Hang onto Gold But Brace for Potential Price Volatility Ahead

Commodities / Gold and Silver 2011 Nov 24, 2011 - 01:35 PM GMTBy: William_Bancroft

In the World Gold Council’s (WGC) last quarterly research piece, the authors find that ‘average gold price volatility is lower for each represented year since 1980’ meaning that ‘gold also becomes less susceptible to sharp swings, heralding its value as a tail-risk hedge’. This statement got us thinking about what the future has in store for future gold price volatility, given that many market participants forecast greater volatility in other markets. In particular we think of the superbly eloquent Rick Rule, who looks for greater volatility presenting itself in a great range of markets as pressures within the financial system build.

In the World Gold Council’s (WGC) last quarterly research piece, the authors find that ‘average gold price volatility is lower for each represented year since 1980’ meaning that ‘gold also becomes less susceptible to sharp swings, heralding its value as a tail-risk hedge’. This statement got us thinking about what the future has in store for future gold price volatility, given that many market participants forecast greater volatility in other markets. In particular we think of the superbly eloquent Rick Rule, who looks for greater volatility presenting itself in a great range of markets as pressures within the financial system build.

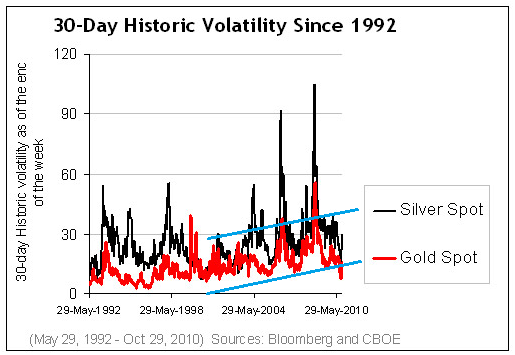

Whilst we do not know exactly how the WGC quantify and measure price volatility, and it is perhaps not surprising to learn that volatility had been declining for some time since the frothy peak of the last bull market in 1980, our thoughts turned to current and future legs of this apparent gold bull market. After the white hot 1980 peak gold bugs suffered two lost decades as gold cooled to become a veritable back-water and Chairman Volcker brought some financial discipline to the world. The chart below might suggest that since the start of this bull market in 2000, a gradual rise in price volatility may have been evidencing itself.

To today’s gold investor it does feel that price volatility might be on the increase and another graph from the Chicago Board of Options Exchange seems to suggest that recently this sentiment might be correct.

As gold enters a more mature phase of a bull cycle perhaps the action is hotting up, and greater participation and speculation are bringing attendant increases in price volatility. The right hand part of the graph below does suggest more violent price oscillations either side of the directional trend line than shown on the left prior to the Credit Crunch of 2008.

Within this potential recent volatility the press’s reporting of gold has maintained its previous form. That of being less likely to report rises in the gold price, than to report falls as ‘shocking’ collapses. Although only relevant anecdotally, gold investors might be surprised about how they are approached by friends asking about recent gold price crashes more often than by friends who have heard or read of steady price appreciation. We feel that such phenomena have contributed to keep significant numbers of investors from allocating their capital to the money of kings.

Our thoughts here were again aroused when listening to a recent King World News interview with John Embry, Chief Investment Strategist at Sprott Asset Management. When discussing with host Eric King his thoughts about potential action in the precious metals markets by the authorities, Mr Embry had this to say:

‘It is testimony to the powers that be that basically they have created sufficient volatility and negative press that the average person is scared to death, because he doesn’t fully understand the fundamentals of gold and silver, and as a result he is driven away by the price action’

It is worth putting into context that Mr Embry, like other prominent commentators from the Sprott stable, believes that the authorities are engaging in improper action in the gold market to resist price rises. Mr Embry does go onto comment that in fact he finds current observable interest levels are ‘very bullish for the next rise up’.

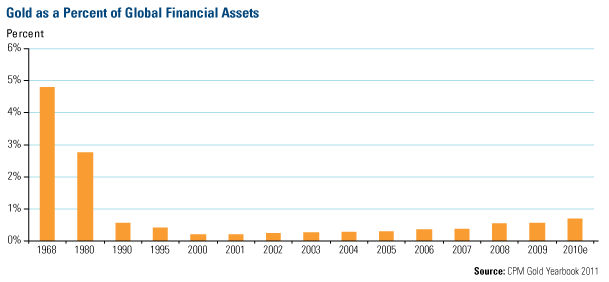

Might it be that the nature of today’s gold market (whether manipulation is occurring or not) and its apparent volatility are keeping significant potential capital inflows on the sidelines? We believe this might be the case. Although the last few price ‘smashes’, as some term them, have often resulted in record reported demand figures from bullion dealers around the world in the month following such price drops (suggesting some investors in the precious metals are true believers and continually looking to buy the dips), the fact is that participation in the gold market is still low. Some might find this claim spurious, but even now after the gold price increasing six-fold in 11 years the chart below suggests that gold actually represents less than 1% of global portfolios.

