Agriculture Prices Continue Upward Trajectory, Present Investment Opportunities

Commodities / Agricultural Commodities Dec 23, 2007 - 03:32 PM GMTBy: Joseph_Dancy

Prices remain elevated and the long term global price and demand trends remain upward for agricultural products. We continue to find the global trends in supply and demand compelling for firms in this sector.

Prices remain elevated and the long term global price and demand trends remain upward for agricultural products. We continue to find the global trends in supply and demand compelling for firms in this sector.

Recent developments include:

• U.S. hay prices are the highest since record keeping began in 1949, according to the National Agricultural Statistics Service.

•  Soybean prices have risen to their highest level in 34 years hitting $11.14 a bushel. Prices have been boosted by strong Chinese demand, biofuel demand, and fears that current prices are not high enough to swing acreage from corn to soybeans in the U.S. (the world's largest producer).

Soybean prices have risen to their highest level in 34 years hitting $11.14 a bushel. Prices have been boosted by strong Chinese demand, biofuel demand, and fears that current prices are not high enough to swing acreage from corn to soybeans in the U.S. (the world's largest producer).

• The price jump in soybeans threatens to resonate through the food supply chain analysts warned, boosting meat and poultry prices.

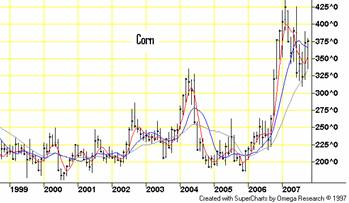

• The USDA reports food prices this year are soaring, rising twice the rate of inflation—the highest annual increase in over a decade. Corn prices doubled since last year. Egg prices are up 44 percent from last year, while milk is up 21 percent.

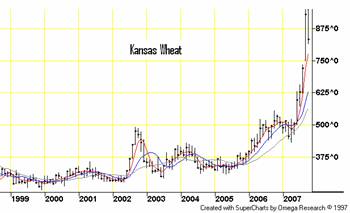

• Buyers and sellers are most concerned about the availability of wheat -- used to make bread and other staples throughout the world. Global stocks are forecast to fall to their lowest level in 30 years. Russia and Argentina raised export taxes in an attempt to mitigate the domestic impact of rising prices.

•  Food and beverage processors will be fighting it out for an increasingly dwindling supply of grains sourced at ever higher prices, the ING Group warned in a new report. ING's financial analysts predict that agricultural prices will increase by another 40 per cent by 2020, reflecting a tight supply brought on by increased demand for grains, a global water shortage, and changing weather patterns.

Food and beverage processors will be fighting it out for an increasingly dwindling supply of grains sourced at ever higher prices, the ING Group warned in a new report. ING's financial analysts predict that agricultural prices will increase by another 40 per cent by 2020, reflecting a tight supply brought on by increased demand for grains, a global water shortage, and changing weather patterns.

• The world is consuming rice much faster than it can produce. For the first time in 25 years, there will be just enough rice left to feed the world at the end of the 2007 marketing season. The main reason for the low inventories is the growing demand for rice in China , India , Bangladesh and Indonesia , where it remains the most important food grain. American rice farmers received the highest price for their crop in 25 years.

• World grain buyers, fearful that soaring prices for U.S. corn, soybeans and wheat may rise even higher in 2008, have snapped up the commodities while other countries raise export taxes or halt overseas sales altogether according to market analysts. Fear of prices rising further has spurred many countries that normally buy grain two to three months in advance to buy four to six months ahead of time.

We continue to find small firms in this sector very attractive. Our favorite plays include Cal-Maine Foods (CALM) and Lindsey Manufacturing (LNN). We own healthy positions in both firms in the LSGI portfolio.

By Joseph Dancy,

Adjunct Professor: Oil & Gas Law, SMU School of Law

Advisor, LSGI Market Letter

Email: jdancy@REMOVEsmu.edu

Copyright © 2007 Joseph Dancy - All Rights Reserved

Joseph R. Dancy, is manager of the LSGI Technology Venture Fund LP, a private mutual fund for SEC accredited investors formed to focus on the most inefficient part of the equity market. The goal of the LSGI Fund is to utilize applied financial theory to substantially outperform all the major market indexes over time.

He is a Trustee on the Michigan Tech Foundation, and is on the Finance Committee which oversees the management of that institutions endowment funds. He is also employed as an Adjunct Professor of Law by Southern Methodist University School of Law in Dallas, Texas, teaching Oil & Gas Law, Oil & Gas Environmental Law, and Environmental Law, and coaches ice hockey in the Junior Dallas Stars organization.

He has a B.S. in Metallurgical Engineering from Michigan Technological University, a MBA from the University of Michigan, and a J.D. from Oklahoma City University School of Law. Oklahoma City University named him and his wife as Distinguished Alumni.

Joseph Dancy Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.