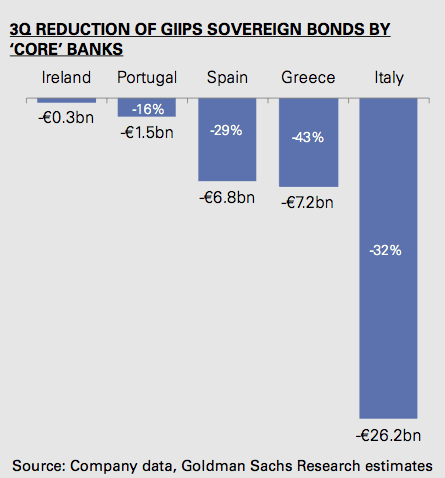

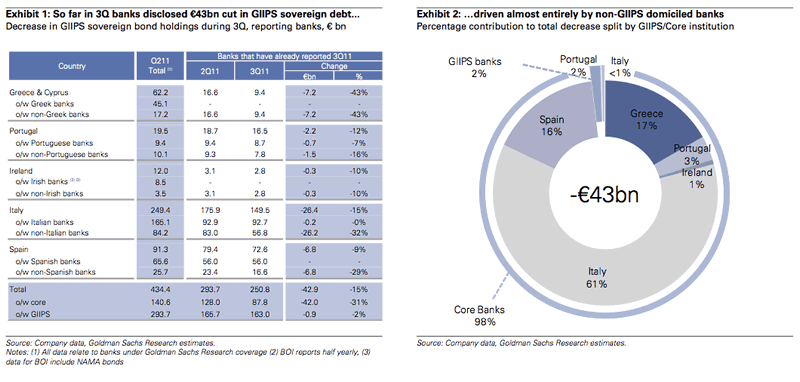

Core’ banks cut GIIPS debt by €42 bn (-31%) in 3Q; a manifestation of PSI side-effects?

