Golden Resource Review 2007 and Forecast for 2008

Commodities / Gold & Silver Stocks Dec 31, 2007 - 02:33 AM GMTBy: Neil_Charnock

Gold has closed at a record high this year – in Australia the junior index has outperformed the emerging producers and larger producers as predicted in my published articles. These were the most undervalued of all stocks on the Australian Stock Exchange – the ASX. As we close this year I see significant under valuation across the resource sector here – and I see a record Australian Dollar gold price of over $950 per ounce.

Gold has closed at a record high this year – in Australia the junior index has outperformed the emerging producers and larger producers as predicted in my published articles. These were the most undervalued of all stocks on the Australian Stock Exchange – the ASX. As we close this year I see significant under valuation across the resource sector here – and I see a record Australian Dollar gold price of over $950 per ounce.

I base my statement re under valuation on PE levels and chart analysis – some producers in growth phases are selling at ridiculous levels and all due to two main factors. Perception of a global slow down which has been exaggerated in the Australian Resource Sector and end of year selling. Balance sheets of these stocks are strong – project pipelines are strong, some already show strong divergences and this time I am talking about diversified miners of a more substantial caliber.

End of year selling by institutions and funds has presented an end of year present for the astute investor here in Australia . They will enter the year with excess liquidity and be underweight resource stocks. Base metals appear to be at base value – physical lead and zinc LME stocks are low – nickel is still a question mark however it may be forming a support base at current price levels.

Directors at RIO claim the BHP bid was insufficient given their outlook and most company reports indicate “longer and stronger” than they expected in relation to the resource boom. Their outlook is based on supply and demand including new mines, mine depletion and muted economic growth. Gold miners continued their stellar hedge book close out – all financed by the banks who insisted on them being in place just a few years back. This is a paradigm shift and indicates the writing is on the wall.

My current thesis is that the Central Banks have decided to go for a new round of monetary inflation, another flood level of fiat currency support for the global economic system rather than a risky correction. Therefore inflation will persist, real interest rates are still in decline, global growth will slow however remain at a healthy level, resource demand will continue at high levels and so will volatility. They (CB's) are stalling to allow internal demand from emerging economies to take up the demand slack for widgets that the US consumer can no longer afford.

The emergent tone of the CB's indicates the game will continue and they are determined to stop the sub prime credit cancer from spreading to the balance of the debt pyramid. Can they succeed yet again is the $64,000 question? Money supply is their game – they hold the aces so I suspect they will succeed again at the expense of a rising gold and silver price, inflation and the desired continuation of a decreasing USD value.

Resources in Australia

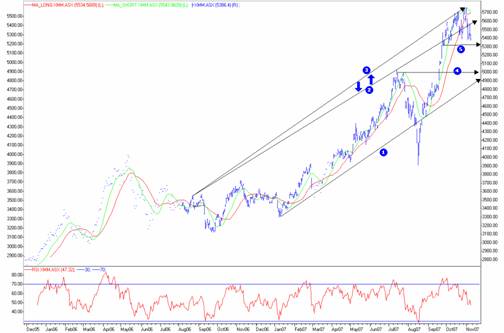

The ASX S&P 300 Metals and Mining Index opened 2007 at 5676 - it peaked up 13.5 % at 6445 in July to complete a strong first half. The second half produced a flat top formation with negative divergence which warned us about a correction which began on July 26 – it corrected back to 5939 by early August.

The sub prime debacle then pushed an over correction which sparked fear, confusion and then panic – it dived sharply back to an intra day low of 5493 on August 16 and at GoldOz we held our ground issuing a “buy or hold” alert in our Weekly Newsletter delivery page. This was indeed an over correction which formed a needle spike with a sharp reversal up to new highs of 6867.5 by November 1 - which was a 25% jump on that intra day anomaly. On November 9 th I released an article on Kitco which included a warning of a top as follows:

Extract from Kitco Article - Nov 9th 2007 – “Remarkable Opportunity ”

“ OK so now we need a pull back in this index but this is the time to get your radar on and do your research and pick off the leaders for the next run up. We have been expecting a pullback and now a top has formed however there are many growth stories here even now because these companies have been quietly working hard with resource definition and project development over the past few years. Strong rises are becoming the norm in strong growth stocks and the volatility is presenting fantastic opportunities.”

This was the chart at the time…

Australian Resource Index - The S&P 300 Metals and Miners

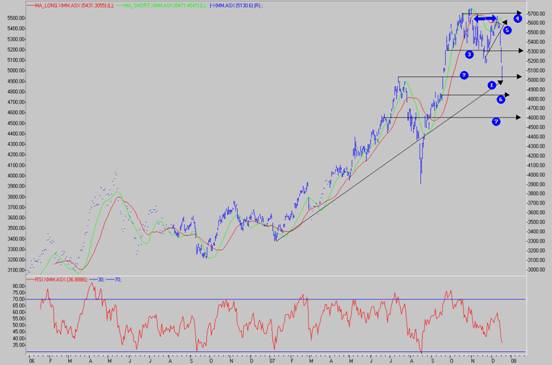

And a week or so back it looked like this… yep a good call it was indeed a top and the radar has to be on now.

Australian Resource Index - The S&P 300 Metals and Miners

Confusion

Confused investors dumped stocks in mid August that were set to head to new 2007 highs a few weeks later so let's take a look at confusion as a subject for a minute. Confusion can be said to exist when conflicting issues mount up to a sufficient degree that they shake confidence in an investors market view – his considerations. Facts swirl about in a chaos where every fact takes on the same magnitude of every other fact – every opinion takes on the same magnitude of every other opinion. So this investor dumps at market bottoms and often buys near tops, his or her view flip flops about in a confusion – unfortunately quite normal for the vast number of participants in the markets.

