U.S. Labor Market is Improving, but Imminent Europe Recession Could Upset the Apple Cart

Economics / Employment Dec 03, 2011 - 03:33 AM GMTBy: Asha_Bangalore

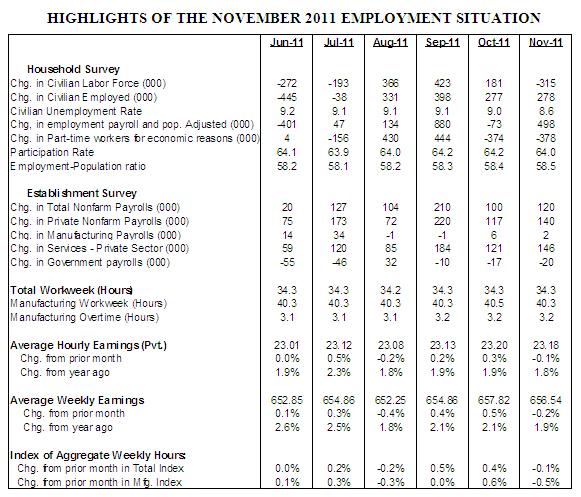

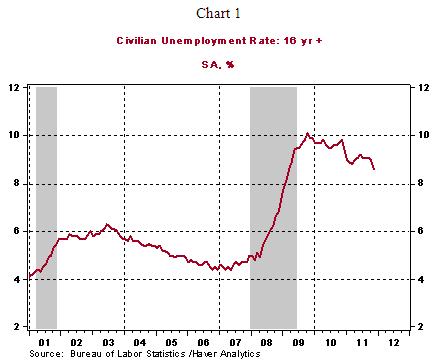

Civilian Unemployment Rate: 8.6% in November, down from 9.1% in October. Cycle high jobless rate for the recent recession is 10.1% in October 2009.

Civilian Unemployment Rate: 8.6% in November, down from 9.1% in October. Cycle high jobless rate for the recent recession is 10.1% in October 2009.

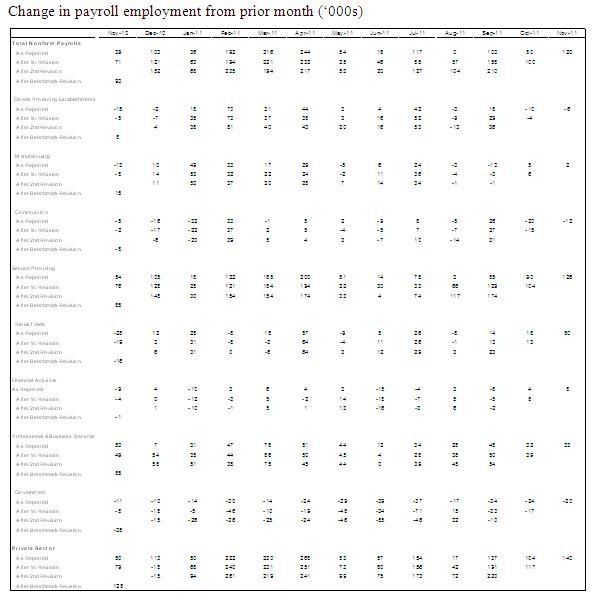

Payroll Employment: +120,000 jobs in November vs. +100,000 in October. Private sector jobs increased 140,000 after a gain of 117,000 in October. Addition of 82,000 jobs after revisions to payroll estimates of September and October

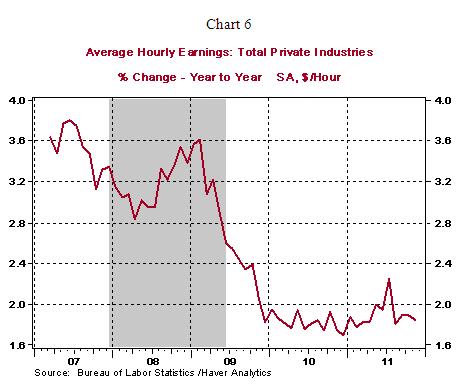

Private Sector Hourly Earnings: $23.18 in November vs. $23.19 in October; 1.8% y-o-y increase in November vs. 1.9% gain in October.

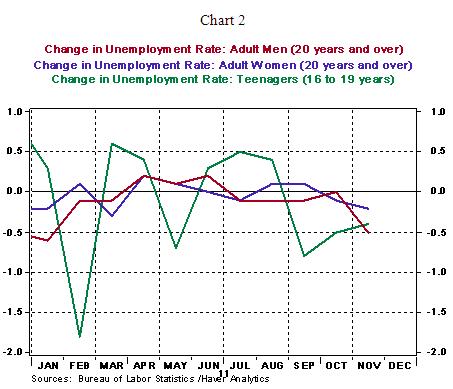

Household survey – The unemployment rate fell to 8.6% in November from 9.0% in October. Not only is the headline impressive but digging deep in to the details confirms that there is a gradual improvement in the labor market.