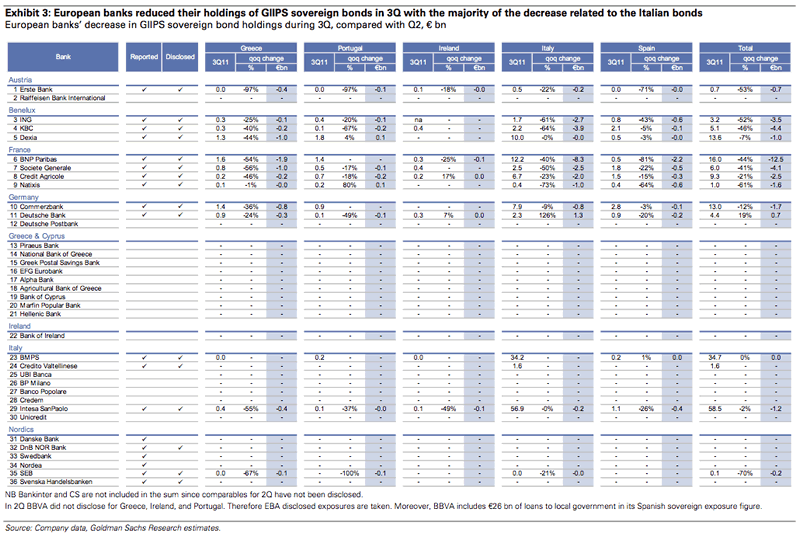

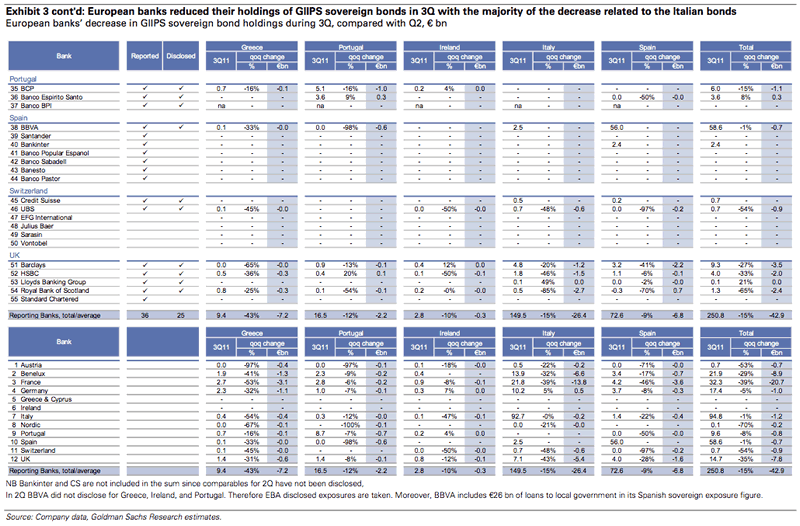

In 3Q2011, banks from the ‘core’ cut their net GIIPS sovereign debt holdings by €42 bn (or by one-third), mostly Italian (€26 bn), Spanish (€7 bn) and Greek (markdown of €7 bn). French and Benelux banks cut their exposures most, by €21 bn and €9 bn, respectively. GIIPS portfolios remained unchanged with periphery banks.

Greek PSI sets a risky precedent, in our view, as the prospect of ‘voluntary’ haircuts becoming a template for GIIPS crisis resolution could drive exposure reduction. Core banks now have €88 bn of GIIPS sovereign bonds remaining. We expect this to decline. Problematically, we observe that GIIPS bond reductions are not resulting in ‘core’ bond purchases but in a rise in deposits at the ECB.

- The disposal of GIIPS sovereign debt accelerated during 3Q2011, and we highlight the following.

- Banks cut net GIIPS sovereign exposure by €43 bn. The largest reductions relate to Italian (€26 bn), Spanish (€7 bn) and Greek (€7 bn) net sovereign debt positions.

- Almost all of the reduction (€42 bn) came from banks in the European ‘core’, where the GIIPS bond positions therefore fell by just over one-third (31%). At the same time the banks from the ‘periphery’ kept their exposures unchanged.

- French (€21 bn) and Benelux (€9 bn) banks reduced their exposure most.

- Individually BNP (€12 bn), KBC (€4.4 bn), SG (€4.1 bn), BARC (€3.5 bn) and ING (€3.5 bn) cut the net sovereign exposures most, in absolute terms.

We expect this trend to extend into 4Q and to ultimately lead to a long-term reduction GIIPS bond holdings by core banks.

Greek PSI – and the ‘voluntary’ 50% haircut – has changed the risk perception of GIIPS bonds. We believe it has allowed for an assumption that PSI will be used as a template in helping other GIIPS sovereigns improve their public finances. Such intention is denied by policy makers. Banks, on the other hand, express their view of the likelihood of such an event through the changes in their net positions.

It is important to emphasizes that a bank’s decision to hold sovereign debt is not an expression of an investment preference. Rather, it is a decision related to liquidity management. As such banks seek ‘risk free’ assets that can be used to access liquidity at any time, particularly at the time of crisis. Regulators continue to treat sovereign debt as highest-quality and risk free (0% risk-weight) collateral. With no RWA constraint and full refinancing eligibility, banks are encouraged to hold sovereign debt; its (selective) transition from a ‘risk free’ to a ‘risk’ asset is therefore unexpected and highly damaging.

