What is Good for EU is Bad for Germany? Euro-zone Debt Crisis Intermarket Views

Interest-Rates / Global Debt Crisis Nov 24, 2011 - 09:59 AM GMTBy: Capital3X

What was good for EU was always bad for Germany and what was good for Germany was bad for other EU countries. This could not have been more pronounced than yesterday Nov 23 2011 as Germany yields rose 11.3% and now are up another 4% for the day as Bond markets take a disliking to the German paper or rather the attitude. But what is interesting is that as the German yields rise, Italy and France continue to be falling in terms of spread. Is this why they say :Germany is the crux of the problem?

What was good for EU was always bad for Germany and what was good for Germany was bad for other EU countries. This could not have been more pronounced than yesterday Nov 23 2011 as Germany yields rose 11.3% and now are up another 4% for the day as Bond markets take a disliking to the German paper or rather the attitude. But what is interesting is that as the German yields rise, Italy and France continue to be falling in terms of spread. Is this why they say :Germany is the crux of the problem?

If Germany is being clinically targeted, then Nov will be a month to remember as a month that brought back fear into the markets. We said on Nov 4, that markets are now going broke for Fear in Nov at a time when Markets had rallied hard in October which too was covered by us on Oct 2 and Oct 4 and Oct 8 articles.

Since the beginning of the Eurozone debt debacle, Germany benefited spectacularly from its reputation as safe haven. While yields were spiking in other Eurozone countries, German bond yields were dropping; and even 10-year bond yields dipped below the rate of inflation. So perhaps when it offered €6 billion in 10-year bonds at an average yield of 1.98%, a record low for auctions, it expected them to fly off the shelf. It was supposed to be a no brainer but has it stirred the hornets nest!!!

Media went berserk as Marketwatch reported: “Debt crisis now at German doorstep,”. Investors only bought €3.6 billion in bonds of the €6 billion offered. The Bundesbank had to retain the remaining €2.4 billion to be sold in the secondary markets. Not unusual under the German system: the Bundesbank had propped up six of the eight most recent bond auctions. But the magnitude is nevertheless a shocker. The 39% that the Bundesbank got stranded with is the highest ratio on record since Germany started issuing bonds in euros.

The German Finance Ministry was out in full strength as it defended the sale and said “All is Well” and “There is absolutely no problem,” said Wolfgang Schäuble to calm the waters.

What should worry the market now is that germany is set to issue 275 billion euros and if this is how it starts, God save Germany from the hands of the Bond investors. They will lock stock and barrel sell Germany.

But we at Capital3x for saw this month before as we proclaimed that eur creators will make sure that EUR survives, be it at any cost. So if EUR has to survive, EU bonds and fiscal union is what is required. But Germany has been opposing this and for good reasons. But now EUR creators have decided to take out the final hurdle as they will force and violate Germany before the German politicians have an all night parliament session sometime in early 2012 to have a vote on implementing EU bonds as the only solution to saving their country. Even with German surplus, Germany still needs to keep rolling its debt for which it needs to issue new bonds in 2012.

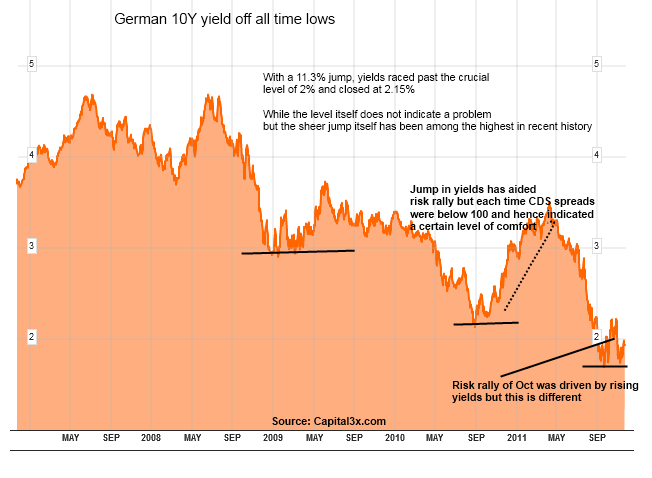

German Yields: On long term downtrend

The question on everyone mind now is: Has the long term trend of falling German yields to all time lows into 1.80 has now changed course. As can be seen, it is not easy to predict a change in such downtrends for a an asset which has been steadily on a one way street.