What is lacking in this situation is sufficient knowledge – knowledge produces a sufficient level of certainty – this level of certainty gives you the ability to focus on one or two major facts which are more important than the rest and make more accurate judgments. Therefore the balance of the data and opinions apparently swirling around can then be assessed in relation to the prime considerations (major facts) – thus you can remain centered in an apparent chaos when other investors panic.

Confusion in investment markets can only exist in the presence of a lack of sufficient knowledge and the investment tool you can use to handle this situation is an accurate assessment of the big picture. The big picture facts change slowly and should form your investment foundation – the prime considerations you work off are the primary trend not the intermediate or short term trends. These shorter cycles are fantastic for increasing your returns - for instance 2007 produced two major investment runs on the ASX S&P 300 M&M Index as shown above. The longer term fundamentals for individual stocks within a broader sector uptrend are just as important in selecting the quality companies – this too increases financial returns to a greater degree.

During the initial onset of the sub prime credit reality Colin Emery (GoldOz Weekly Newsletter author) was able to assess conditions based on 25 years of elite level analysis and he has seen it all before. As Manager of Forex for the Bank of America – also in senior Management roles at other global banks and as their Senior Trader too – he has seen it all before. Of course the considerations change over time so an understanding / knowledge of changing global economics and the major market forces becomes key to the necessary assessment of big picture conditions.

Our analysis indicates the macro uptrend is still intact led by China , India , Russia , the Middle East other emerging economies such as Brazil et al - and also led by cash creation at the Central Bank level – the source. The Central Banks have managed to put out major “economic fires” over the past 27 years via monetary policy in a world dominated by nothing but fiat currencies – this offers a global liquidity management system that has confounded analysts in its ability to handle dire macro situations during this time – at least up until now for certain. Until this system indicates they are contracting credit and allowing a giant natural economic contraction to occur I will stick to my major investment considerations.

This game of global liquidity appears to defy gravity and basic economic rules – however they were rules carved out by common sense and observation during times of individual country fiat experiments and in the absence of the current level of global infrastructure roll out. Other countries still had the gold standard but this is now global. Each fiat experiment finished like the last – in hyperinflation and depression – chaos. What has changed? Capital was able to flee to other countries where there was some fiscal responsibility forced by the old gold standard & globalization was mainly restricted to the so called first world. It happened mostly one country at a time until Asia began its major growth cycle – reached a critical growth mass which is key to understanding these phenomena.

These are the two key facts that have changed – they are senior considerations that all other changes and information / opinions have to be viewed in context with. Global growth on an unprecedented scale and the global fiat machine gives no formal large scale alternative for capital – so the smart money rushes in and out of short term bonds and it builds up in gold as an insurance measure. The new emergent wealth also buys jewelry and bullion as savings.

When overall global growth falters significantly (not just US growth) or when the Central Banking system withdraws major liquidity support there will be a fundamental and long term shift. This will be a disaster for investors that do not get it right. Missing opportunity between now and then will be an opportunity cost. Ignoring the dangers in the changing conditions will be disastrous for individual investors. I steer clear of most financial stocks and property for instance and concentrate on a safer alternative – low sovereign risk - resource and gold plays plus bullion for these reasons as it appears to me to be pure common sense.

We are currently in a gold up-leg and every indicator tells me that this is not over as yet in the short – term. The gold stocks and diversified miners are highly likely to play catch up so buckle up for the ride. Watch for entry points in low PE producers to begin with and look to the juniors again after these have run back significantly. Silver will outperform towards the end of this cycle and I hold bullion at the bank as a long term investment and insurance policy.

We just released a special Christmas issue of our GoldOz Newsletter covering over sold stocks with full technical analysis and the annual subscription offer still stands. We have an information tool with massive coverage of the whole sector for only $AUD35 for those with interest – 4 files in all breaks down this sector in detail. This file set currently comes free with the annual subscription to our Newsletter and we will throw in two free months as well with this offer.

Good trading / investing.

Regards,

By Neil Charnock

www.goldoz.com.au

Copyright 2007 Neil Charnock. All Rights Reserved.

REGISTERED ADVISOR – WHO THE ADVICE COMES FROM IN THE GOLDOZ NEWSLETTER: Colin Emery is currently a Branch Manger and Senior Client Adviser of a Stock Broking Company in Queensland Australia. Prior to his work in Share broking he spent nearly 20 years in Senior Management and Trading positions in Treasuries for major International Banks such as Bank Of America, Banque Indosuez, Barclays Bank, Bank Of Tokyo and Deutsche Bank AG. He spent a number of years as a Senior trader in New York , London , Singapore , Tokyo and Hong Kong with these institutions. He also was Global Head of emerging energy, emission and commodity products for the leading Energy and Commodities brokerage firm of Prebon Yamane Ltd – Prebon Energy for four years before moving to Cairns in 2003 to focus on the Stock market and Private consulting work. The private consulting and advisory work currently undertaken is with companies involved in Resources, Energy and Renewable Energy and Forestry.

Neil Charnock is not a registered investment advisor. He is a private investor who, in addition to his essay publication offerings, has now assembled a highly experienced panel to assist in the presentation of various research information services. The opinions and statements made in the above publication are the result of extensive research and are believed to be accurate and from reliable sources. The contents are my current opinion only, further more conditions may cause my opinions to change without notice. The insights herein published are made solely for international and educational purposes. The contents in this publication are not to be construed as solicitation or recommendation to be used for formulation of investment decisions in any type of market whatsoever. WARNING share market investment or speculation is a high risk activity. Investors enter such activity at their own risk and must conduct their own due diligence to research and verify all aspects of any investment decision, if necessary seeking competent professional assistance.

Neil Charnock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.