Gold - The Simple Secular Thesis

Commodities / Gold and Silver 2011 Dec 09, 2011 - 03:09 AM GMTBy: Adam_Brochert

It's more subtle and sophisticated than "buy Gold and get rich." But in the end, not much. Traders and speculators are always looking for the edge - much like the hares racing the tortoise. But the tortoise method of investing for this secular cycle is important and should comprise a significant portion of one's portfolio regardless of your preferred time horizon when investing and/or speculating/trading. After all, when MF Global can happen in one of the so-called safe haven countries (i.e. the USA), then isn't a component of safety without counter party risk important? Holding paper fiat currency and stuffing it under the mattress requires infinite faith that the apparatchiks and central bankstaz pulling the strings will not fall into the trap of human nature that has plagued every currency, including those backed by Gold, since currencies were first invented. I am speaking of debasement and debauchery.

It's more subtle and sophisticated than "buy Gold and get rich." But in the end, not much. Traders and speculators are always looking for the edge - much like the hares racing the tortoise. But the tortoise method of investing for this secular cycle is important and should comprise a significant portion of one's portfolio regardless of your preferred time horizon when investing and/or speculating/trading. After all, when MF Global can happen in one of the so-called safe haven countries (i.e. the USA), then isn't a component of safety without counter party risk important? Holding paper fiat currency and stuffing it under the mattress requires infinite faith that the apparatchiks and central bankstaz pulling the strings will not fall into the trap of human nature that has plagued every currency, including those backed by Gold, since currencies were first invented. I am speaking of debasement and debauchery.

And understand that currency under the mattress and certificates of confiscation (i.e. government bonds) may outperform equities and real estate as general investment sectors over the remainder of the cycle. I am not sure and I don't care, as this is a game I am not willing to play with my hard-earned capital.

The bottom line is this: the charts and secular trends scream that we are in a secular private sector credit contraction, also known as a depression in impolite company. For uttering the word "depression" is an admission of failure and we all know that confidence must be maintained, regardless of reality. Close your eyes, stamp your feet and repeat after the apparatchik: "Remain calm. All is well."

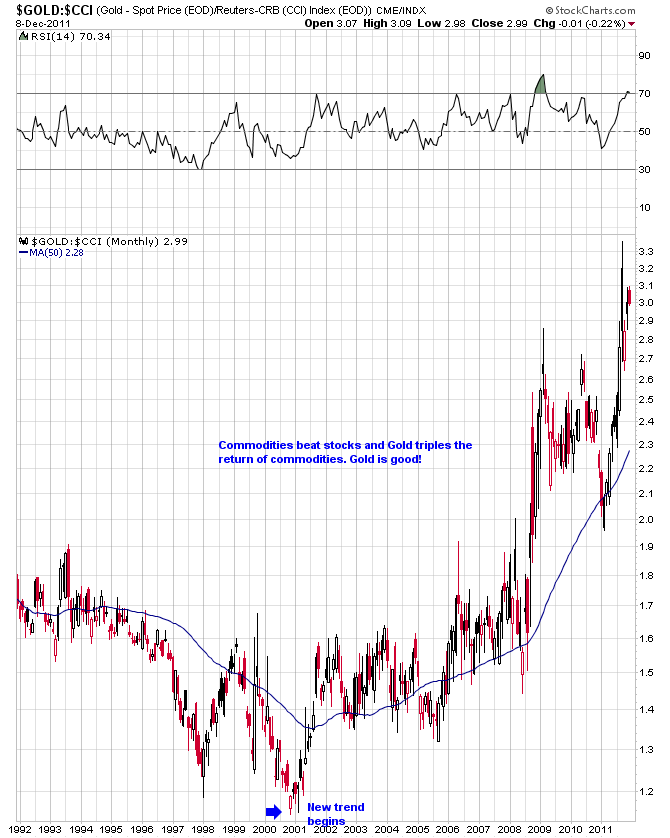

Here is the skinny on the secular trend for at least the next few years and potentially a decade or more: it's actually pretty easy. Hard assets, using general commodities as a proxy, have been and will continue to outperform financial assets such as common stocks, corporate bonds and real estate (individual specific opportunities and travesties aside, as I am speaking in broad sector-type terms). Additionally, Gold will continue to outperform general commodities and will continue to rise relative to all major paper currencies (i.e. outperform paper cash, as "hard" cash is preferred to paper promises in our current secular environment).

