Investing vs. Speculating in Gold and Silver Stocks

Commodities / Gold & Silver Stocks Dec 21, 2011 - 03:28 AM GMTBy: Jordan_Roy_Byrne

One thing that is intriguing about the precious metals sector is the vast composition of the companies in the sector. The entire equity sector can be divided in so many forms and ways. We can divide the gold and silver stocks, the producers and non producers, the explorers and the developers, the royalty companies and non-royalty companies as well as those making money and those not making money. To make money in this sector one really needs to have a plan and know what they are doing. Specifically, one needs to define an investment and a speculation.

Though the sector itself is risky, there are still numerous companies that can be defined as an investment. An investment is something which you receive a return on your money and a return of your money. Therefore we are looking for companies that are making money and have the reasonable ability to grow cash flow and earnings. The royalty companies and large and senior producers fit this bill. An investment in GDX or a gold mutual fund fit this category. Mid-tier and smaller producers with experienced management, a track record and a strong financial position can be categorized as investments.

Anything and everything else falls into the speculation category. How about a large developer with 10 M oz Au? It is a speculation. No one knows if the owner will ever be acquired, much less if the project will ever go into production. Even if a junior explorer or junior developer are trading at $10/oz in the ground, it still qualifies as a speculation.

Why are we talking about this?

Many gold bulls were hurt in 2007-2008 and again this year as they forgot that most of the companies in this sector as speculations. They forgot that shares can fall tremendously, even as the metals remain firm or even rise. You cannot just sit in your juniors and think they will be up 50-fold by the end of this bull market. After all, you should know by now that most juniors will fail and even fail in this historic bull market.

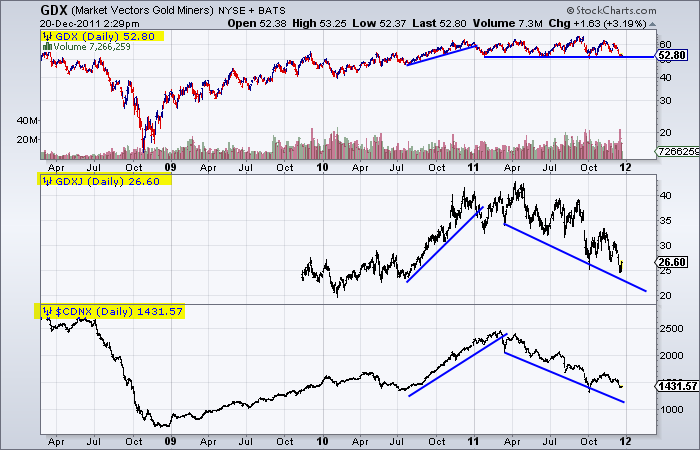

This year provides a clear example of the difference between speculating and investing. GDX is down 14% while GDXJ is down 33% while the CDNX is down 38%.

Going forward, one has to have a plan that distinguishes between investing and speculating. How much of your portfolio should be in Gold-related investments and how much should be in speculations?

Obviously, we are coming out of a difficult year and those who held too many speculations will feel jaded. They will feel that the juniors will never gain or that gold stocks will always underperform the metal. The result of this year will cloud their thinking for 2012 and beyond. On the other hand, the real professionals were cautious this year. They held high cash positions and focused most of their risk-capital on investments and not speculations. Since the market is likely to make a major low within potentially days or weeks, it may be time to consider some of the speculations, rather than become really defensive and only sit in a few large cap stocks.

Your job, Joe Investor is to figure out the right balance for your portfolio and then shift accordingly with market conditions. Your investments should earn you a return of your money and a return on your money. Whether that is 80% or 50% of your portfolio depends on your risk tolerance, time horizon and other factors. In our premium service, we look for both investments and speculations in this sector that can make you money. We invite you to learn more about our service.

Good Luck!

Jordan Roy-Byrne, CMT

Trendsman@Trendsman.com

Subscription Service

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.