European Central Bank Loans Are Just 'Chump Change'

Interest-Rates / Credit Crisis 2011 Dec 03, 2011 - 03:25 AM GMTBy: Bloomberg

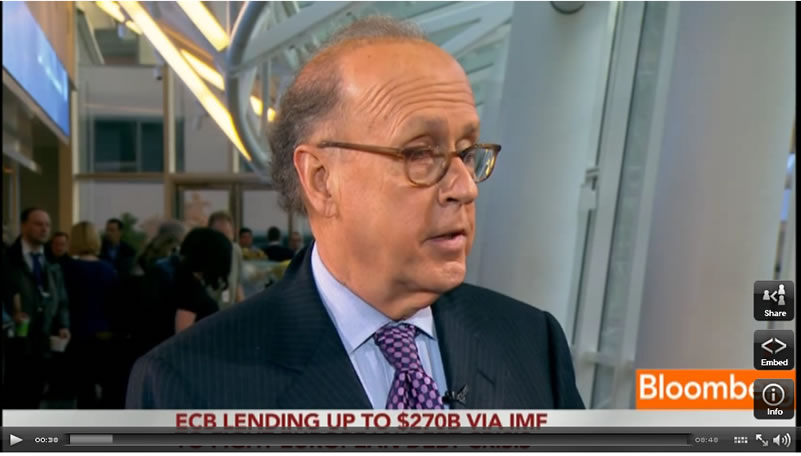

Stephen Roach, non-executive Chairman of Morgan Stanley Asia, spoke with Bloomberg Television's Betty Liu about Europe's crisis, the banking system in China and the U.S. economy.

Stephen Roach, non-executive Chairman of Morgan Stanley Asia, spoke with Bloomberg Television's Betty Liu about Europe's crisis, the banking system in China and the U.S. economy.

On the European proposal to channel central bank loans through the IMF, Roach said that "this is not a bazooka" and "200 billion is chump change."

Roach also said that he hopes Jim Chanos, who told Liu last week that the banking system in China is sitting on quicksand, will try to "actually go to China and see it himself."

Roach on the European proposal to provide up to $270 billion via the IMF:

"The theory of using a bazooka to put a floor on markets in crisis is the right theory. But a few things about this. This is not a bazooka. 200 billion is chump change in the context of the debt overhang that exists across Europe right now. Secondly, the idea that you can stop a liquidity crisis with a bazooka is important, but as we're seeing in the United States right now, it does not foster sustainable and meaningful economic recovery. Thirdly, what about Europe's fundamental issues? The lack of a fiscal transfer mechanism and the fact that Europe's debt burdens will only grow as the European economy now slides into a recession. These are all big issues and what worries me is that we're focused on the short term so called palliative of a relatively small commitment to IMF intermediated funding to deal with this crisis."

On what amount would really be needed to aid Europe's crisis:

"Just go back to what the Federal Reserve assembled in the aftermath of the crisis a three years ago. With all the various programs, including QE1 and all of the alphabet soup of special programs, they were able to put together firepower in excess of $12 or $13 trillion U.S. dollars. That clearly put a floor on the crisis and fostered a powerful upturn in risk markets, which is now being drawn into question by a shaky recovery. That's what massive firepower can do and the Europeans don't even have a commitment close to that."

On Jim Chanos saying that the banking system in China is very fragile:

"[Chanos] is a lot more negative on China than I am and I hope one of these days he can actually go to China and see it himself. The banking system in China is the central player in the credit intermediation process and they are obviously responsible for funneling an enormous amount of lending in the aftermath of the financial crisis of '08 to stimulate the economy. Now they are dealing with some of the credit quality issues in the aftermath. But I think these concerns over non-performing bank loans are vastly overblown. The banking system itself is much more liquid given the huge deposit base. Loan to deposit ratios in China are 65% today. Typically pre-crisis loan to deposit ratios for banks that are overextended are in excess of 120 or 130%. So the idea that the Chinese banking system is teetering on the brink of a crisis is not borne out by fact."

On the People's Bank of China lowering the reserve requirement ratio this week and whether it's a signal that the Chinese are concerned about a hard landing:

"I think the action on required reserve ratio does reflect the fact that export led China is now seeing a softening in its biggest export market, which is Europe, and the likelihood of more softening is clearly got them on the alert. The good news for China, unlike the United States and Europe, is they've got plenty of ammunition in their arsenal...they can actually make conventional policy adjustments to stimulate their economy. We can't. Inflation is coming down...I would expect headline inflation to continue to fall back in China and that reflects that policy officials in China have really been on top of this problem from the start."

On how Wednesday's coordinated central bank intervention to aid Europe will stimulate the economy in the United States:

"That's a question I ask myself every night before I go to sleep. The answer is, it's not. American consumers are still in the grips of a tough balance sheet recession. They have too much debt, their savings is too low to provide for the retirement of 77 million aging baby boomers of which I am one. We have to address the balance sheet problems in terms of excess debt and inadequate saving and financial security. Until we do that, I think consumer demand will remain surprisingly weak. Liquidity injections, QE1, QE9, is not going to change that until consumers feel more comfortable about their balance sheets and that is my biggest concern."

On whether QE3 would do any good for the U.S. economy:

"All these QEs do is that they provide a better sense of stability for markets, but do they translate into traction on the real side of the economy? So far, the answer is absolutely not."

On how Bernanke will look at today's jobs report in terms of shaping policy:

"I think they look at it as the glass getting a little more half full - cautiously encouraged but they're not going to celebrate the dawn of a classic economic recovery. I think they will raise some questions along the lines of whether or not this sharp drop in the unemployment rate is an statistical apparition and what does it mean for consumer income that drives the demand side. I think they stay cautious and they will keep debating whether they will need to inject more liquidity a la QE3 at some point in early 2012...You need validation. You're not going to extrapolate on the basis of one data point."

On repatriation and job creation in the United States:

"I am not against repatriation, but I think there's a risk of overselling this as a panacea for the jobs problem in America. Companies aren't hiring because demand is week...I think we have to get to the core of the problem. If you don't expect your markets to be expanding, why are you going to hire a lot of people? Why are you going to build a new plant? Get demand up - fix the demand problem for the American consumer. That should be priority #1 in Washington."

Copyright © 2011 Bloomberg - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.