Saving Gold, Old reliable stands tall in crisis atmosphere

Commodities / Gold and Silver 2011 Dec 02, 2011 - 11:28 AM GMT The United States has become a nation of savers. Where once the money management mantra was "invest it and retire wealthy," it is now "save it or lose it" -- a healthy reaction to the chaos, greed and notable lack of safety in traditional investments including those sponsored by Wall Street's financial firms. Retirement plans and pensions are in trouble. The fear is that individual savings could disappear overnight in a general financial system meltdown. Overriding all is a sense that things are going to get worse before they get better and that the time has come to take matters into one's own hands.

The United States has become a nation of savers. Where once the money management mantra was "invest it and retire wealthy," it is now "save it or lose it" -- a healthy reaction to the chaos, greed and notable lack of safety in traditional investments including those sponsored by Wall Street's financial firms. Retirement plans and pensions are in trouble. The fear is that individual savings could disappear overnight in a general financial system meltdown. Overriding all is a sense that things are going to get worse before they get better and that the time has come to take matters into one's own hands.

Gold has been a major beneficiary of the changing money psychology. The World Gold Council reports that bullion investment demand is running at all time highs. Gold ETFs -- a bellwether for physical gold demand -- continue to turn in impressive growth statistics on a global basis. Gold coin demand too, as reported in this newsletter last month, is running at all-time highs. Americans are saving, but increasingly they are adding gold to the savings mix as a hedge against declining returns and overall systemic risks.

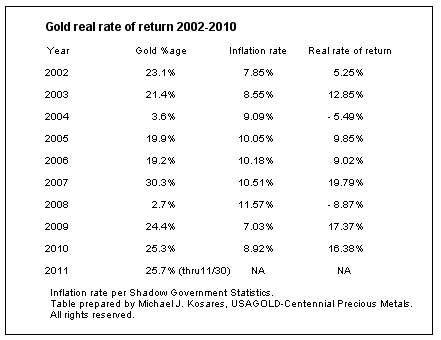

Over the past decade as shown by the table immediately below, the returns on gold have been gratifying. In compiling the table, I was careful not to skew it in a way to make the numbers look any better than they need to be to make the point. I did not over-state the returns by going from the low to the high in any given year, or even by basing it on average prices -- both of which would have resulted in much higher returns -- but straightforwardly on calendar year prices. Gold has posted returns of 19% or better in eight of the last ten years -- a "yawner" for those who constantly inveigh against gold's supposed volatility, but "old reliable" for those who bought it intending to hedge the disastrous turn of events in the global economy. Anyone purchasing gold at any time during the past decade and holding it for at least three years has garnered a solid return on his or her holdings.

What's more, the real rate of return as shown in the final column -- the yield minus inflation -- has been the stuff of portfolio planners' dreams. Even when you take into account the two off-years of 2004 and 2008, the average real rate of return over the nine year period was a stellar 8.5%. If I were to use a single word to define gold's performance over the past decade, it would be "stalwart." The other word that comes to mind is "consistent." These two words are near and dear to the heart of those who wish to hold on to their hard earned wealth.

The real rate of return numbers in the table were arrived at using the inflation rates generated by Shadow Government Statistics (SGS). SGS methodology, in my view, provides a more reliable -- albeit significantly higher -- measure of the inflation rate than the one used by the U.S. Bureau of Labor Statistics (BLS). As a result, SGS statistics lend themselves to a more accurate rendition of the real rate of return. If we would have used BLS numbers, the real rate of return would have been significantly higher. SGS uses the same statistical format for inflation the government used in 1980 before the Bureau of Labor Statistics went to hedonic adjustments. Many economists believe the contemporary version of the Consumer Price Index understates the inflation rate.

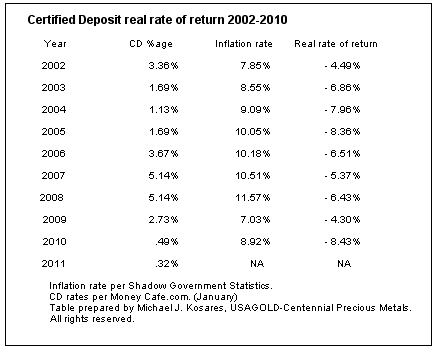

One of the problems often overlooked in savings plans is the long-term effects of currency erosion. Instead of looking at the real rate of return on gold in isolation, let's also take into account the real rate of return on dollar based savings, once again using the SGS inflation numbers.

As you can see by the right hand column, returns on bank savings, and by extension most yield-based investments, are deeply in the red when inflation is taken into account. That said, let me assure you that the purpose of this special report is not to convince you to run to the bank and empty your accounts. Rather, it is to emphasize the importance of diversifying your savings plan to counter the effects of long-term currency debasement.

Over the ten year period things have gone from bad to worse. In 2002, the real rate of return was a negative 4.49%. In 2010, rate of decline was 8.43% -- the highest in the last ten years. 2011 does not look like it is going to end on a much happier note. The swing between what was lost in dollar-based accounts and what could have been gained by a simple diversification into gold should also be taken into account. For 2010, a $10,000 certificate of deposit would have been valued at $9,157.00 after inflation. That same $10,000 in gold would have been valued at $11,638 after inflation. That amounts to a nearly $2,500 swing -- a difference of over 27%!

When one takes into account that inflation is a clear and present reality and that it truly does affect the value of the money we have stored at the bank or in a money market account, it gets the wheels turning. One remedy -- and the one often taken -- is to seek higher returns in investments associated with higher risk, the Jon Corzine approach. We all know how that ended for Corzine and MF Global. The prospect of higher returns always brings with it the risk of potential losses -- the polar opposite of what we expect from our savings. In the end, the best approach is the time-worn one -- the one that comes down to us through the centuries. It is the most direct, the easiest to understand, and for the past ten years it has been the most reliable. The best remedy is to save gold.

For a free subscription to our newsletters, please click here.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael Kosares has over 30 years experience in the gold business, and is the author of The ABCs of Gold Investing: How to Protect and Build Your Wealth with Gold, and numerous magazine and internet articles and essays. He is frequently interviewed in the financial press and is well-known for his on-going commentary on the gold market and its economic, political and financial underpinnings.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.