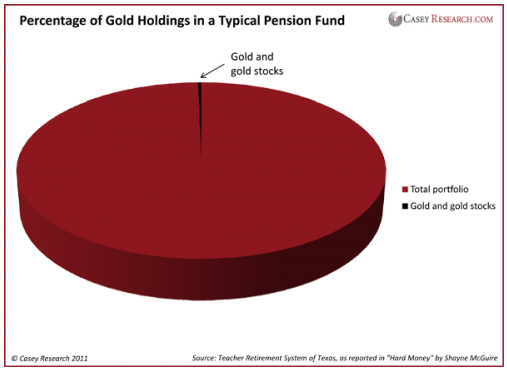

When talking about the current stage of the gold bull market noted analyst and trader Jim Sinclair urges that ‘this train is leaving the station’. Leaving it may be, but it seems that no-one is really on board. Gold is still not seen widely as a better savings mechanism and/or form of liquidity than fiat money and other supposedly stable asset classes. An interesting and potentially representative example of this is the extremely low level of participation in gold by the savers or managers of savings of the world. In his excellent book ‘Hard Money’, pension fund manager Shayne McGuire finds that a typical pension fund (some of the giants of the capital markets) has only a 0.30% allocation to gold and gold mining shares.

Whilst we need to be careful not to make trends from a potential pension fund example to justify our argument, volatility in the gold price does seem to be a concern to savers and pension funds, alongside lack of yield (a concern greatly reduced in today’s negative real interest rate world). Your writer is often reminded of both of these two potential issues by his grand-mother. I often defer to her wisdom, but in this case will bumptiously opt not to eschew gold.

We sometimes call the gold market the fox-hunting debate of the financial markets because currently few really participate but many have strong opinions and provide emotive responses when asked about gold. Gold is a controversial topic, and rising volatility will make it more so. We are often interested to note the reference to gold as a large feature on the front cover banner of newspapers such as the FT, but when you go to page X to read the advertised report you find a measly few column inches covering some academic’s opinions on gold. It seems gold’s controversial status can be a good hook to lure readers inside, even when there’s not much literary fat to chew on.

To return to issues of volatility, with confidence in today’s financial system and monetary paradigm being severely tested, we believe capital flows (speculative and prudent) into gold will increase. Gold is a relatively small investment market (approx. $8 trillion) compared to other capital markets and is relatively less liquid than certain large debt markets for example. As a result we feel these capital flows cannot be absorbed without relative increases in price volatility. If we can judge the years 2000 – 2008 as the first phase of this gold bull market, where investors experience derision and a lonesome existence, we might judge the period since gold price rebounds in 2008 as the second phase. During the second phase of bull markets justification is still being sought for an asset class but at least some discussion and consideration for it is being made in the financial and maybe wider media. As gold’s attributes and price rises since 2000 are increasingly appreciated we feel greater capital will seek to flow into gold.

This is why increases in gold price volatility are a real possibility that we urge investors to mentally prepare for. Bull markets can find all sorts of ways to throw you off, hence why legendary trader Jess Livermore used to muse that finding a man that could ‘be right, and sit tight’ through a secular bull market was so rare. In the 1970 – 1980 gold bull market, investors were firmly tested by a near 50% price drop in 1976, but those that stayed the course were rewarded by a later 8 fold increase to $850/ounce. Looking back at 1976 Bill Bonner, of The Daily Reckoning, urges investors to prepare for a bumpy ride and significant corrections. Could gold halve in a year again? It’s possible. We are not ones to try and predict the near or maybe even medium term, but in the longer term we see the probabilities more favourably weighted in favour of further price appreciation. The fundamentals that helped start this bull market starting in 2000 are all still in attendance, and if anything have got stronger. We would far prefer to hold gold now than not. Gold investors that really appreciate the fundamentals behind gold and observe a creaking monetary system based upon an elastic and flawed unit of account may be the firm hands within this market. We feel these firm hands will be rewarded for their conviction and patience. If capital market dislocations continue as they are now, hang onto your hat, but most importantly hang onto gold.

Regards and good investing,

Will Bancroft

For The Real Asset Company.

Aside from being Co-Founder and COO, Will regularly contributes to The Real Asset Company’s Research Desk. His passion for politics, philosophy and economics led him to develop a keen interest in Austrian economics, gold and silver. Will holds a BSc Econ Politics from Cardiff University.

© 2011 Copyright Will Bancroft - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.