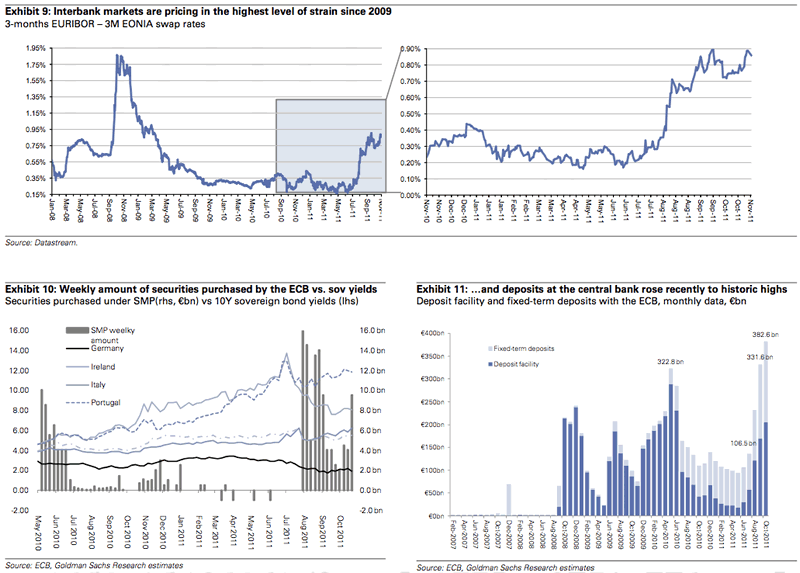

Earlier we said all but two entities have been dumping PIIGS (or GIIPS as Goldman prefers to call them). Sure enough, one of the unlucky two tasked with buying everything sold in the secondary market is of course the ECB: the same bank that everyone is accusing of not doing more to help.

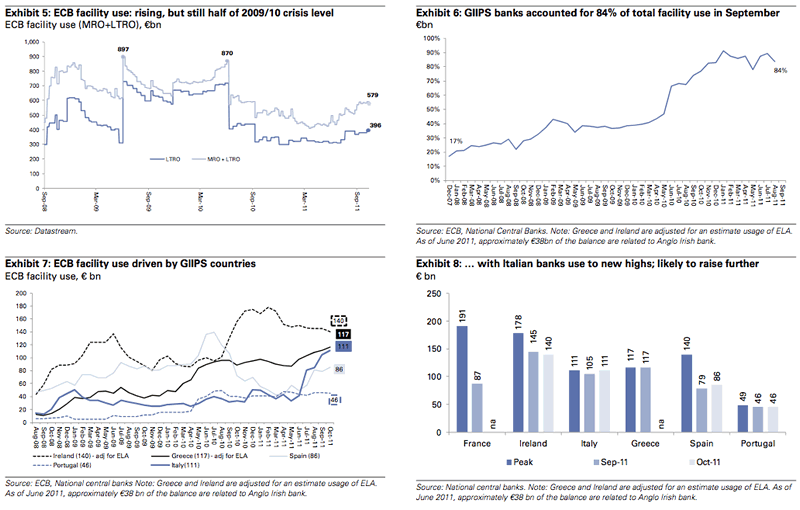

Funding: Increasingly reliant on the ECB

The use of ECB facilities rose again in October, driven by Spanish (€7 bn) and Italian (€6 bn) banks. For 4Q, we expect a sharp increase in use by Italian banks, driven by: (1) LCH’s increased margin requirements on Italian REPOs, which now make market REPOs comparatively more expensive than those at the ECB; and (2) a steady fading of the ECB funding ‘stigma’. It is possible that the majority of the €300 bn of interbank funding and market REPOs could end up on ECB’s balance sheet. That alone would have the capacity to lift current ECB use from €579 bn to just below €900 bn. This level of use would compare with previous crisis peak levels (2009) of €870-897 bn.

We have long argued that the ECB has capacity to back-stop bank funding requirements – and there is no change to this view. That said, a gradual closing of the last functioning wholesale funding market – short-term REPOs, backed by government bonds – is certainly not an encouraging sign. The re-opening of the long-term funding markets has been pushed further out, in our view.

