Disappointing Year for Gold and Silver

Commodities / Gold and Silver 2011 Nov 26, 2011 - 05:08 AM GMTBy: Ned_W_Schmidt

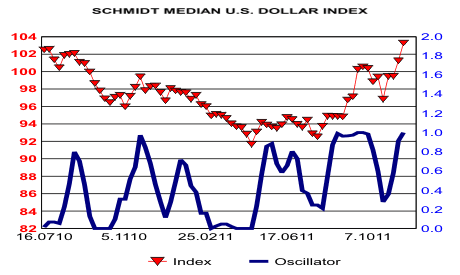

2011 is very soon to become a disappointment. U.S. dollar was popularly forecast to be zero by now. As is readily evident in the chart, a second possibility existed. Why did the dollar not go to zero? Well first, that was a ridiculous expectation. Secondly, that forecast was doomed to failure because it rapidly became the consensus forecast.

2011 is very soon to become a disappointment. U.S. dollar was popularly forecast to be zero by now. As is readily evident in the chart, a second possibility existed. Why did the dollar not go to zero? Well first, that was a ridiculous expectation. Secondly, that forecast was doomed to failure because it rapidly became the consensus forecast.

A third reason the dollar did not go to zero is that the consensus forecast is now that the Euro may go to zero as the EU collapses into chaos. That view too is destined for the junk pile of foolish follies. That pile is starting to become a little high as this year comes to a close. We also tossed onto it earlier forecasts of $50 Silver and $2,500 Gold. Or, was it $100 Silver and $5,000 Gold?

Those forecasts for Gold and Silver may indeed come true. In fact, the probability of those targets ultimately being reached is high. However, the missing element of these forecasts was time. Are those targets relevant to someone with a predominance of gray hairs?

The expectation that reward is going to happen "today" over powered reasoned judgement. Patience is the missing part in most forecasts. Patience is how we deal with an important market dimension: Time.

Simple diagram below is how we should think about a market move, be it a bull or a bear. Area of that rectangle is a measure of the total pleasure of a bull market and total pain in a bull market. Measuring those two dimensions after the event is easy. Forecasting them forward is the trick.

As humans, we do not do a very good job of forecasting these dimensions. We tend to over estimate price. On time, we tend to underestimate it, or ignore it. Latter dimension seems to be the one to which we give the least attention. That is a forecasting frailty that causes us trouble.

Most efforts to develop tools to deal with time have not been particularly successful. Cycle analysis is hampered by the reality that humans and trees behave differently. Trees are genetically hard wired to create rings. They do not flip a coin each year on whether or not to grow another ring. Humans seem to act as if they are flipping a coin at every intersection.

Perhaps, though, some slight optimism might be justified. Recently published was George Lindsay and the Art of Technical Analysis by Ed Carlson. Lindsay was a brilliant technician that was fixated on the market variable of time. His remarkable insight was that intervals not cycles are the key to time in markets.

Lindsay wrote a market timing newsletter, but never wrote a book on his stock market techniques. Carlson, an individual who seems to view moving a mountain with a spoon as just a matter of time, reviewed and studied the newsletters of Lindsay that were available. From that effort he produced this book to explain Lindsay's work. It is probably the most important investment book written since What Works on Wall Street by James O'Shaughnessy in 1998. For that reason, we are far more positive about dealing with the elusive market variable of time in the future.

By Ned W Schmidt CFA, CEBS

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.