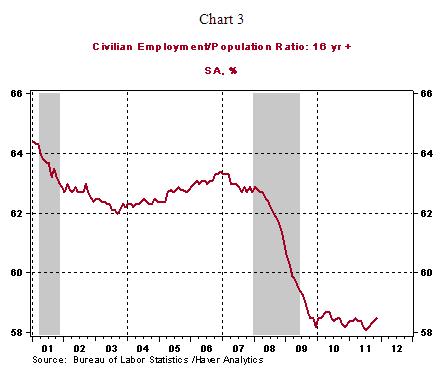

The increase in the employment-population ration to 58.5% in November from 58.1% in July is another piece of evidence supporting the view that the labor market is probably turning the corner.

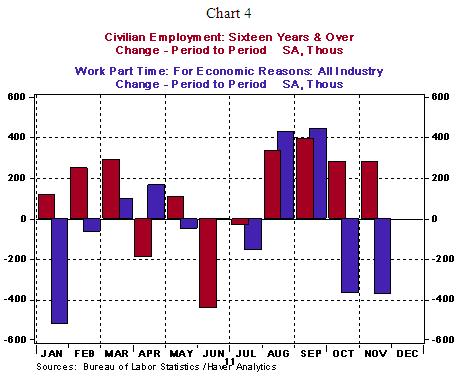

In August and September, the gain in part-time employment exceeded the increase in total employment, a reversal occurred in October and November (see Chart 4); this one more positive feature of the household survey among the other listed so far.

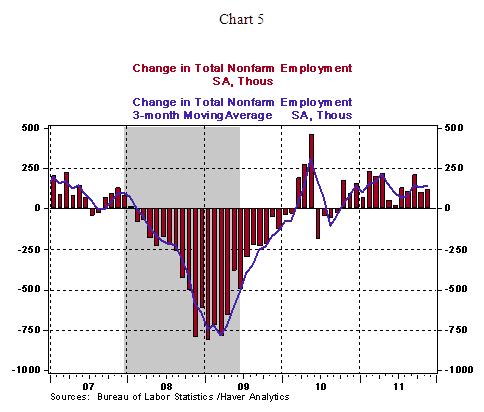

Establishment Survey – Payroll employment increased 120,000 in November after upward revisions to estimates of the prior two months adding 82,000 jobs. Revisions of payroll estimates since June have resulted in an addition of jobs, which is a noteworthy aspect. In the last three months, the average gain in payrolls is 143,000 vs. an increase of only 84,000 jobs in the three months ended August (see Chart 5). This pace of job creation is inadequate to bring the unemployment rate down in the near term, which leads us to conclude that the recent improvement in hiring is encouraging but insufficient for the Fed to stop fretting about the labor market.

Highlights of changes in payrolls during November 2011:

Construction: -12,000 vs. -12,000 in October

Manufacturing: +6,000 vs. +2,000 in October

Private sector service employment: +140,000 vs. +117,000 in October

Retail employment: +50,000 vs. +13,000 in October

Professional and business services: +39,000 vs. +33,000 in October

Temporary help: +22,300 vs. +15,800 in October

Financial activities: +8,000 vs. +8,000 in October

Health care: +17,200 vs. +25,500 in October

Government: -20,000 vs. -17,000 in October

The workweek was steady at 34.3 hours in November, while both hourly (-0.1%) and weekly (-0.2%) earnings slipped. The increase in payroll employment combined with a decline in earnings is most likely to result only in a small increase in personal income during November. The weak trend of personal income is a headwind for consumer spending going forward. The 0.5% drop in the manufacturing man-hours index bodes poorly for industrial production in November.

Conclusion – Latest economic reports have bought the Fed time until the early months of 2012 to consider another round of quantitative easing. Bank credit has risen in the third quarter and is on track to post an increase in the fourth quarter, which augurs positively for economic activity. Auto sales rose to an annual rate of 13.63 million units in November, putting the October-November (13.4 million units) average strongly ahead of the 12.5 million sales pace registered in the third quarter. The November ISM manufacturing survey showed increases in indexes tracking new orders and production. Sales of existing and new homes advanced in October, the Pending Home Sales Index for October posted a sharp increase. The tone of these economic reports and moderate gains in hiring visible in the November employment report have marginally modified the profile of the U.S. economy but the challenges in the labor market and still distressed conditions in the housing sector overwhelm these improvements such that the case for additional monetary policy support remains strongly legitimate. In addition, we have not felt directly or indirectly the effects of the European recession, which is likely to wash up the shores of the U.S. economy in early-2012 and bolster the case for renewed monetary policy support.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.