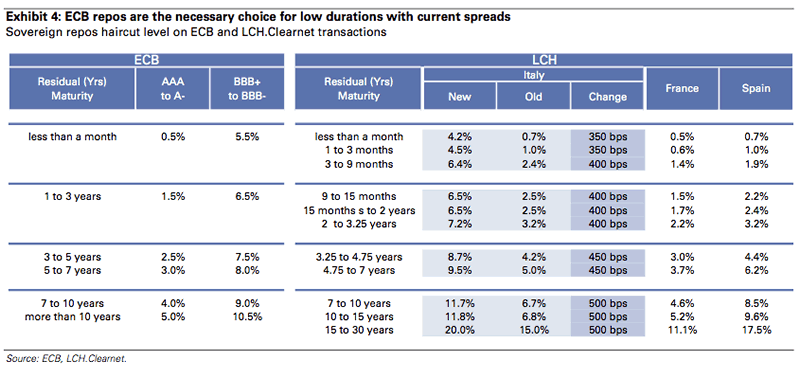

LCH triggers increased margin requirements on Italian REPOs

On November 9, 2011, LCH.Clearnet (LCH) announced its decision to increase ‘deposit factors’ applied to Italian debt repo transactions (e.g. haircut on collateral) by 3.5% to 5% depending on the duration of the collateral. The move was not a surprise as LCH’s Risk Management Framework states that it “would generally consider a spread of 450bp over the 10-year AAA benchmark to be indicative of additional sovereign risk”, which may cause it to “materially increase the margin required for positions in that issuer”. Previously, ECB interventions kept the spreads below the key trigger level of 450bp.

Italian banks likely to switch to the ECB

Owing to increased margin requirement, market REPOs have become more expensive. In our view, the banks are therefore likely to look for alternative sources of funding, especially with the ECB.

Typically, the cost a bank faces to fund a sovereign bond portfolio through a tri-party repo transaction consists of: (i) the funding rate (‘repo rate’) for the duration of the repo and applied to the market value of the bonds; and (ii) additional funding costs, mostly in the form of the haircut/margin required by the Central Clearing House as collateral. The higher the haircut/margin level and the marginal funding cost, the higher the cost of the borrowing, which becomes ineffective when it exceeds the cost of the ECB repo facility (1.5% repo rate + haircut funding cost).

The Italian banks’ funding currently includes €155 bn of customer repos and €193 bn of interbank funding exposure to non resident MFIs. The large portion of the latter takes the form of secured funding (repos). In addition, the Italian banks currently draw on €111 bn of ECB funding.

It is possible that the majority of the €300 bn of interbank funding and market REPOs could end up on the ECB’s balance sheet. That alone would have the capacity to lift current ECB use from €579 bn to just below €900 bn. This level of use would compare with previous crisis peak levels (2009) of €870-897 bn.

So just why again is it that anyone accuses the ECB of doing nothing? When all is said and done under the current regime, the ECB balance sheet will be just under €2 trillion, and that is without any incremental printing, courtesy of the farce that is "sterilization" with banks which exist only due to the ECB, thereby making said sterilization about the most idiotic thing ever conceived. Yet that is what spin is for…

In the meantime, the European shadow banking system is on the verge of a complete shutdown, with repos of all shapes and sizes about go dark.

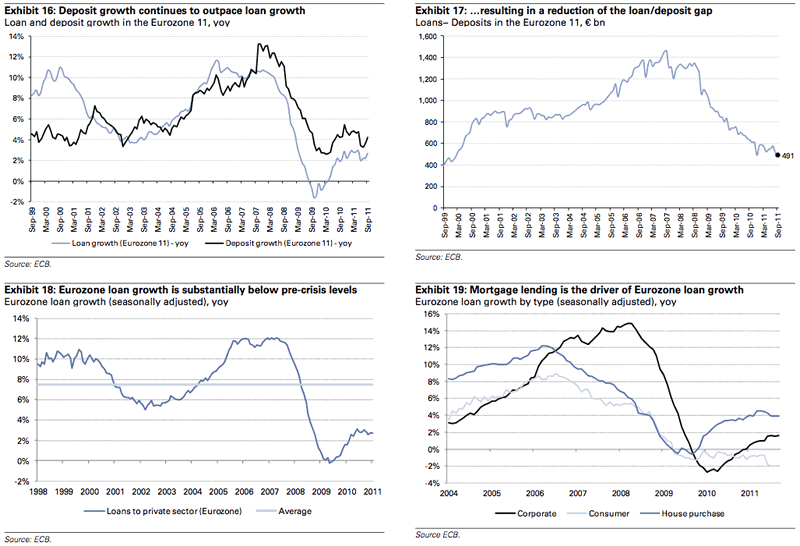

And summarizing all of the above visually, here come the charts:

And while we already discussed that one half of Europe’s dumb money is the ECB by necessity, to get the answer for who is the other half we go back to our post from last Friday:

Completing the picture is the answer of who the dumb money is:

Italian bonds still have one support bloc. Domestic banks appear to be holding on to their much larger holdings. As of last December, EBA stress tests showed Intesa Sanpaolo held €60bn of Italian debt. UniCredit and Banca Monte dei Paschi di Siena held €49bn and €32bn respectively. Recent results indicate that those holdings have changed little.

“We will keep investing the largest part of our liquidity in Italian government bonds,” said Corrado Passera, chief executive officer at Intesa Sanpaolo, in a call with analysts this week. “We believe they provide the right yields vis-à-vis the cost. So no policy change on our side.”

Still, according to the investment banker advising firms on their Italian holdings, the domestic banks’ decisions to hold on could have more to do with their inability to offload such large amounts quickly and without deep losses. Indeed, some Italian bankers seem resigned to the situation.

Capital concerns are also preventing them from selling. “The key issue is on solvency and I think they made a mistake in requiring us to hold more capital,” said the chief executive of a mid-sized Italian bank. “To meet these levels we cannot sell too much of our sovereign debt.”

So instead of selling, Italian banks are doing all they can to dodecatuple down and…buy!?

To summarize: everyone is dumping European paper, except for the ECB and Italian banks, which have no choice and instead have to double down and buy more. In the meantime, the market is going increasingly bidless as liquidity evaporates, confidence has disappeared and virtually everyone now expects a repeat of Lehman brothers. Of course, this means that when the bottom finally out from the market, the implosion of the Italian banking system, and thus economy, will be instantaneous. And when Italy goes, so goes its $2 trillion+ in sovereign debt, and at that point we will see just how effectively hedged and offloaded the rest of the world is, as contagion shifts from Italy and slowly but surely engulfs the entire world.

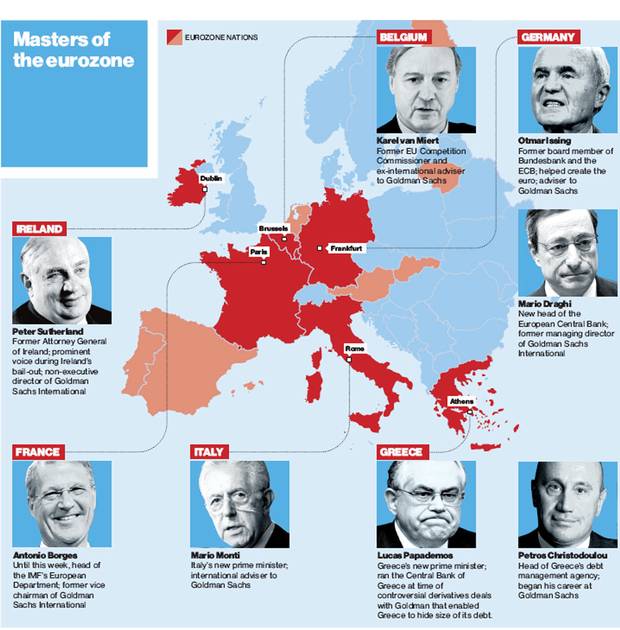

Incidentally, is it really that surprising that Goldman is now doing its best to precipitate a bank run of Europe’s major financial institutions by "suddenly" exposing the truth that was there all along? During the great financial crisis of 2008, the one biggest winner from the collapse of Bear and Lehman was none other than the squid. This time around, Goldman has set its sights on Europe and has already made sure that its tentacles will be in firmly in control at all the right places when the collapse comes, as the Independent shows.

And when banks are falling over like houses of cards in the middle of a tornado cluster, and the financial power vacuum is in desperate need to be filled, who will step in once again but… Goldman Sachs.

Phil

Click here for a free trial to Stock World Weekly.

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.