Rationalization, Ripped from the Headlines, Stock Market Is Not Physics: Part IV

InvestorEducation / Learn to Trade Dec 31, 2011 - 05:06 AM GMTBy: EWI

The following series is excerpted from two classic issues of Robert Prechter's Elliott Wave Theorist. Although originally published in 2004, the valuable series has been re-released in the Independent Investor eBook, along with over 100 pages of other reports that challenge conventional economic thinking.

The following series is excerpted from two classic issues of Robert Prechter's Elliott Wave Theorist. Although originally published in 2004, the valuable series has been re-released in the Independent Investor eBook, along with over 100 pages of other reports that challenge conventional economic thinking.

Here is Part IV of the series, you can download your free copy of the Independent Investor eBook here.

Another Example of Rationalization, Ripped from the Headlines Almost every day brings another example of rationalization in defense of the idea that news moves markets. The stock market rallied for half an hour on the morning of April 20, peaked at 10:00 a.m., and sold off for the rest of the day. Almost every newspaper and wire service claims that the market sold off because "Greenspan told Congress that the nation's banking system is well prepared to deal with rising rates, which the market interpreted as a new signal the Fed will tighten its policy sooner rather than later."3 Is this explanation plausible?

Point #1: Greenspan began speaking around 2:30, but the market had already peaked at 10:00.

Point #1: Greenspan began speaking around 2:30, but the market had already peaked at 10:00.

Point #2: Greenspan said something favorable about the banking system, not unfavorable about rates. A caption in The Wall Street Journal reads, "Greenspan smiles, markets don't."4 The real story here is that the market went down despite his upbeat comments, not because of them.

Point #3: Greenspan's speech was not the only news available. Most of the other news that day was good as well. As the AP reported, profits of corporations were good and "most economists don't expect the Fed to raise rates at its next meeting." So if news were causal, then on balance the market should have risen.

Point #4: The Fed's interest rate changes lag the market's interest rate changes. Interest rates had moved higher for months. Even if Greenspan had stated (which he didn't) that the Fed would raise its Federal Funds rate immediately, it would have been no surprise.

Point #5: Greenspan said nothing that people didn't already know, so while the fact of the speech was news, there was no news in the content of the speech.

Point #6: The simultaneously reported fact that "most economists don't expect the Fed to raise rates at its next meeting" contradicts the argument for why investors sold stocks. If economists don't believe it, why should we think that anyone else does?

Point #7: Greenspan did not say that rates would go up.

Point #8: We have no data on the history of stock market movement following mere hints of a possible rates rise, which means no data on which commentators could justifiably base an explanation of the market's apparent reaction to such a hint, if in fact there was one.

Point #9: There is no evidence that a rise in interest rates makes the stock market go down. In 1992, the Federal Funds rate was 3 percent. In December 1999, it was 5.5 percent. The Dow didn't go down during that time; it tripled. Rates also rose from the late 1940s to the late 1960s, during almost all of which time there was a huge bull market. Ned Davis Research has done the research and found that in the 22 instances of a single rate hike since 1917, "the Dow was always higher...whether three months, six months, one year or two years later."5 In other words, if interest rates truly cause market movements, then a rate rise would be bullish. According to Davis, it takes a series of four to six rate increases to hurt the market, and that's if you allow the supposed negative causality to appear up to twelve months later! So even accepting the bogus claim of causality would mean that investors would have had to read into Greenspan's optimistic comment on the banking system a whole series of four to six rate rises, after which maybe the market would go down within a year after the final one! (The truth is that rising central-bank rates are usually a function of a strong economy, so many rate increases in a row simply mean that an economic expansion is aging, from which point a contraction eventually emerges naturally. Interest rates, like all other financial prices, are determined by the same society that determines stock prices. It's all part of the flux within the same system. Changes in interest rates are not an external cause of stock price movements, just as stock price movements are not an external cause of changes in interest rates.)

So why did so many people conclude that Greenspan's speech made the market go down? They didn't conclude it from any applicable data; they just made it up. The range of errors required for people to concoct such "analysis" is immense, from an inapplicable chronology to contradictory facts to an utter lack of confirming data to a false underlying theory. Yet it happened; in fact, it happens every day.

Quiz: What does this sentence from the AP article mean? "Worries that interest rates will rise sooner rather than later have distracted investors from profit reports this earnings season." Answer: It simply means, "The market went down today." There is no other meaning in all those words.

Had the market instead gone up on April 20, commentators would simply have cited as causes the numerous optimistic statements in Greenspan's address, i.e., "deflation is no longer an issue," "pricing power is gradually being restored," inflation is "reasonably contained," labor productivity is "still impressive," etc. There were, in fact, no -- zero, none -- negative statements about markets, the economy or the monetary climate in his address, which is why commentators -- in order to maintain their belief in news causality -- had to resort to such an elaborate rationalization to "explain" the day's price action.