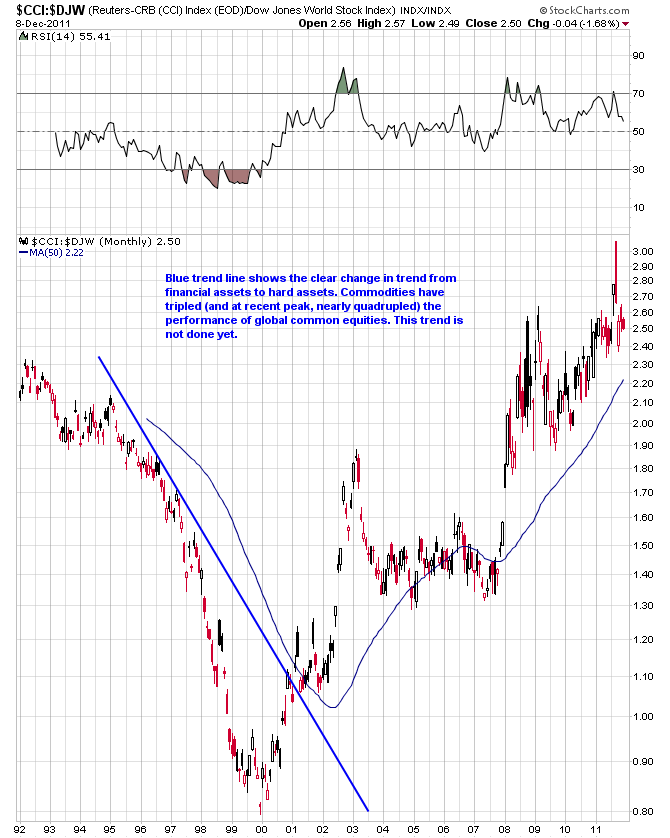

Don't believe me? Look at the charts! First up, the ratio of commodities, using the CCI Commodities Index (i.e. $CCI, which is more balanced than the oil-heavy CRB Index) relative to the Global Dow Jones Stock Index (i.e. $DJW, a less-than-perfect proxy for global equities). Here is a 20 year monthly chart of the $CCI:$DJW thru today's close:

Next up, the Gold ($GOLD) to commodities ratio chart (i.e. $GOLD:$CCI) over the same period of time using the same monthly log-scale format thru today's close:

That's it. The only subtlety comes in because of the issue of "nominal" versus "relative" return. In other words, if Gold goes to $700 US/oz from here and general commodities and the global stock market indices go to zero or near zero, you may show a "loss" on paper, but will gain immensely in relative wealth and won't have to pay capital gains tax. This is the scenario Robert Prechter of Elliott Wave fame envisions. In this scenario, just hold paper US cash and do better than everyone else. I think Gold is the perfect hedge, as it has already proven that it can hold its value this cycle even in severe deflation. Remember 2008? Everyone talks about how Gold dropped from $1000 US/oz down to $700/oz but they always fail to mention that by February of 2009 Gold was back at $1000/oz while the stock market continued to fall! In other words, Gold was flat, just like US Dollar cash was flat. To say that the US Dollar index rose more than Gold is only relevant to traders playing in the currency markets. Holding paper cash and physical Gold netted the exact same return during the worst deflationary wave of this generation: 0%.

And then what happened after the dust settled in March of 2009? Did physical Gold double in value or did paper cash under the mattress? 'Nuff said. Those who say 2008 can't happen again are wrong, but they usually miss the point. Gold hedges against this outcome while providing upside potential if a repeat of 2008 doesn't occur, while paper US Dollars hedge against a repeat 2008 outcome with no upside potential on the other side of the deflationary wave and further loss of purchasing power if 2008 doesn't repeat. Paperbugs, wake up!

Bottom line: ask the Greek people. Their stock market ($ATG) is now down about 90% from the 2000 peak, which is slightly worse than the 89% loss in the Dow Jones from 1929-1932. A deflationary-type stock market collapse by any reasonable standard applied. Did people in Greece earn a better return holding paper Euro notes or paper US Dollars (or short-term government debt denominated in these currencies) since 2000 or better holding Gold? Again, 'nuff said.

Gold stocks are a hybrid. Gold they are not, despite what bulls say (and what I used to believe before I took the time to investigate the actual facts market history provides for those interested). Gold plus counter party, business and political risk is not the same as unencumbered physical Gold held outside the banking system However, the potential speculative gains in Gold stocks are significant. This is one of the areas I focus on in my subscription service. Once a core position of physical metal is secured, then speculation with a portion of one's capital may be appropriate for those seeking higher returns.

So, knowing these secular trends have existed is one thing, but when will they end? Well, the usual sign posts are not archaic relics to be laughed at and degraded as CNBC likes to do. When the dividend yield on general common stocks reaches greater than 6% on average, then perhaps it will be time to start looking to trade some metal for some paper. And when my favorite secular ratio, the Dow to Gold ratio, hits 2 (and we may well go below 1 this cycle) then it may be time to start trading Gold for paper.

Until then, I'll stick with the secular theme that has worked wonders so far. History is repeating right in front of our eyes. This time won't be any different. My advice is to buy physical Gold, hold it outside the banking system, and enjoy the fireworks with your wealth intact (and likely increased) and your purchasing power enhanced.

For those crazy enough to speculate in this environment, consider my low cost subscription service. My subscribers and I are currently short emerging markets and waiting for a bottom in the precious metals sector to start speculating in Gold stocks from the bull side.

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2011 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.