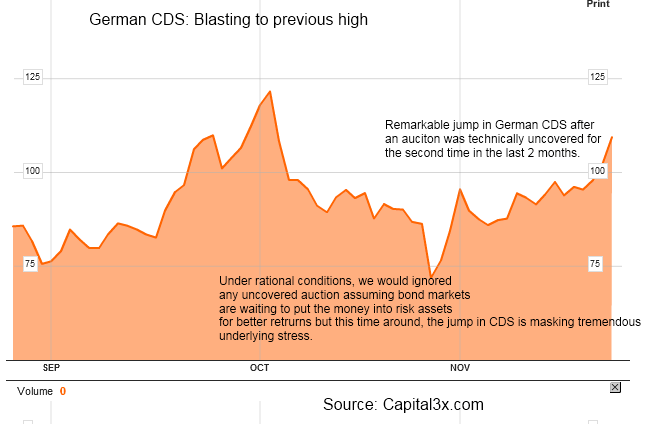

What was so different about the auction on Nov 23 was the breakout in CDS spreads which was clearly signifying a loss of confidence rather than bond investors waiting for higher yield under rational market condition. Is the simultaneous jump in CDS spreads (covered below) enough to indicate a change in course for the long term downtrend in German yields? Well the answer is complex but this current rise in German yields has significant room to run up.

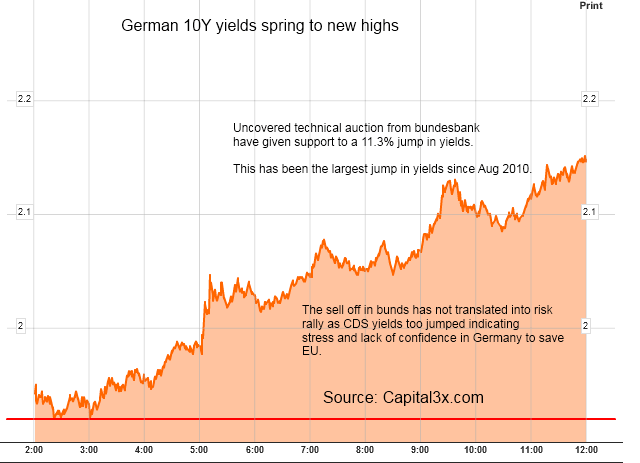

German Yields (23 Nov 2011)

11.5% jump in a single day for Germany has been noted across the world as series of failure for the German auction.

Germany 1 Day

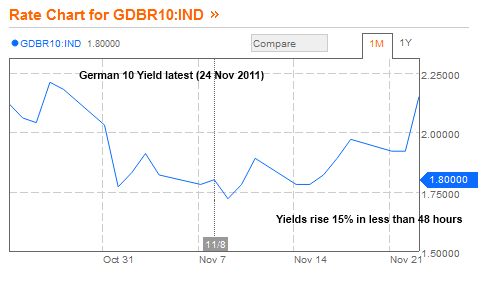

Germany yields have gaped up at 2.25% on 24 Nov once again thus building further stress in the system. We believe this is medium trend that is now in play in the German Yields as Germany realizes that not even them are free to do what they will.

German CDS

The German CDS spreads have widened to 110 levels (Closing 23 Nov) but are below 125. A clean break of 125 means huge trouble for Europe largest economy. Germany is now in the bulls eye of the bond investors and you have to look to Argentina to understand the havoc they can cause.

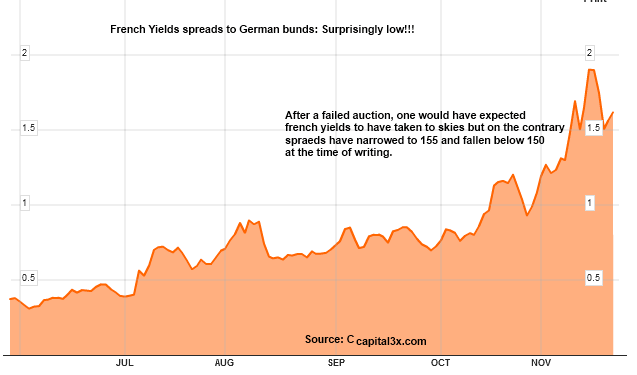

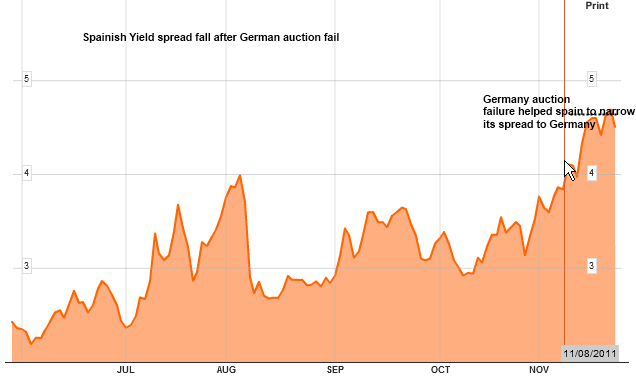

On the spread analysis, France and Italian spreads have fallen below the previous highs and in a ironical sense, their yields have not responded to the mayhem in the Germany markets.

French Spreads: Narrow

Spain yields Narrower after German auction failure

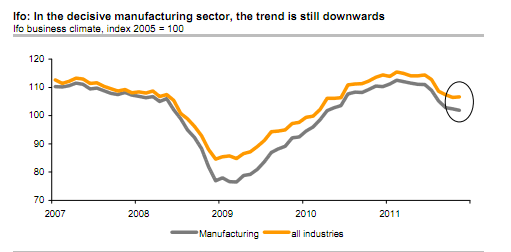

On the macro side, Germany continue to throw data that may be lagging the recession that is coming its way in 2012. The IFO reported numbers beat expectations.