But wait. The market went up the next day, April 21. Let's see what the explanation was then: Appearing this time before the Joint Economic Committee of Congress, Greenspan reiterated that interest rates "must rise at some point" to prevent an outbreak of inflation. But he added that "as yet," the Fed's policy of keeping interest rates low "has not fostered an environment in which broadbased inflation pressures appear to be building." Analysts took that to mean the Fed might not be in such a hurry to raise short-term rates, the opposite of their reaction to his testimony to the Senate Banking Committee on Tuesday. -- The Atlanta Journal-Constitution, April 22, 20046

We read that Greenspan "reiterated" his comments; in other words, he said essentially the same thing as the day before, yet investors "reacted" to the statements differently and did "the opposite" of what they had done the day before.

We read that Greenspan "reiterated" his comments; in other words, he said essentially the same thing as the day before, yet investors "reacted" to the statements differently and did "the opposite" of what they had done the day before.

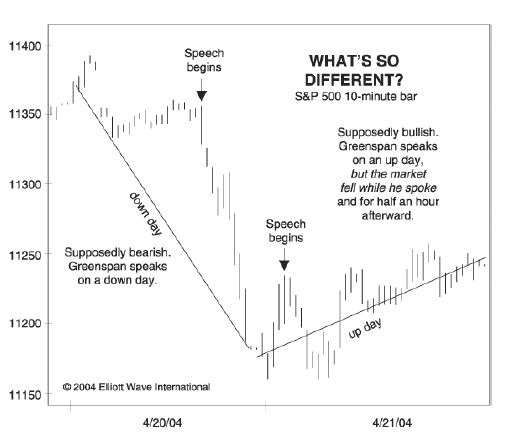

We know that this argument is false. How do we know? We know because once again we take the time to look at the data. Here is a 10-minute bar graph of the S&P 500 index for April 20 and 21. On it is shown the time that Greenspan was speaking. Observe that the market fell throughout his speech on April 21. It rallied after he was done. So his speech did not make the market close up on the day. It's no good saying that there was a "delayed positive reaction," because that's not what happened the day before, when stocks were falling throughout the speech and for the rest of the day thereafter. Such ex-post-facto rationalization is common but never consistent. The conventional presumption of causality demanded an external force that made the market close up on the day, and, as usual, it manufactured one. An article that put the two days' events side by side reveals how silly the causal arguments are:

NEW YORK -- Stocks ended higher Wednesday despite Federal Reserve Chairman Alan Greenspan's acknowledgment that short-term interest rates will have to be raised at some point. The gains came a day after stocks had sold off sharply when Greenspan said pricing power was improving for U.S. companies, sparking inflation fears. -- USA Today, April 22, 20047

One interviewee stated the (false) conventional premise: "Wall Street was in a less hysterical mood than yesterday with Fed Chairman Alan Greenspan being more expansive in his view of the economy," i.e., the news changed investors' mood. The socionomic view is different: People's mood came first. Greenspan's words did not make people calm or hysterical; people's calm or hysterical moods induce them to buy or sell stocks, and then they rationalize why they did. Since there is no difference in the news items on these two days, our explanation makes more sense. It is also a consistent explanation, whereas news excuses are typically contradictory to past excuses and the data.

Those offering external-causality arguments, by the way, include economists and market strategists, people who supposedly spend their professional lives studying the stock market, interest rates and the economy. Yet even they barrel ahead on nothing but limbic impulses, sans data and sans correlation, because it seems to make sense. It does so because most people's thinking simply defaults to physics when analyzing financial events. But when we take the time to examine the results of applying that model, we find that it is not useful either for predicting or explaining market behavior.

Another interesting aspect of financial rationalization is that in fact there is virtually never any evidence that people actually bought or sold stocks for the reasons cited. The fact that people actually sold stocks on April 20 or bought them on April 21 because of these long chains of causal reasoning is dubious at best. Had you asked investors during the rout why they were buying or selling, would they actually have cited either of these convoluted interest-rate arguments? I doubt it. Most people buy and sell because the social moods in which they participate impel them to buy and sell. A news event, any news event, merely provides a referent to occupy the naive neocortex while pre-rational herding impulses have their way.

This is what's happening: When news seems to coincide sensibly with market movements, it's just coincidence, yet people naturally presume a causal relationship. When news doesn't fit the market, people devise an inventive cause-and-effect structure to make it fit the day's market action. They do so because they naturally default to the physics model of external cause and effect and are therefore certain that some external action must be causing a market reaction. Their job, as they see it, is simply to identify which external cause is operating at the moment. When commentators cannot find a way to twist news causality to justify market action, the market's move is often chalked up to "psychology," which means that, despite the plethora of news and ways to interpret it, no external causality could even be postulated without exposing an overly transparent rationalization. Few proponents of the physics paradigm in finance seem to care that these glaring anomalies exist.

Read again carefully the newspaper excerpt quoted above. If you at some point begin laughing, you're halfway to becoming a socionomist.

