BOA 2012 Top Trades- Buy Gold Versus Euro; Iran Warns of Oil at $250

Commodities / Gold and Silver 2012 Dec 05, 2011 - 07:05 AM GMTBy: GoldCore

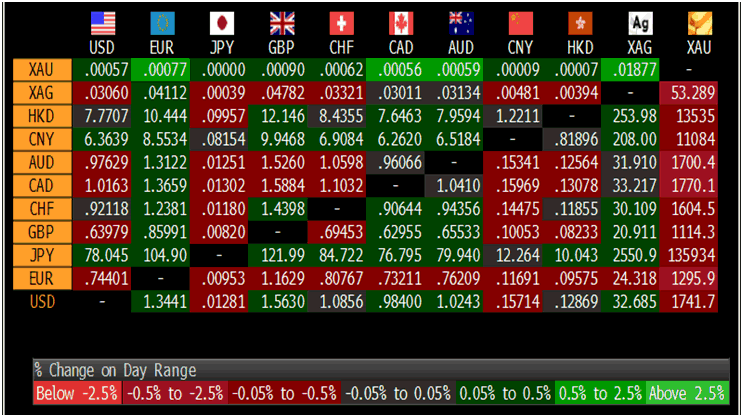

Gold is trading at USD 1,740.10, EUR 1,295.90, GBP 1,114.30, CHF 1,604.5, JPY 135,900 and AUD 1,700.4 per ounce.

Gold is trading at USD 1,740.10, EUR 1,295.90, GBP 1,114.30, CHF 1,604.5, JPY 135,900 and AUD 1,700.4 per ounce.

Gold’s London AM fix this morning was USD 1,744, GBP 1,114.88, and EUR 1,296.08 per ounce.

Friday's AM fix was USD 1,751.00, GBP 1,116.50, and EUR 1,298.29 per ounce.

Cross Currency Rates

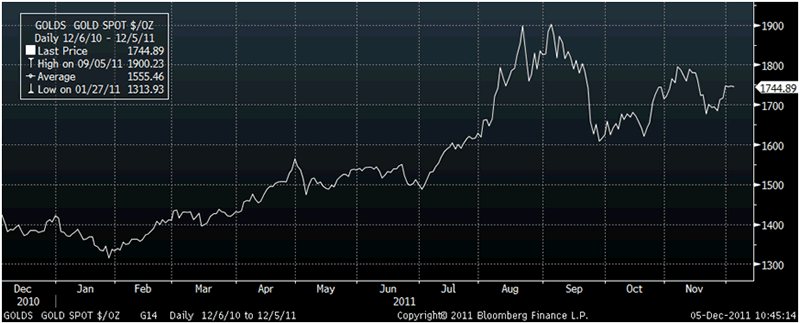

At the open in Asia, gold spiked from $1,746.75/oz to $1,755/oz before being capped at that level and falling back to its opening price. It remained near the $1745/oz mark overnight and this morning in Europe until soon after the London AM Fix ($1,744/oz) when selling commenced again.

Traders may be hesitant to place positions ahead of the Franco-German summit and there may also be some profit taking after the nearly 4% gains seen last week.

Gold will likely be supported this week by the intractable eurozone debt crisis and renewed jitters about Iran which has seen oil rise again today (NYMEX/ WTI at $101.80).

Iran warned yesterday that any move to block its exports would lead to oil at $250 a barrel.

Physical buying continues internationally. Indian gold edged higher this morning following a weaker rupee, and premiums in the physical market steadied after a recent lull in buying. Chinese demand is gradually picking up again ahead of Chinese New Year.

Safe haven demand from Eurozone countries has increased significantly in recent days due to the concerns about euro exposure due to the possible collapse of the single currency.

Speculators, hedge funds and money managers pared their holdings of Comex gold and silver futures and options in the week ended Nov. 29, according to data released Friday by the Commodity Futures Trading Commission (CFTC).

The CFTC data, typically released Friday, were delayed because of the Thanksgiving holiday.

In gold futures and options, 4,207 long positions were cut and 1,249 short positions were cut.

This reduced their net position by 2% to 146,298 long contracts, from 149,256 long contracts a week earlier.

The managed fund net-long position represents around 14.6 million troy ounces of gold.

In Comex silver futures and options, these funds added 110 long contracts and 316 short contracts. This reduced their net long position by 2% to 12,334 contracts, from 12,542 contracts the previous week.

The net silver position represents around 61.6 million troy ounces of silver.

In platinum, 243 long positions were cut and 555 short lots were added, taking the net long position down to 12,952, from 13,750.

In palladium, 64 long lots were cut and 506 short lots were added, reducing the net long position to 5,231 from 5,800.

Volatility in currency markets has increased markedly in recent months and this looks set to continue in the coming weeks as liquidity dries up in the run up to and during Christmas and New Years.

Currency markets have proved even more difficult to predict than usual due to the global debt crisis. News headlines and rumours are causing large swings in the market.

Intervention from governments around the world to weaken their currencies and competitive currency devaluations have surprised markets. Investors can no longer assume that the yen, Swiss franc and the US dollar will be safe havens.

Foreign exchange trading today normally averages £4 trillion (€4.7 trillion) a day, according to the Bank for International Settlements.

2012 Top Trades of BOA - Buy Gold Versus Euro

Gold and the dollar are Bank of America Merrill Lynch’s top currency trades for 2012.

BOA, the second-biggest U.S. bank by assets after JPMorgan Chase & Co., said that investors should buy gold versus the euro as the ECB engages in quantitative easing to contain debt turmoil.

David Woo, global head of rates and currencies in New York at the Bank of America Corp. unit, told clients in research note that “the ECB will be buying more government debt and doing QE, so buy gold against the euro.”

“The second major theme is U.S. fiscal tightening is about to come, and the U.S. economy will slow, and this will be very good for the U.S. dollar.”

“The general theme for the year ahead is pretty negative for the risk environment,” Woo said.

SILVER

Silver is trading at $32.60/oz, €24.24/oz and £20.83/oz

PLATINUM GROUP METALS

Platinum is trading at $1,541.70/oz, palladium at $644.75/oz and rhodium at $1,575/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.