The Ifo business climate has not fallen further in November, against the expectations (106.6 compared to 106.4 in October). However, at the trend-setting core of the German economy, namely the manufacturing industry, the business climate has deteriorated again. The sovereign debt crisis is lying like mildew upon the economy. But the figures are only good on the surface. The slight rise of the business climate came from the building sector and wholesale, i.e. from sectors where the business climate often fluctuates more strongly from month to month than in other branches of the economy. However, at the trend-setting core of German industry, namely the manufacturing sector, the business climate has fallen further from 102.4

to 101.9 (Chart). The trend is therefore clearly downwards.

The official order intake figures in Germany have fallen in past months. More and more now suggests that even the very competitive German economy will contract somewhat in the winter half year.

The debt crisis is quite clearly now at German doorsteps and it is being clearly told that unless Germany foot the bill which will result in massive spike German bund yields, the EU situation will not stabilize.

On other side of the ocean, the US is not exactly any signs of life but neither is it falling of the cliff.

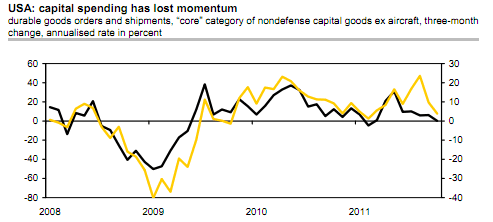

The US capital orders slow down in October.

US capital spending has decelerated somewhat recently. Total orders for durable goods declined 0.7% in October, and ‘core’ capital goods orders even slipped 1.8%. Furthermore, the data for September were revised down. While the report slightly disappoints, these data are extremely volatile on a monthly basis. From a medium-term perspective the uptrend may be challenged in the coming months as US economy begins to feel the heat from EU banking crisis. Durable goods orders declined 0.7% in October on a slump in the always volatile aircraft orders. Excluding transportation goods, orders advanced 0.7%. The most interesting category, the ‘core’ component of nondefense capital goods orders ex aircraft which are a proxy for future investment spending, declined 1.8% in October after a 0.9% increase in September (revised down from 2.4%). Shipments in the core category fell 1.1%, following a 1.0% decline in September. Bear in mind, however, that due to problems with seasonal adjustment, core orders and shipments tend to drop in the first month of a quarter. It therefore makes more sense to look at (annualised) three-month changes: Core orders were about unchanged in October from three months before while core shipments increased at an annual rate of 4% (chart). This clearly marks a deceleration from more lively business over the summer but the 15.6% increase in investment in equipment and software in the third quarter was unlikely to be sustained anyway.

View from the Forex markets which are a direct derivation of bond markets, continue to indicate challenging times for risk markets in 2012.

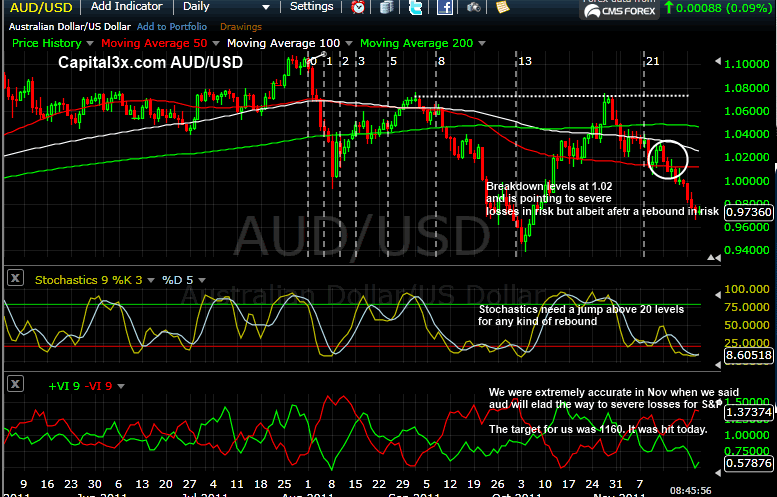

AUD/USD which is as a good a proxy of risk as any other parameter, is now showing signs of clear break down in S&P500 to levels of 950 levels in early 2012 before we believe FED prints new money and exits the TWIST operation.

The falling stochastic and vortex did help us short the AUDUSD at 1.04 levels and also led us to short S&P500 and long USDCAD at crucial breakout levels for a profit success ratio of 84%.

We continue to watch the price action and will update our premium subscribers with new analysis and charts. Our trade portfolio (Forex, SPX Emini, Crude, Gold, Silver) is visible to our premium subscribers

Our feeds: RSS feed

Our Twitter: Follow Us

Kate

Capital3x.com

Kate, trading experience with PIMCO, now manage capital3x.com. Check performance before you subscribe.

© 2011 Copyright Capital3X - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.