Gold Stocks Lessons Learned in 2011 and Implications for 2012

Commodities / Gold & Silver Stocks Dec 31, 2011 - 06:15 AM GMTBy: Jordan_Roy_Byrne

2011 certainly was a difficult year for gold bugs. Gold barely held onto its gains for the year while Silver went parabolic and eventually fell to negative on the year. Mining stocks? Don't ask. The large caps (gdx) are currently down 17% on the year while the mid-tiers (gdxj) are down 41% and the explorers (gldx) are down 44%. In our last commentary we discussed the equities with respect to investing and speculating. By now, you should know that most mining stocks are speculations and do not perform consistently, even in a raging bull market.

2011 certainly was a difficult year for gold bugs. Gold barely held onto its gains for the year while Silver went parabolic and eventually fell to negative on the year. Mining stocks? Don't ask. The large caps (gdx) are currently down 17% on the year while the mid-tiers (gdxj) are down 41% and the explorers (gldx) are down 44%. In our last commentary we discussed the equities with respect to investing and speculating. By now, you should know that most mining stocks are speculations and do not perform consistently, even in a raging bull market.

The often hyped "juniors" have been a disaster unless you've been extremely patient and selective while getting lucky with your timing. The juniors are an excellent tool for speculation and only speculation. They cannot be bought and held. They have to be timed nearly perfectly. Ironically, many advisors who are "doom and gloom" types favor the juniors. Some of these types are super bearish on the USA. They've expatriated, waiting for the collapse of the USA while holding juniors. This foolhardy strategy has helped them sell newsletters but hasn't been too profitable.

Below we show a chart of the CDNX next to the S&P 500. They appear nearly identical which means that the juniors do well when the overall market does well and they perform poorly when the overall market is falling.

We should have learned a few things by now. If you are really bearish then you want to concentrate your investments in Bonds, cash and Gold and completely avoid all speculative mining stocks. If you are more optimistic then look to buy quality companies and speculate in some of the juniors. We should also have learned that the dollar is not going to collapse and the US is not going collapse or go into hyperinflation. Anytime you hear this talk, get as far away as you can. This talk is romantic, enticing and can be powerful but it is never profitable. It is entertainment and fantasy. We are seeing what will be a slow motion transformation of the monetary and financial system.

Pertaining to Gold we hear nonsense that you should avoid the equities because they are rigged or shorted by hedge funds. We recently explained why the shares are under-performing. How timely is this frustration from the gold bugs? Last we heard it, it was late 2008 and a tremendous buying opportunity.

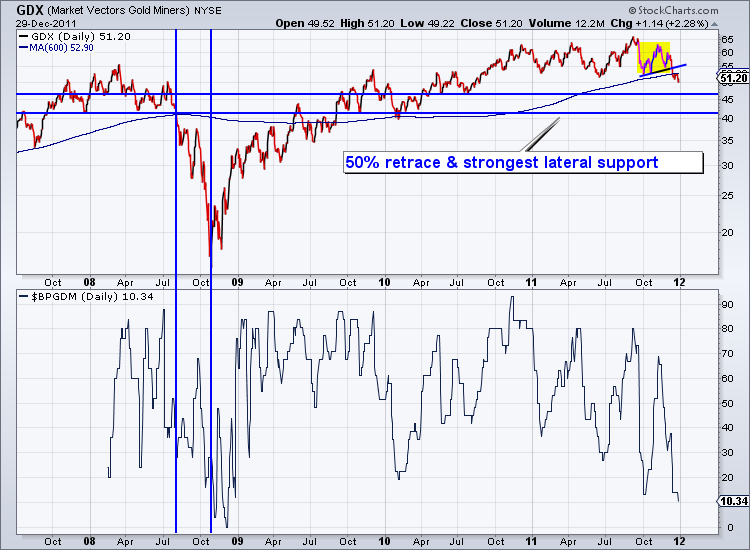

All this being said, now is the time to be optimistic and aggressive on the mining stocks and even the juniors. Various sentiment indicators, if not comparable to 2008 lows are nearing 2002 lows. The coming bottom in the sector will certainly be a major bottom. Technically, the large cap gold stocks have broken down but interestingly, this breakdown occurred with a bullish percent index (% of stocks on a P&F buy signal) of 10%. Back in 2008, the equities began to breakdown with a BPI of 30%. The October decline began with a BPI near 70%. By the time the BPI fell to 10%, the sector had bottomed.

Traders, investors and speculators need to be a bit more patient as the market bottoms. It could be a few days or perhaps a few weeks but it should be clear one month from now. Most stocks are likely to have big rallies. How do we find the ones which will outperform? Those trading near highs with strong bases are likely to have substantial breakouts provided the fundamentals are there. Many juniors have been beaten badly but the ones with substantial cash positions, tight share structures and promising prospects have a chance to explode off their bottoms. We were cautious and neutral for most of 2011 but we are bullish on 2012. If you'd like professional guidance in navigating what lies ahead, while managing risk, consider learning more about our premium service.

Good Luck!

Jordan Roy-Byrne, CMT

Trendsman@Trendsman.com

Subscription Service

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.