A Model That Cannot Predict Financial Events Let's ask another question of our believers in the cause-and-effect physics model of finance. What was the cause in August 1982 of the start of the strongest one-year rally in stocks since 1942-1943? (Was it the bad news of the recession? No, that doesn't make sense.) What was the cause in early October 1987 of the biggest stock market crash since 1929? (Don't spend too much time trying to figure this one out. An article from 1999, twelve years later, says, "Scholars still debate the reason why" the stock market crashed that year.8)

Can you imagine physicists endlessly debating the cause of an avalanche and feeling mystified that it happened? Physicists know why avalanches happen because they are using the right model for physics, i.e., physics, incorporating the laws and properties of matter and physical forces. The crash of 1987 mystifies economists because they are using the wrong model for finance, i.e., physics. They are sure that the crash was a reaction, so there must have been an external action to cause it. They can't find one. Why? Because they are using the wrong model of financial causality.

No External Causality

The model is wrong because it assumes that each element of the social scene is as discrete as billiard balls. But they are not. Here is a pertinent passage from The Wave Principle of Human Social Behavior: When dealing with social events, what is an "external shock"? What is an "outside cause"? Other than the proverbial asteroid striking the earth, which presumably might disrupt the NYSE for a couple of days, or the massive earthquake or destructive hurricane that we repeatedly observe does not affect financial market behavior in any noticeable way, there is in fact, in the social context, no such thing as an outside force or cause. Every "external shock" ever referenced in finance is in fact an internal event. Trends in the stock market, interest rates, the trade balance, government spending, the money supply and economic performance are all ultimately products of collective human mentation. Human minds create these trends and change both them and their apparent interrelationships as well. It is men who change interest rates, trade goods, create earnings and all the rest. All social events, whether a rise in interest rates, a drop in the stock market, or even a war, are the result of collective human mentation. To suggest that such things are outside the social phenomenon under study is to presume that people do not communicate (consciously or otherwise) with each other from one aspect of their social lives to another. This is not only an unproven assumption but an absurd one. All financial events, indeed all social movements, are part and parcel of the interactive flux of human cooperation. All such forces are intimately commingled all the time. Yet to the conventional analyst, each is as detached a cause as a cue stick striking a billiard ball. It is this error that so profoundly undermines the conventional approach.9

The more useful model of social (including financial) causality is socionomics, the theory that aggregated unconscious impulses to herd conform to the Wave Principle, a patterned robust fractal. In this model, social actions are not causes but rather effects of endogenous, formologically determined changes in social mood. To learn more about this new model of finance, see the April and May issues of The Elliott Wave Theorist and the two-volume set, Socionomics.

Many people, by the way, dismiss the Wave Principle as impossible because they think that news and events move the market. We have shown that this notion is highly suspect. I hope that the demonstrations offered in this and the previous issue remove a primary impediment to a serious exploration of the Wave Principle model of financial markets.

A Stone's Throw This discussion about the natural tendency of people to apply physics to finance explains why successful traders are so rare and why they are so immensely rewarded for their skills. There is no such thing as a "born trader" because people are born -- or learn very early -- to respect the laws of physics. This respect is so strong that they apply these laws even in inappropriate situations. Most people who follow the market closely act as if the market is a physical force aimed at their heads. Buying during rallies and selling during declines is akin to ducking when a rock is hurtling toward you. Successful traders learn to do something that almost no one else can do. They sell near the emotional extreme of a rally and buy near the emotional extreme of a decline. The mental discipline that a successful trader shows in buying low and selling high is akin to that of a person who sees a rock thrown at his head and refuses to duck. He thinks, I'm betting that the rock will veer away at the last moment, of its own accord. In this endeavor, he must ignore the laws of physics to which his mind naturally defaults. In the physical world, this would be insane behavior; in finance, it makes him rich. Unfortunately, sometimes the rock does not veer. It hits the trader in the head. All he has to rely upon is percentages. He knows from long study that most of the time, the rock coming at him will veer away, but he also must take the consequences when it doesn't. The emotional fortitude required to stand in the way of a hurtling stone when you might get hurt is immense, and few people possess it. It is, of course, a great paradox that people who can't perform this feat get hurt over and over in financial markets and endure a serious stoning, sometimes to death. Many great truths about life are paradoxical, and so is this one.

NOTES: 3 Associated Press, "Possible rate increase sends stocks reeling," The Atlanta Journal-Constitution, p. C5. May 21, 2004. 4 The real story here is that the market went down despite his upbeat comments, not because of anything he said. 5 Walker, Tom, "Stocks plunge on Greenspan's rate-boost hint," The Atlanta Journal-Constitution, April 21, 2004. 6 Walker, Tom, "Greenspan soft-pedals on rates; market rebounds," The Atlanta Journal-Constitution, p. F4. April 22, 2004. 7 Shell, Adam, "Greenspan calms jittery investors," USA Today, April 22, 2004. 8 Walker, Tom, "Identifying sell-off trigger difficult." The Atlanta Journal-Constitution, p. F3. August 6, 1998. 9 See page 325 in The Wave Principle of Human Social Behavior.

Learn to Think Independently -- Download Your Free Independent Investor eBook "The Stock Market is Not Physics" is just one report in the more than 100 page, two-volume Independent Investor eBook. You'll get some of the most groundbreaking and eye-opening reports ever published in Elliott Wave International's 30-year history; you'll also get new analysis, forecasts and commentary to help you think independently in today's tumultuous market. |

This article was syndicated by Elliott Wave International and was originally published under the headline Stock Market Is Not Physics Part III. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.